A cup of Tieguanyin, a can of Biluochun—these teas journey across the seas from Fujian’s tea mountains to Singapore. This is not merely a journey of tea aroma but also an opportunity for tea brands to embrace the international market.

In recent years, Chinese tea companies—especially leading enterprises like Baima with annual revenue of over 1 billion yuan—have set their sights on Singapore, a multicultural and high-end consumer market.

I. From Fujian to Singapore:

The Baima Case Reveals the Logic of Brand Globalisation

1. Father earns 1.6 billion yuan annually from tea sales; the story of a wealthy family’s marriage alliance is like a TV drama

Wang Wenli, a native of Anxi, Fujian, founded ‘Baima Tea Industry’ in 1993. After transitioning from a journalist in Shenzhen to an entrepreneur, he established the brand using his hometown’s Tieguanyin and Longjing teas. In less than 30 years, Baima Tea Industry has grown to over 3,000 stores.

In the first three quarters of 2024, revenue reached approximately 1.647 billion yuan, ranking among the top in China’s high-end tea market. Beyond the family’s entrepreneurial story, the recently disclosed ‘high-society marriage’ background has also drawn significant public attention to the brand.

↑Stock photo, remove if infringing

2. The IPO Dream: Three Attempts, Three Failures—The Capital Market Journey Is No Easy Feat

Baima Tea Industry has previously listed on the National Equities Exchange and Quotations (NEEQ), attempted to list on the Growth Enterprise Market (GEM), withdrew from the main board, and shifted to the Hong Kong Stock Exchange, finally obtaining approval for its Hong Kong IPO in July 2025. This process reflects the high standards required for financial compliance, brand transparency, and capital structure during the internationalisation of tea companies. To establish a presence in the Singapore market, capital image and brand storytelling are equally critical.

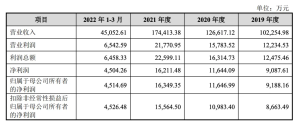

Chart: Baima Tea Industry’s revenue from 2019 to the first quarter of 2022, sourced from Baima Tea Industry

3. High-end positioning and market share reveal industry competition

Although Baima ranks highly in China, its market share is only approximately 1.7%, and the top five brands collectively hold just 6.2% of the market. This indicates that even leading brands face intense competition and market segmentation.

When expanding into Singapore, how to position itself as a premium gift and health-focused brand, as well as establishing a differentiated brand positioning, are core strategies.

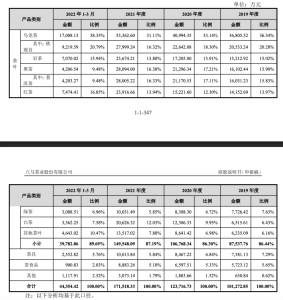

Chart/Baima Tea’s main business revenue breakdown by product category, sourced from Baima Tea

II. The Marriage Network of Fujian’s Billionaire Tycoons:

Collaborating to Weave a Commercial Network

1. The Map of Elite Family Alliances

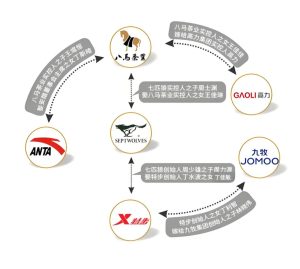

For ordinary consumers, Baima Tea may not be as well-known as brands like Seven Wolves or Anta. However, these Fujian giants are closely interconnected through complex family alliances, forming a network spanning hundreds of billions in wealth:

Wang Jialin, the daughter of Baima Tea founder Wang Wenbin, married Zhou Shiyuan, vice president of the Seven Wolves Group (whose father is the chairman of the Seven Wolves Board of Directors).

Zhou Shiyuan’s cousin Zhou Liyuan (also a member of the Seven Wolves family) married the daughter of the founder of Xtep in 2024.

Wang Wenbin’s son Wang Kunheng married the daughter of Anta founder Ding Shizhong.

Wang Wenbin’s other daughter, Wang Jiajia, married Gao Li, the son of the founder of Jiangsu Gaoli Group.

These marriages have deeply tied together well-known Fujian-based companies such as Baima, Seven Wolves, Anta, Xtep, and Gaoli.

Photo: Wang Kunheng, Co-General Manager of Baima Tea Industry (left), and Wang Jiajia, Host of Baima Tea Talk (right), sourced from Yan Finance. Please remove if infringing.

2. The Business Logic Behind the Marriages

These family marriages appear to be catalysts for business cooperation (e.g., Seven Wolves holds shares in Baima, and Anta has procurement and leasing transactions with Baima). However, the actual scale of business transactions is limited (e.g., from 2018 to 2020, Baima’s total sales to Seven Wolves and Anta’s affiliated parties amounted to only 144,600 yuan). The core value lies in deeper resource integration:

Building a business community: The marital bond adds a familial relationship to contractual ties, establishing a trust foundation far exceeding that of ordinary business partners. This enables families to share resources more closely, mitigate risks, and consolidate their positions in regions and industries.

Continuation of ‘strong alliances’: These ‘second-generation entrepreneurs’ generally possess excellent education and career planning. Marriages are viewed as an optimised integration of family strength and resources.

Choice of specific environments: Economist Chen Zhiwu notes that in Asian markets where institutional frameworks are still underdeveloped and the reliability of commercial contracts is relatively low (such as Thailand, Hong Kong, and Taiwan), entrepreneurs tend to strengthen internal connections and acquire resources through political or commercial marriages, reflecting a certain degree of distrust in the external environment. Anta’s Ding Shizhong’s statement that ‘Jinjiang merchants are as close as family’ is a vivid illustration of this high level of cohesion.

Figure: Relationship diagram between Baima Tea Industry and other companies, sourced from Yan Finance

3. Real-world challenges under the spotlight

Despite having a strong network of marital alliances to safeguard its core business (the ‘lower limit’), Baima Tea Industry still faces significant challenges in its own development:

Limited market share: In 2023, the Chinese retail tea market was valued at approximately 350 billion yuan, with the top five players in the high-end market accounting for only 6.2% of the market. As a leading tea company, Baima’s market share was only 1.7%, which is not particularly significant in terms of absolute size.

Capital market scrutiny: Capital markets prioritise a company’s core competitiveness over marriage alliances. To gain investor recognition and achieve growth, Baima must make substantial breakthroughs in product innovation, tea standardisation, and scaled operations.

Alliances are not a panacea: Close alliances provide networking and resource advantages, but they cannot replace the hard power companies need to compete in the market. Behind the romantic alliance stories lies the commercial reality that companies must rely on their own strengths to succeed.

Chart/Shareholding ratios disclosed in the prospectus, sourced from Baima Tea Industry

III. Singapore Tea Market Overview:

Market Characteristics and Consumption Trends Analysis

1. Mature Market, Stable Volume with Quality Improvement: Premium Tea Remains a Focus

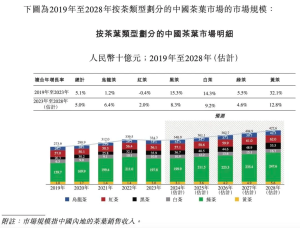

According to a summary of the Euromonitor report: Singapore’s tea market has seen overall stable consumption volumes in recent years, with retail sales showing slight growth but limited in scope. However, consumers have demonstrated a clear preference for green tea, floral and fruity teas, and premium teas, driving growth in the premium segment.

2. Green tea and fruit-flavoured tea show strong growth, driven by health consciousness

According to a 6Wresearch report, the Singapore green tea market is projected to grow at a rate of approximately 5.07% by 2025, reaching a peak of 5.15% in 2026, and maintaining an increase of about 3.5% by 2029; fruit-flavoured tea and other health-focused tea products are growing even faster, with tea consumption showing a trend toward younger consumers.

Source: 6Wresearch, Salt Finance

3. Bubble tea is booming, indirectly boosting awareness of tea-based products

Although bubble tea (Bubble Tea) in the Singapore market primarily focuses on blended tea beverages, it reflects Singaporeans’ high acceptance of innovative products based on tea.

The global bubble tea market is projected to grow from USD 283 million in 2022 to USD 478 million by 2032, with a compound annual growth rate (CAGR) of approximately 7.8%. This indicates that Chinese tea companies can collaborate with beverage brands to increase consumers’ exposure to and willingness to try traditional tea products.

4. Data Chart Overview: Growth Prospects for Singapore’s Tea Market

The global tea market size is estimated to reach approximately USD 5.611 billion in 2024 and is projected to grow to approximately USD 9.32 billion by 2034 (CAGR ≈ 6.2%). Although Singapore’s role in the global tea value chain is limited in scale, it offers abundant opportunities for premiumisation and innovative experiences.

4. Overseas Expansion Pathway Guide:

A Comprehensive Guide from Registration Regulations to Tax Compliance

1. ACRA Company Registration: Obtaining the UEN Number as the First Step

According to the regulations of the Accounting and Corporate Regulatory Authority (ACRA) of Singapore, all profit-oriented companies must be registered (including online sales and physical tea houses). Registration grants the Uniform Entity Number (UEN), laying the foundation for importation, account opening, and tax filing.

Image source: Lianhe Zaobao

2. SFA Import Permit: Tea is classified as food and must comply with regulations

Tea falls under the food category, so an import permit from the Singapore Food Agency (SFA) is required prior to importation, and a CCP declaration must be submitted through the TradeXchange system to ensure compliance with food safety standards. If selling in a physical store, a Food Shop Licence (similar to a business licence) is also required.

3. IRAS Tax Requirements: GST, Import Declaration, and Financial Reporting Compliance

After company registration, you must register for GST (Goods and Services Tax) with the Singapore Inland Revenue Authority (IRAS) and file corporate tax returns regularly. Importing tea also involves declaring customs duties and preparing annual financial statements in accordance with Singapore Financial Reporting Standards (SFRS) to avoid fines or business restrictions.

4. Cross-border considerations: freight, customs clearance, and e-commerce regulations

For logistics, direct mail from China must use approved import channels; e-commerce sales must comply with buyer customs declaration requirements. If using third-party platforms or transshipment trade, it is also necessary to carefully plan import responsibilities, customs clearance costs, and tax liabilities.

↑Stock image, remove if infringing

5. Marketing strategies and brand implementation:

Making Chinese tea flourish in Singapore

1. Combining Direct-Operated Experience Stores with Tea Culture Events

Chinese tea brands can open specialty tea rooms in Singapore:

Combine tea art demonstrations, tasting experiences, and gift sales to create an immersive environment. For example, if Baima opens a store in the Marina Bay area, it can incorporate Chinese and English packaging, health lectures, and tea tasting courses to integrate tea culture into the local elite circle and gift economy.

2. Collaborate with Local Channels: Expand into Supermarkets, E-commerce, and Chain Stores

Access high-end supermarkets, department stores, and gift shops through distribution channels like DKSH and GLS Foods, such as Odani Kokufun partnering with DKSH to introduce tea. Also, enter local e-commerce platforms like Lazada and Shopee to tap into the online market.

↑Stock image, remove if infringing

3. Promote tea bases through bubble tea brand collaborations

Collaborate with bubble tea chain brands to launch specialty beverages featuring Chinese teas like jasmine green tea and Tieguanyin as bases. This is an effective way to connect with younger consumer groups and increase brand exposure. Simultaneously, leverage social media promotions to make health-focused beverages a new trend on platforms like Instagram and TikTok.

4. Storytelling marketing + content dissemination to attract attention

Utilise online platforms to report on the family story of Baima Tea, its capital twists and turns, and brand positioning, turning the story into a media talking point. Combine this with short video content (tea garden picking, factory production, Fujian hometown), influencer KOL tasting experiences, and Singaporean expert recommendations to achieve content-product synergy and amplify the dissemination effect.

5. Community + Customised Gift Box Strategy

Targeting Chinese festivals and Singapore’s multicultural holidays, launch bilingual (Chinese-English) customised gift boxes (e.g., Spring Festival, Mid-Autumn Festival, Hari Raya Haji gift sets) and promote them through WeChat, Xiaohongshu, or local community group buying platforms. Combine regular online tea gatherings, health lectures, and DIY tea bag experiences to enhance interaction and brand loyalty.

↑Stock image, remove if infringing

△Start a new journey in the Lion City with a cup of good tea

In summary, exporting Chinese tea to Singapore is not as simple as ‘shipping tea over.’ It is a comprehensive project involving brand internationalisation, legal compliance, cultural positioning, channel layout, and marketing packaging.

High-end tea brands such as Baima have grown from Yao Yang Village in Fujian to listing on the Hong Kong Stock Exchange, which signifies the dual wings of compliant operations and storytelling marketing.

For Chinese tea companies looking to go global, Singapore may be small in scale, but it serves as a litmus test for the premium gift market and health-conscious consumption trends. All you need to do is register a company with ACRA, apply for compliance procedures with SFA and IRAS, then combine direct sales, agency partnerships, collaborations, and online channels, followed by cultural storytelling and social media promotion to transform tea into a popular healthy lifestyle choice in Singapore.

Singapore, as an international metropolis, warmly welcomes the arrival of tea. Why not start today by brewing a cup of good tea, bringing the warmth and stories of Chinese tea to Singapore, allowing the brand to take root and flourish overseas, and enabling the tea industry to find its own niche in the globalisation wave? The aroma of tea reaches far, and business opportunities lie within this cup.

Note: Reference materials sourced from Baima Tea, China Securities Regulatory Commission, Yan Finance, LinkedIn, Market Research Network, Euromonitor, 6Wresearch, Cailian Press, 21st Century Business Herald, Lianhe Zaobao, and compiled from publicly available news. Reproduction must credit the source; contact for removal if infringing. ….