As a global business hub, Singapore offers a transparent business environment and meticulously manages foreign labor.

For enterprises, understanding foreign worker quotas, median wage levels (LQS), and foreign worker levies is crucial for business operations and workforce cost planning.

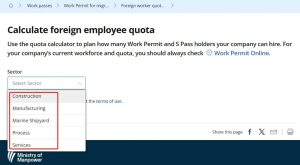

I. What is the Foreign Worker Quota?

The Foreign Worker Quota is Singapore’s limit on the number of foreign employees a company can hire. It aims to protect local employment opportunities and maintain labor market balance.

Quotas are not fixed but dynamically adjusted based on the company’s industry, employee structure, and number of local staff.

1. How are local employees counted toward the quota?

Local employees include Singapore citizens and Permanent Residents (PRs). Companies can only apply for a corresponding number of foreign workers once they meet certain local employee thresholds and fulfill the Local Qualifying Salary (LQS) requirement. The calculation rules are as follows:

Full-time employees (working 35–44 hours per week):

– Monthly salary at or above the LQS counts as 1 local employee.

Full-time low-wage employees (LQS half to below LQS):

– Counts as 0.5 local employees.

Part-time employees (working less than 35 hours per week): Must earn at least S$9 per hour with a total monthly salary of no less than S$800 to count as half an employee toward the quota.

Excluded from the quota: Sole proprietors, partners in partnerships, and employees receiving salaries and CPF contributions from three or more companies simultaneously.

Currently, the LQS benchmark for Construction, Manufacturing, Maritime & Shipbuilding, Processing, and Service sectors is S$1,600 monthly (full-time). Employers can verify employee wages against the LQS benchmark via Singapore’s Progressive Wage Portal (PW Portal) to ensure accurate quota calculations.

Source: MOM

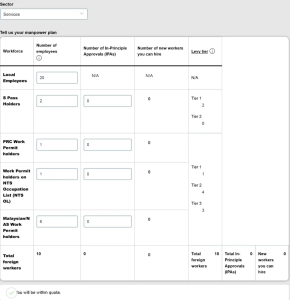

2. S Pass and WP Quotas

When Singaporean companies apply for foreign workers, both S Pass and WP quotas are calculated based on the number of local employees. Quota allocations for different WP and S Pass types are as follows:

PRC WP (China): Approximately 8% of total workforce;

NTS OL WP (India, Sri Lanka, Thailand, Bangladesh, Myanmar, Philippines): 8% of total workforce;

Malaysian/NAS WP (Malaysia and North Asia): Calculated at a 2:1 ratio, meaning 10 local employees allow hiring 5 WPs;

S Pass: Generally accounts for 15% of total employees, with specific numbers dynamically calculated based on local workforce size;

EP: Does not consume quota allocation.

Companies must first meet local employee quota requirements before applying for corresponding numbers of S Passes or WPs.

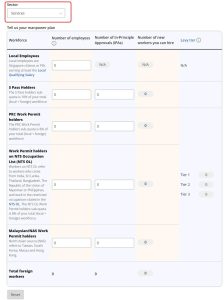

Quota calculation illustration, Source: MOM

3. Quota Characteristics by Industry

Construction Industry: Strict WP and S Pass quotas; EP does not count toward quotas

Manufacturing Industry: Similar to construction, with additional sub-quota requirements for PRC, Malaysian/NAS, and NTS OL

Maritime and Shipbuilding Industry: WP quotas are sensitive. From January 2026, the foreign worker ratio will decrease from 77.8% to 75%. Employers exceeding this ratio may continue hiring under existing contracts but cannot apply for new work permits or renew related documents.

Processing Industry: Quota calculation method is the same as the construction industry.

Service Sector (Food & Beverage, Retail, Logistics, etc.): S Pass and WP ratios follow service sector standards, with a maximum employment quota (DRC) of approximately 35%.

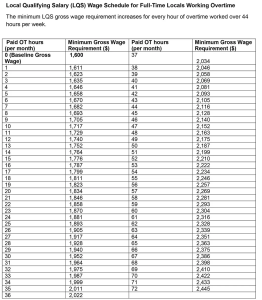

II. How the Level of Quality Salary (LQS) Affects Quotas

The Level of Quality Salary (LQS) is Singapore’s benchmark to ensure local employees receive meaningful wages, directly determining the number of foreign workers an enterprise can apply for.

1. LQS for Full-Time and Part-Time Employees

Full-time employees (35–44 hours/week): Monthly salary ≥ S$1,400 counts as 1 local employee;

Overtime workers (>44 hours/week): Hourly wages must be increased to meet LQS standards;

Part-time employees (<35 hours/week): Hourly wage ≥ S$9 and total monthly salary ≥ S$800 counts as 0.5 local employees.

The purpose of LQS is to prevent companies from paying token wages to secure more foreign workers, ensuring local employees receive meaningful compensation.

Source: MOM

2. Application of LQS in Quota Calculation

When calculating quotas, the LQS of local employees directly determines the number of foreign workers a company can hire. For example:

10 full-time local employees (all meeting LQS):

→ Can hire approximately 1–2 S Pass holders

→ Can hire 5 Malaysian/NAS Work Permit holders

→ PRC Work Permit and NTS OL Work Permit holders each account for 8% of total workforce

Companies can verify employee wages against LQS standards via the Progressive Wage Portal (PW Portal) to ensure accurate quota calculations.

Illustration of LQS, Source: MOM

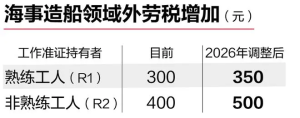

III. Detailed Explanation of Foreign Worker Levy

The Foreign Worker Levy is a fee paid by companies to the Ministry of Manpower for employing foreign workers. The Levy increases based on employee type, industry, and number of hires, with WPs typically subject to higher rates and S Pass holders lower rates.

1. Levy Calculation Logic

The Levy is paid by the company; individual employees bear no cost.

Companies are exempt from paying Levy for Singapore citizens or Permanent Residents (PRs), but must contribute approximately 20% of their wages to the Central Provident Fund (CPF);

Levy rates increase as the number of foreign employees approaches the quota ceiling. Companies should strategically plan staffing to avoid excessive tax burdens.

2. Latest Policy Adjustments (Effective 2026)

Reports indicate Levy rates for WP holders in the maritime and shipbuilding sectors will increase:

Unskilled workers: From S$400 to S$500;

Skilled workers: From S$300 to S$350.

Concurrently, the quota ratio for foreign workers will decrease. Employers exceeding the quota may retain existing workers until their current contracts expire but cannot apply for new work permits or renew related documents.

Source: Lianhe Zaobao

IV. Detailed Explanation of Foreign Worker Quotas and Levies by Industry

1. Construction Industry

Quota: WP and S Pass quotas count toward total workforce; EP holders excluded from quota calculations;

LQS: Full-time ≥ SGD 1,600, part-time ≥ SGD 9 per hour;

Levy: WP levy rate exceeds S Pass levy, increasing incrementally near quota ceiling.

When applying for WPs and S Passes, companies may log into the MOM website to automatically calculate compliance with quotas based on industry and employee count, preventing overages.

2. Manufacturing Sector

① Quota: WP and S Pass quotas align with the construction sector;

Sub-quota requirements:

PRC WP: 25% of total workforce;

Malaysian/NAS WP: Calculated at a 2:1 ratio;

NTS OL WP: 8% of total workforce;

②LQS: Same as construction sector;

③Levy: Increases based on WP/S Pass type.

3. Maritime and Shipbuilding Sector

Quota sensitivity: WP holder ratio to decrease to 75% by 2026;

①LQS: Full-time ≥ SGD 1,600;

②Levy adjustment:

Unskilled workers: S$500;

Skilled workers: S$350.

③Quota overrun: Employees hired beyond quota may continue working until contract expiry but cannot apply for new permits or renewals.

4. Manufacturing Sector

Quota calculation identical to construction sector;

LQS standards and Levy calculation methods also align with construction sector.

5. Service Sector

Common industries: Food & Beverage, Retail, Logistics;

Quota: Approximately 35% DRC, with WP and S Pass allocated proportionally.

Calculation Method:

10 local employees → 1–2 S Passes, 5 Malaysian/NAS WPs;

PRC/NTS OL WPs each account for 8% of total workforce;

Levy: Higher rate for WP, lower for S Pass, increasing near the ceiling.

Source: Lianhe Zaobao

V. Operational Guide for Enterprises

When hiring foreign workers in Singapore, enterprises may follow these steps:

1. Calculate Local Employee Count

Ensure employees meet LQS criteria;

Pay CPF monthly;

Submit payments by the 15th of each month to ensure quota updates.

2. Determine Industry Quota Allocation

Refer to the latest data on the MOM website;

Allocate WP and S Pass quotas appropriately.

3. Dynamic Adjustment

Quotas are updated only after paying the first month’s salary and CPF for new hires;

Verify quota compliance via the MOM system.

4. Avoid Over-Allocation

Long-term over-allocation may lead to rejection of WP and S Pass applications;

Approved work passes may also be revoked.

5. Plan Levy Costs

Levy increases incrementally as quotas approach limits;

Optimize workforce structure to reduce tax burden.

Source: Lianhe Zaobao

VI. Practical Case Study: Service Industry

Assume a food and beverage enterprise plans to hire foreign workers:

Local Employees: 10 (Singapore citizens or PRs, all meeting LQS);

S Pass: Proportionally employ 1–2 individuals;

WP (Malaysian/NAS): Employ up to 5 individuals;

PRC/NTS OL WP: Each may constitute 8% of total workforce;

Through the above calculations, the enterprise can determine permissible foreign worker quotas, ensure compliance with limits, and pay Levy appropriately.

Quota calculation illustration, Source: MOM

Conclusion:

In Singapore, understanding foreign worker quotas, median wage levels (LQS), and foreign worker levies is fundamental for corporate compliance. Staying abreast of policy updates and strategically planning workforce composition not only enables lawful foreign worker employment but also optimizes costs and enhances business competitiveness.

Companies can check the latest quotas via MOM’s official system and cross-reference CPF payment records to ensure accurate quota calculations. As policies evolve, prudent management of foreign workers will become crucial for smooth business operations in Singapore.

Note: References sourced from Singapore’s MOM, IRAS, ACRA, CPF, PW Portal, Lianhe Zaobao, and compiled news reports. Reproduction requires attribution; contact for removal if infringing.