Amidst the booming economy of Southeast Asia, Company A, a cross-border trading company, has successfully opened its global funding vein with OCBC Bank’s efficient and professional corporate account services.

Starting from the industry characteristics of lubricant international trade, relying on Singapore’s internationalized financial infrastructure and OCBC’s digital service system, it quickly completes the whole process from qualification review to account activation, and builds a financial hub covering multi-currency settlement, intelligent risk control and cross-border speedy remittance for EP’s executive team to open a new chapter of globalized operation.

1. Enterprise background check

Company’s industry: international trade of petrochemical products.

Core Business: Specialized in cross-border trade of lubricants, industrial motor oils and other products, with a business network covering Southeast Asia, the Middle East and Africa.

Team Strengths: Both founders are holders of Singapore Employment Pass (EP) with rich industry experience and international background.

2. Account opening requirements and challenges

Company A faces multiple financial service needs as it expands into Southeast Asia:

Multi-currency billing support (USD, SGD, EUR, etc.) is required;

High timeliness requirements for cross-border payments and receipts;

Subject to international trade compliance review standards;

Seek to establish long-term partnerships with multinational banks.

3、OCBC bank account opening solution

Professional team escorting the whole process withbilingual account managers;

Setting up exclusive service channels to shorten the communication chain, andconductingKYCpre-qualification guidancein advance;

Digital account opening process optimization,online document pre-qualification system to improve the accuracy of materials;

Video witnessing service replaces offline signing;intelligent progress tracking system provides real-time feedback on the approval stage;

Specialized financial service configuration andthe opening of the Global Express service;

Setting up multi-level fund management authority andsupporting trade finance credit lines.

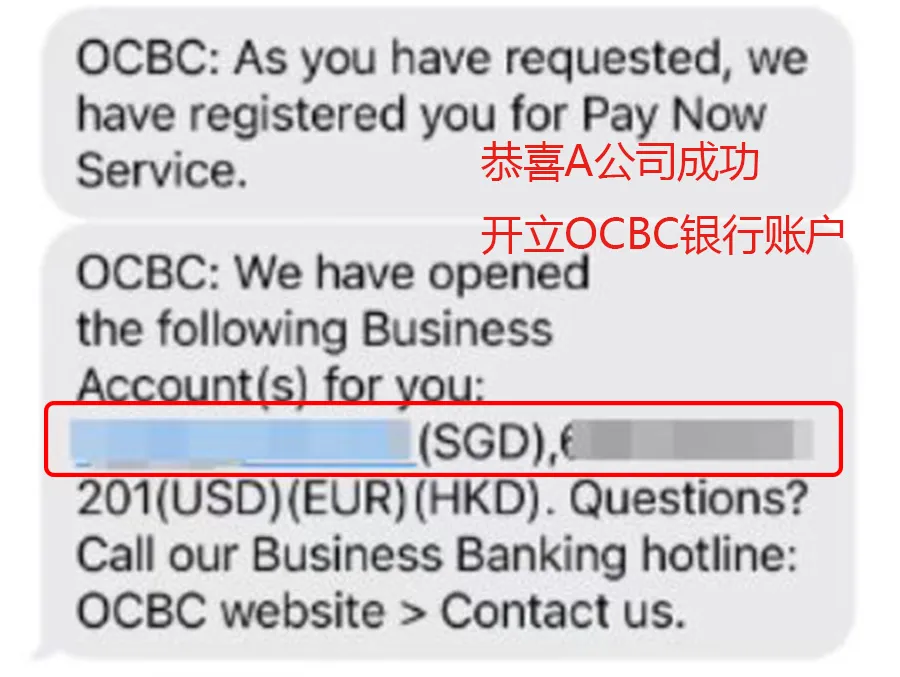

Photo/Company A successfully opened an account with OCBC, stolen image!

4、Efficient account opening process full record

2024.12.20 Pre-consultation phase:

OCBC account managers complete business model analysis and customize account opening solutions.

2024.12.26 Application formally submitted:

Electronic submission of a full set of account opening documents (company registration data, shareholder information, business contracts, etc.).

2025.1.5 Supplementary materials phase:

Supplemental supply chain documentation and EP supporting documents as per bank compliance requirements.

2025.1.15 Video interview passed:

Two directors were remotely identified and interviewed for business.

2025.1.22 The account is officially activated:

Synchronize the opening of enterprise Internet banking and mobile management privileges.

5. Results and customer feedback

“OCBC’s professional services exceeded expectations! From material preparation to account activation, the whole process was followed up and fast tracked, and its global clearing system perfectly matched our cross-border business needs.

Particularly praiseworthy is the account manager’s deep understanding of the trading industry and the design of an optimal funds management program for us within the compliance framework.”–Company A Finance Director Comments

This case fully highlights the strengths of our company in our area of expertise:

Relying on the location advantage of Singapore’s international financial center, and with a deep understanding of international trade business, we create efficient, safe and intelligent financial service solutions for cross-border operating enterprises through the organic combination of standardized processes and personalized services.

What else do you want to know about overseas company registration and bank account opening?