At the Starbucks in Changi Airport, a latte costs 12 Singapore dollars (about 60 RMB). For that price, you could buy three cups in a Beijing alley! Some people taste the “poverty line” in this coffee, while others don’t even bat an eyelid. This cup of coffee acts like a wealth detector, instantly revealing your position in the global income food chain.

1. The cities where wealth rivals that of nations—Shanghai didn’t make the top 20

1. The top five cities by per capita income globally, with Singapore in third place

According to authoritative statistics, the five cities with the highest per capita annual income in 2024 are:

① Zurich, Switzerland, approximately $125,000, relying on a strong financial sector (UBS, Credit Suisse, etc.) and precision manufacturing (watches, pharmaceuticals), where high incomes are the norm.

② San Francisco Bay Area, United States, approximately $118,000, a global hub for technological innovation, home to companies like Apple, Google, and Meta, where software engineers can earn over $230,000 annually.

③ Singapore, approximately US$102,000, relies on low taxes and free trade policies to attract international financial headquarters and high-end manufacturing, with the financial sector contributing approximately 14% of GDP.

④ Oslo, Norway, approximately US$99,000, benefits from the resources of the North Sea oil fields and the dividends of the sovereign wealth fund, ensuring ample welfare for its residents.

⑤ Sydney, Australia, approximately $96,000, relies on mineral resource exports, financial services, and tourism to create a vibrant economy with abundant high-paying job opportunities.

These cities’ high incomes are the result of policy design, industrial structure, and global resource allocation working in tandem. However, significant disparities persist globally: Bermuda’s per capita GDP reaches $139,000, while Burundi’s is approximately $150, a difference of 926 times.

↑Internet image, remove if infringing

2. China’s representative city: Shanghai’s strength and potential

In 2024, Shanghai residents’ per capita disposable income was RMB 88,366 (approximately US$12,400), representing a year-on-year increase of approximately 4.2%.

Although it did not rank among the top 20 globally in terms of per capita income, its economic scale, urban influence, and comprehensive strength are undeniable. Shanghai’s large population lowers the per capita data, but its rapid development and industrial diversity make it a highly competitive city both in China and globally.

In recent years, Shanghai has vigorously developed industries such as finance, technology, and manufacturing, attracting a large number of talents annually and providing abundant employment opportunities. For many Shanghai residents, whether it be career paths or lifestyle conveniences, this city offers a vast stage for personal growth.

Despite its relatively lower ranking in per capita income, Shanghai remains a city brimming with opportunities, vitality, and a source of pride for its residents.

↑Internet image, remove if infringing

II. Why is a monthly salary of 20,000 RMB “redefined” in Singapore?

1. A 12 Singapore dollar coffee shatters the “middle-class fantasy”

At Singapore’s Changi Airport, a Starbucks latte costs 12 Singapore dollars (approximately 60 RMB); in Beijing’s old hutongs, the same quality might only cost 20 RMB.

This contrast is not due to exchange rate differences but rather the combined reality of Singapore’s rental costs, taxes, import costs, and labor prices.

2. 20,000 RMB ≠ Singaporean middle class

Converted to a local monthly salary of approximately 4,000 Singapore dollars, this income is barely sufficient to cover basic expenses for the local middle class. Expenses such as HDB down payments, transportation, education, and healthcare quickly erode the income.

A coconut rice stall owner candidly shared: her daughter works at a bank with a monthly salary of around 8,000 Singapore dollars, yet she still “feels strapped for cash.” This is not a complaint but a matter-of-fact acknowledgment of the high cost of urban living.

3. The absurd reality of relative poverty

In China, a monthly salary of 20,000 RMB often signifies the “start of a moderately prosperous life”; in Singapore, it may be classified as part of the “low-income group requiring government subsidies.” This drastic change in status reminds us that different cost structures and social standards lead to vastly different definitions.

3. Singapore has been ranked as the “world’s most expensive city for high-end living” for three consecutive years

1. Julius Baer Group Report: Top Ranked for Three Consecutive Years

According to Julius Baer Group’s 2025 “Global Wealth and Lifestyle Report,” Singapore has topped the list of “the world’s most expensive cities for high-end living” for three consecutive years, followed by London and Hong Kong.

Shanghai previously ranked among the top four but has slipped to fourth place this year, though it still holds a significant position in the global luxury consumption sector.

Image source: Julius Baer Group, Lianhe Zaobao

2. The index covers all aspects of high-end living

The Julius Baer Index assesses the cost of living for high-net-worth individuals in 25 cities, including 20 items and services such as luxury homes, luxury watches, cars, business-class airline tickets, Michelin-starred dinners, private schools, and legal services.

Overall, Singapore ranks among the world’s most expensive cities due to high prices for housing, cars, weddings, children’s education, and healthcare.

3. Why is it so expensive?

High car costs: Due to the Certificate of Entitlement (COE) system, purchasing a car requires paying a high license fee, making Singapore one of the most expensive places in the world to own a car.

High residential prices: High-net-worth individuals compete to purchase properties, driving housing prices to the top globally.

High rates for luxury goods and services impose significant living costs on high-consumption groups.

Despite the high costs, Singapore remains highly attractive to high-net-worth individuals due to its political stability, public safety, and superior infrastructure.

4. Local residents are not entirely equivalent to HNWIs in terms of cost structure

It is worth noting that the Baoshang Index primarily measures the consumption experience of high-net-worth individuals. Ordinary Singaporeans enjoy subsidies for education, housing, and healthcare, resulting in lower actual living costs.

Average households can receive HDB subsidies when purchasing a home, and education and healthcare also offer significant discounts for local residents. However, for expatriates or those seeking a high-end lifestyle, Singapore remains an unparalleled high-cost city.

↑Stock image, remove if infringing

4. What kind of lifestyle can 10 million RMB sustain in Singapore?

1. Housing affordability: Affordable, but limited to certain locations

Approximately 2 million Singapore dollars (equivalent to 10 million RMB) can be used to purchase a five-bedroom HDB flat or a three-bedroom private apartment, but these are typically located in non-core areas. Premium locations such as Orchard Road, Marina Bay, and Sentosa command prices far exceeding this budget.

2. Investment returns: substantial annual income but requires rational planning

If this amount is invested in stable investments (assuming an annual return of 5%–7%), it can generate approximately 60,000–100,000 Singapore dollars in passive income annually, sufficient to cover expenses such as high-quality rentals, occasional luxury spending, and overseas travel.

Image source: CPF

3. Luxury spending: Limited in both scope and quantity

If you choose to splurge short-term, such as staying at a luxury hotel (approximately SGD 1,000 per night at Marina Bay), purchasing luxury watches or handbags, this amount could sustain a lavish lifestyle for two years. However, once the money is spent, real-life expenses must still be managed.

4. Long-term living costs still require budgeting

According to Expatica/Expatistan data, the monthly living expenses (excluding rent) for an average single person in Singapore are approximately SGD 1,500–1,513; for a family of four, this can reach SGD 5,467–5,500 per month.

If central district rent (approximately SGD 4,000–5,000 per month) is added, annual expenses may exceed SGD 150,000. Even with 2 million Singapore dollars in assets, careful financial planning is required to maintain a stable lifestyle.

5. Central Provident Fund (CPF) and Welfare System: Long-Term Savings and Safety Net

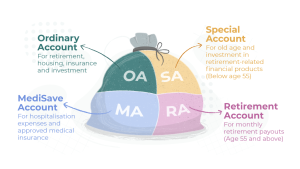

Singapore’s CPF system has strict regulations for citizens and permanent residents. Contributions from employees and employers are divided into three accounts: the Ordinary Account (housing), the Special Account (retirement), and the MediSave Account (medical). The government provides additional subsidies for local low-income individuals to help offset living costs. However, the system offers limited support for foreign nationals.

Source: CPF

Conclusion: There Are No Winners in the Wealth Game, Only Players

Zurich elites counting money can’t keep up with the pace of coffee price hikes in Singapore; Shanghai workers’ paychecks trail behind Sydney miners’ dust.

But the most surreal part is: San Francisco programmers with a $230,000 annual salary sleep under bridges, Chinese aunties ditch their gold chains to snatch platinum, and Chanel is forced to lower prices because it’s too expensive—this world no longer plays by the rules!

Perhaps true financial freedom is recognizing which cup of coffee is worth half a meal’s worth of money, then smiling at the cashier and saying, “Less ice, please.”

Note: Reference materials sourced from Singapore’s Ministry of Finance (MOF), Central Provident Fund (CPF), Lianhe Zaobao, Baoshang Group’s 2025 “Global Wealth and Lifestyle Report,” Oxford Economics’ Global Cities Index, and compiled from public news reports. Reproduction must credit the source; contact for removal if infringing…..