In today’s rapidly evolving global economic landscape, where international capital flows are increasingly sensitive, Hong Kong and Singapore—the “Asian Twin Stars”—have long been regarded as key platforms for corporate expansion, capital allocation, and wealth management planning for high-net-worth individuals.

Both are renowned for their low tax rates, stable regulatory environments, and business-friendly policies. However, due to differences in institutional structures, political backgrounds, and regional functions, they have taken distinct development paths and offer varying strategic values.

This article will analyze the relative advantages of Hong Kong and Singapore within the global financial ecosystem through three key dimensions: regional roles, economic environments, and business and tax system comparisons.

I. Basic Information and Regional Roles:

Bridge vs. Hub

1. Geographic and Demographic Structure Comparison

Both regions are highly urbanized city-based economies with limited land resources and dense populations, making them among the most dynamic economic regions in Asia.

👆Double-click to open, larger image for clearer view

2. Regional Role Positioning

Hong Kong, China: Super Connector

Hong Kong, China, with its independent tax system and legal framework, leverages mainland policy support and a vast market to serve as a vital gateway connecting China to global capital. Its financial center status not only serves the local market but also plays a bridging role as a “super connector” in areas such as RMB internationalization, financial product globalization, and outbound direct investment (ODI).

Singapore: ASEAN Hub

In contrast, Singapore is a sovereign state that, with its social stability, mature legal system, and excellent governance, has become the first stop for multinational companies entering the Southeast Asian market. Singapore maintains frequent flights and commercial connectivity with neighboring countries such as Malaysia, Indonesia, and Thailand, earning it the title of “the capital of ASEAN.”

↑Stock image, remove if infringing

3. International Financial Status

In the 2024 Global Financial Centers Index (GFCI):

Hong Kong ranks 3rd globally (behind New York and London), with significant advantages in stock market financing and banking services.

Singapore ranked 4th, with rapid growth in wealth management, fintech, and green finance.

Summary: Hong Kong primarily implements the policy strategy of “connecting with China to the north,” while Singapore serves as a regional financial hub for “integrating with ASEAN to the south.” Their directions differ, but their strategies complement each other.

Image/Source: GFCI 37

II. Economic Scale and Cost of Living:

Each has its advantages, but their structures differ

1. GDP and Industrial Structure Comparison

👆Double-click to open, larger image for clearer view

While Hong Kong excels in the financial sector, Singapore’s overall economy is more diversified. Its high-end manufacturing, chemicals, and biopharmaceutical industries all possess global competitiveness. For example, over 50% of global semiconductor equipment relies on core components supplied by Singaporean manufacturers.

2. Global Cost of Living Rankings

According to the 2024 EIU Cost of Living Index, Singapore has ranked among the world’s most expensive cities for the ninth consecutive year, tied with Zurich for first place; Hong Kong ranks fifth.

Housing: Hong Kong has extremely high property prices, a low rent-to-sale ratio, and low homeownership rates among the general population, but its government public housing policy has broad coverage;

Automobiles: Singapore has the world’s most expensive automobile market, with vehicle ownership requiring bidding for a “Certificate of Entitlement” (COE), priced as high as 60,000 to 80,000 Singapore dollars—equivalent to purchasing an additional vehicle;

Daily Consumption: Both regions have high costs, but Singapore, due to its higher reliance on imports, is slightly more expensive overall in terms of food and education expenses.

Image source: Unsplash

3. Summary Comparison

Although Singapore leads in GDP size and per capita income, Hong Kong still holds a strong advantage in terms of profit density in the financial industry and capital market activity.

Meanwhile, Hong Kong has a higher dependence on the mainland Chinese economy, and policy changes may cause fluctuations, while Singapore demonstrates greater policy independence and risk-resilience through its national governance capabilities.

III. Tax Structure and Business Environment:

Simple vs. Diverse

1. Company Registration and Bank Account Opening

👆Double-click to open, larger image for clearer view

Hong Kong: Registration procedures are simpler, and account opening processes are relatively faster, making it the preferred choice for SMEs expanding overseas.

Singapore: Bank compliance requirements are stricter, especially for Chinese clients, with rigorous reviews of KYC, tax residency declarations, and beneficiary structure, making it more suitable for enterprises and funds with long-term development plans.

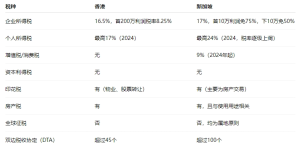

2. Tax System Structure and Collection Methods

👆Double-click to open for a clearer view

Key Differences Summary:

Hong Kong’s tax system is simple and transparent, with no value-added tax (VAT) or capital gains tax, making it a traditional low-tax haven, more suitable for companies engaged in high-frequency trade;

Singapore offers more flexible tax exemptions and incentives, such as the Productivity and Innovation Credit (PIC) and the Global Trader Program (GTP), which are more advantageous for multinational companies and fund operations;

Singapore has approximately twice as many bilateral tax treaties as Hong Kong, giving it a competitive edge in global tax planning and cross-border tax avoidance.

Image source: Unsplash

△Ultimate Choice: “Northward” or “Southward”?

Although Hong Kong and Singapore are both global financial hubs, their historical backgrounds, policy frameworks, and regional roles are entirely different.

If a company’s target market is mainland China and it aims to leverage China’s institutional advantages and access mainland resources, Hong Kong is the natural choice.

If a company prioritizes Southeast Asian expansion, diversified industrial synergy, or global tax planning, Singapore’s policy independence and rigorous regulatory framework are more appealing.

For businesses and individuals pursuing cross-border development, it is not enough to focus solely on tax rates; a comprehensive assessment of multiple factors is essential, including business convenience, corporate governance, tax incentives, regulatory environment, regional connectivity, and living costs.

In the context of “US-China strategic competition” and the “rise of the Global South,” only by precisely positioning oneself and clarifying strategic objectives can one truly leverage the institutional advantages and hub value of both regions. Hong Kong and Singapore are not replacing each other but are instead clearly positioning themselves and leveraging their respective strengths in the new global economic landscape.

Note: Reference materials sourced from Singapore’s IRAS, ACRA, Lianhe Zaobao, China’s HKIRD, HKCR, GFCI, and compiled from public news reports. Reproduction must credit the source; contact for removal if infringing. ……