In recent years, Singapore’s labor market has shown steady performance, with employment growth recorded for 15 consecutive quarters. However, it faces challenges from global trade frictions and economic uncertainties.

In the second quarter of 2025, 8,400 new jobs were created, which is higher than the previous two quarters but lower than the same period last year. In particular, the financial services and healthcare sectors showed strong demand, while outward-oriented industries such as professional services and information and communications technology faced increasing pressure.

In this context, how should EP and PR applicants accurately identify their career directions and enhance their chances of approval?

I. Overview of the Employment Market:

New Trends Amid Stable Growth

1. Continued Employment Growth: Second-Quarter Growth Overview

According to preliminary data from the Singapore Ministry of Manpower (MOM)’s 2025 Second-Quarter Labor Market Report released on July 30:

The number of employed residents (including non-residents, excluding foreign domestic helpers) continued to rise, with an increase of 8,400, marking a stronger growth compared to the previous quarter’s 2,300 and the fourth quarter of 2024’s 7,700, though it remains significantly lower than the 11,300 increase from the same period last year.

The total number of local employed individuals reached approximately 3,755,200, with the services sector accounting for about 2.7 million, the construction sector exceeding 540,000, and the manufacturing sector nearing 490,000.

Resident employment growth was primarily driven by the financial services sector and the health and social services sector, while non-resident employment growth was mainly attributed to foreign workers holding Work Permits (WP), particularly in the construction, administrative support services, and healthcare and social services sectors.

Source: MOM, Lianhe Zaobao

2. Unemployment and Layoffs: Remaining at Healthy Levels

In June 2025, the resident unemployment rate rose to 2.9%, with the citizen unemployment rate at approximately 3.0%, slightly higher than the March level but still within the non-recessionary range. The overall unemployment rate remained around 2.0%, consistent with or slightly higher than the end of 2024 (1.9%).

The number of layoffs in the second quarter was approximately 3,500 (3,590 in the previous quarter), with a layoff rate of 1.4 per 1,000 employees, primarily due to corporate restructuring and structural adjustments. Layoffs in the manufacturing and construction sectors slightly decreased, while layoffs in the services sector rose from 2,330 in the previous quarter to approximately 2,700.

The Ministry of Manpower will release the final data for the second quarter Labor Market Report in mid-September, which will include information on the number of job vacancies, labor mobility, and the re-employment rate of laid-off local residents.

Image source: Lianhe Zaobao

II. Outward-oriented industries under pressure:

Weakening hiring and salary increase intentions

1. Decline in corporate hiring and salary expectations

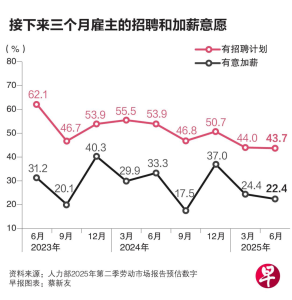

According to MOM’s survey of companies conducted in April–June 2025, the proportion of companies planning to hire in the third quarter is expected to decline from 44.0% in the previous quarter to 43.7%, while the proportion of companies planning to raise salaries is expected to drop from 24.4% to 22.4%.

This trend is particularly pronounced in major outward-oriented industries such as finance and insurance, professional services, and transportation and warehousing.

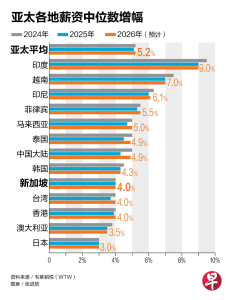

According to the latest “Salary Budget Planning Survey Report” released by consulting firm Willis Towers Watson (WTW), 15% of surveyed employers in China plan to increase their salary budgets, but as many as 40% of companies are reducing their salary budgets due to expected economic downturns or cost pressures.

Source: MOM, Lianhe Zaobao

2. Diverse performance in professional services and communications industries

The report noted that employment in professional services and communications and information services continued to decline, while employment growth among residents was more concentrated in sectors with strong local demand, such as finance and health and social services.

It is anticipated that due to global economic uncertainty and trade friction, future hiring and salary growth will become more cautious.

Economic analysts pointed out that the uncertainty surrounding the US’s high tariffs has made businesses more conservative. While the “early export” strategy drove strong performance in the first half of the year, labor demand in outward-oriented industries may weaken in the second half, and businesses may remain cautious in hiring and wage increases.

Industry insiders predict that despite the unclear external environment, the third quarter traditionally sees a significant increase in employment, potentially reaching around 20,000 people.

Image/Source: WTW, Lianhe Zaobao

III. EP and PR Application Guidelines:

Balancing Choice and Strategy

1. Steady Employment Growth

Local employment continued to grow for the 15th consecutive quarter in the second quarter, with an increase of 8,400 people, though lower than the same period last year, it was higher than the previous two quarters.

2. Optimization of the Employment Structure

The financial services and health/social services sectors performed strongly, indicating continued growth opportunities for the local labor force. In contrast, outward-oriented industries (particularly professional services and information and communications) showed weaker performance.

3. Declining hiring and wage increase intentions

Employer hiring intentions decreased from 44.0% to 43.7%, while wage increase intentions fell from 24.4% to 22.4%. Outward-oriented industries were particularly cautious.

4. Persistent Impact of Global Uncertainty

Trade frictions and tariff policies have made companies more conservative in their future labor investments, particularly in export-oriented sectors.

Image source: Lianhe Zaobao

4. Application for Employment Pass (EP) and Permanent Resident (PR)

Occupational and Strategic Recommendations

Based on MOM, ICA, and employment trends, the following are forward-looking planning recommendations for potential EP/PR applicants:

1. Which occupational fields offer greater advantages?

Financial services, health, and social services-related positions: Resident employment continues to grow, with strong demand, potentially providing a stable competitive environment for EP holders and PR applicants in the future.

Professional services and information and communications technology industries should proceed with caution: Employment contraction, weak wage growth momentum, and high future job uncertainty.

2. EP Application Criteria and Building Competitive Advantages

Salary Threshold Increase: Effective January 1, 2025, the minimum monthly salary for new EP applications (non-financial services sector) is S$5,600; for the financial services sector, the minimum monthly salary is S$6,200, increasing with age to a maximum of S$10,700 or S$11,800.

Strict COMPASS points system: Applicants must pass the second-stage points-based assessment, scoring at least 40 points; factors such as institutional qualifications, the institution where the applicant obtained their degree, professional certifications, salary, and industry hiring trends will all influence the score.

Thorough document preparation: This includes the passport homepage, academic credentials (which may require third-party verification), company registration documents, and employment recommendation letters.

Use the SAT self-assessment tool: Before submission, use the Self-Assessment Tool provided by MOM to test whether you meet the salary and COMPASS requirements.

Highlight professional skills and job value in your resume: Emphasize international experience, rare skills, industry contributions, company background, and salary competitiveness.

3. PR Application Direction and Advantage-Building Strategy

PR prefers long-term contributions and employment stability: professionals in financial services or public health/social welfare sectors align with local employment trends.

High competition: occupations in tight labor market sectors (e.g., professional services, ICT) face more intense competition.

Demonstrate long-term residency and employment stability: maintaining continuous EP holding, social contributions, tax payments, and CPF contributions all aid PR review.

Image source: Lianhe Zaobao

5. How to increase approval rates:

A three-pronged strategy

1. Resume and salary positioning

Select positions with salaries above the minimum threshold (e.g., finance/healthcare), highlight educational background, qualifications, experience at brand-name companies, and emphasize special skills.

2. Ensure sufficient COMPASS scores

In addition to salary, enhance academic credentials, professional qualifications, and proof of industry-specific skills. Utilize SAT mock scores and apply in advance for certifications from relevant industry bodies (e.g., IMDA, MOH, ACRA, etc.).

3. Submit Complete Documents and Plan Timelines Reasonably

Prepare identity proof, academic verification, and company documents in advance to avoid delays due to incomplete documentation. EP applications typically receive feedback within 10 working days online; applications submitted by overseas companies may take approximately 8 weeks.

PR applications also require supporting documents such as tax statements, CPF records, and employment stability statements.

【Conclusion】

Overall, Singapore’s job market continued to grow steadily in the second quarter of 2025, with financial services and healthcare/social services emerging as key areas for future employment trends. However, outward-oriented industries face challenges such as slowing growth and reduced willingness to offer salary increases.

As potential applicants for an Employment Pass (EP) or Permanent Resident (PR) status, individuals should closely monitor industry trends, prioritize career fields with stable growth, and ensure that their salary, qualifications, and COMPASS scores meet the latest requirements;

simultaneously, they should thoroughly prepare application documents and supporting materials, and align with official mechanisms (such as SAT, COMPASS, and industry certifications). This approach will enhance approval rates in a competitive environment and lay a solid foundation for future career development and relocation to Singapore.

Note: Reference materials are sourced from Singapore’s Ministry of Manpower (MOM), Immigration and Checkpoints Authority (ICA), the second quarter of 2025 Labor Market Report estimates, Willis Towers Watson (WTW) Salary Budget Planning Survey Report, Lianhe Zaobao, and a compilation of publicly available news reports. Reproduction must credit the source; please contact us for removal if necessary…..