In Singapore, corporate rentals may seem simple, but there isa pitfall of“institutional differences“.

Whether it is an office building, a factory or a residential office, there is a risk ofhigh compensationdue to“early surrender“, “capital guarantees” and “contractual clauses“. Compared to China’s flexible leasing, Singapore’s contractual spirit is stricter and the compensation mechanism is clearer.

First. From“deposit security“to“contract is king”:

What makes Singapore’s rental system more“hardcore“?

Compared to China, Singapore’s rental system emphasizes contract and credit rather than favours and flexibility.

In China, the landlord and tenant can verbally negotiate an early surrender of the lease, and the deposit is usually only used as a“liquidated damages cushion“.In Singapore, however,every CommercialLeaseorTenancy Agreementis legally enforceableand the cost of default is much higher than the rent itself.

1. According tothe relevant guidelines of theUrban Redevelopment Authority (URA) and the Housing and Development Board (HDB) inSingapore:

Commercial leases are generallyregulatedbyboththeCivil Law Actand theLand Titles (Strata) Act;

HDB Commercial units or residences converted to office use are required to declare in advance and comply with the zoning ordinance;

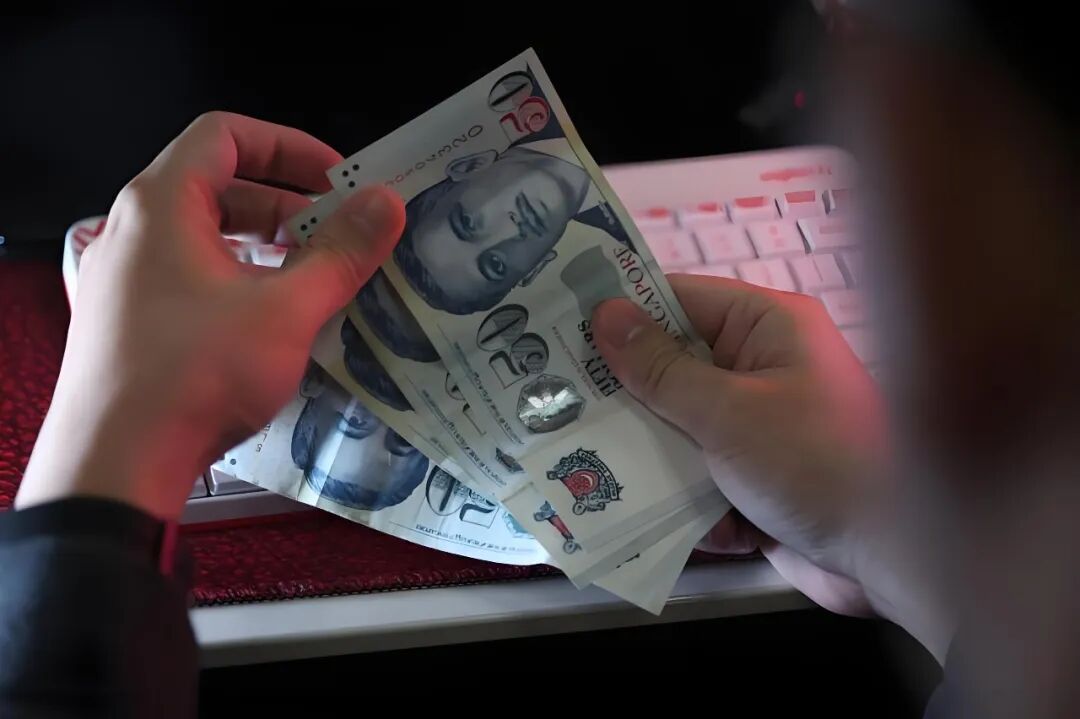

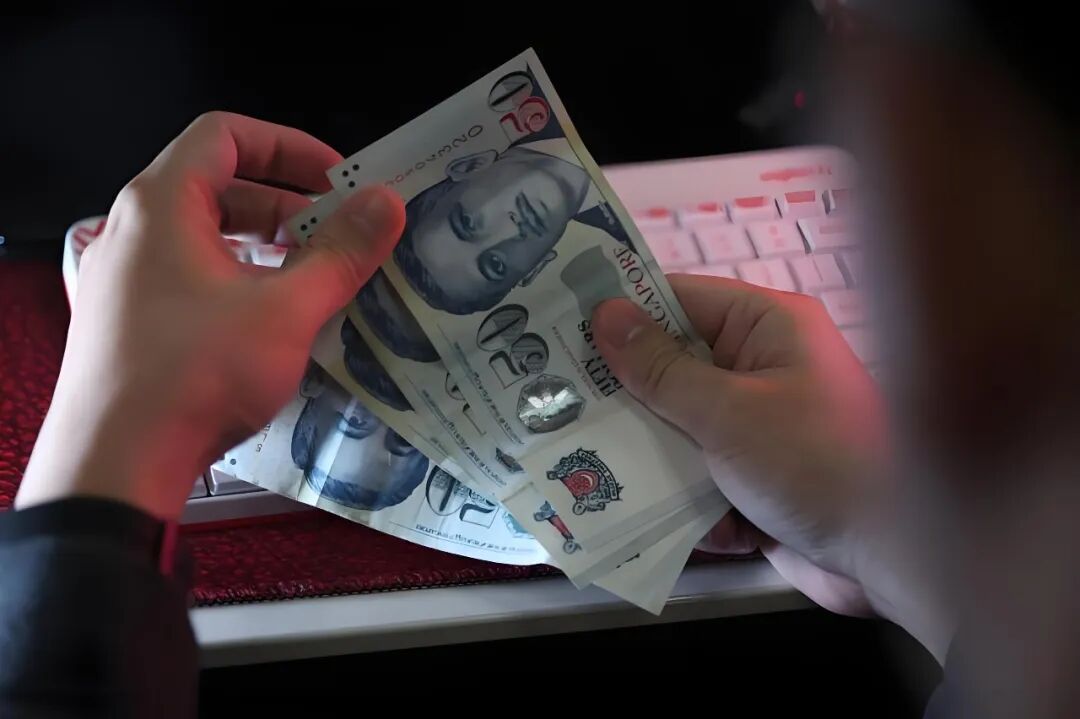

Landlords often require 3to6 months‘ rent as aSecurity Deposit, and it is common for tenants to forfeit the full amount of the deposit if they leave early.

Photo credit: United Morning Post

2.3major differences betweenChina vs Singapore:

Differences in contract enforceability:Chinese contracts can be terminated flexibly; Singapore emphasizes“performance to the end“and courts rarely support unilateral surrender.

The logic of deposits and compensation is different:in China the deposit is a risk buffer; in Singapore the deposit is only the starting point for breach of contract, and the landlord can still make additional claims.

Differences in credit systems:URA and the Accounting and Corporate Regulatory Authority (ACRA) databases provide landlords with access to company credit, capital structure and legal representative information, making lease negotiations more transparent.

In short, Singapore is a“contract-based“society. If you do not read it carefully before signing it, it is difficult to change it after signing it.

Photo credit: United Morning Post

Second, signa 3-year lease butreturn it in2years:

How much compensation? Can you pay less?The key is in these3articles

If a company enters intoa 3-year lease andwishes to surrender the lease at the 2-yearmark, the legal framework in Singapore depends mainly on whether the contract containsaBreak Clause.

1、With Break Clause: Conditional“Safe Getting Off“

If it is clearly written in the contract:

“Tenant may terminate this tenancy after 24 months by giving 3 months’ written notice.”

The tenantcan legally withdraw from the lease by giving three months’ notice to the landlord before or after thetwenty-fourthmonth, and will only be required to pay the contractual“notice period rent“or“small compensation“(e.g., one month’s rent).

But these2pointsneed to be noted:

The Break Clause usually has an“exercise window“(e.g.,it can be withdrawn after24months, otherwise it is still a breach of contract);

Some landlords require payment of“administrative fees,” “brokerage fees,”or renovation and restoration costs.

Photo credit: United Morning Post

2. No Break Clause: full compensation or continued performance

In the absence of such a clause, the surrender of the lease is deemed to bea unilateral breach of contract.

The landlord may demand itundersection74oftheCivil Law Actand case law (Common Law):

Payment of the full rent for the remainder of the lease term, or compensation for actual damages (e.g., for the period of vacancy).

Example:

If the company has a monthly rent of S$10,000,12 monthsremaining on the contract, and a vacancy period of6monthsbefore the landlord re-let the premises, compensation may be claimed:

6monthsx S$10,000 = S$60,000 + renovation restoration fee + brokerage commission.

This type of compensation is usually partially offset directly by the deposit, with the remainder being recovered through civil litigation.

3.Protection of“derogating obligations“other than theBreak Clause

The landlord has to fulfilla “Mitigation of Loss”when making a claim.

This means that if the landlord could reasonably re-let the property but deliberately left it empty in order to claim more, the court will reduce the amount of their compensation.

This is a key point of law that a tenant can assert when negotiating.

Photo credit: United Morning Post

III. From security to capital:

The invisible impact of company registered capital on leasing risk

Many startups or foreign companies renting apartments in Singapore find that landlords ask to“see the company registration“or“personal guarantee letter“. This is not a redundancy, but stems from the transparency of the legal structure and credit system.

1. Paid-in capital vs. registered capital: no pressure on paid-in capital, but affects credit

Singapore company registration only requires Paid-up Capital, which can be as low as S$1, and there is no mandatory paid-up requirement.

However, in a leasing scenario, landlords oftencheck the capitalization of their tenantsthrough ACRA . If the registered capital is found to be too low, it will be considered:

The company’s solvency is weak and the risk of default is high;

Additional deposit (3-6months)orPersonal Guaranteemayberequired.

Photo credit: United Morning Post

2. Guarantee mechanisms: the line between personal and corporate guarantees

Common patterns include:

Director’s Guarantee: Individuals are liable for liquidated damages;

Corporate Guarantee: Joint and several liability provided by affiliated companies.

In the event of early termination, the landlord usuallydoes notclaim on the basis of the registered capital, but rather on the basis of the amount of the contractual breach of contract. However, if the company’s capitalization is extremely low or it has been written off, the guarantor is still liable for the full amount.

3. Risk control recommendations

Registered capital is recommended to be not less than S$10,000to demonstrate business sincerity and creditworthiness;

The terms of the guarantee should expressly limit the maximum amount and duration of the compensation (e.g.,“the amount of the guarantee shall not exceedthreemonths’ rent and shall be valid for a period of24months“);

The signatory to the contract should be a corporate body to avoid unlimited personal liability.

Photo credit: United Morning Post

IV. Early Rent Surrender Practices and Dispute Paths:

What’s the best way to save from negotiation to arbitration?

Singapore is a highly contractual society, but“negotiation first“is still the prevailing practice.

The following process can be used by companies to minimize losses in the event of an early exit:

1. Advance notice to the landlord:at least3 monthsin advanceto show sincerity;

2、Propose subletting(Subletting): assist the landlord to find new tenants and reduce their losses;

3. Preserve evidence:including email exchanges, screenshots of property advertisements, and home restoration quotations;

4. Confirmation of the responsibility for restoration of renovation(Reinstatement Clause): If the contract requires restoration to its original state, the costs need to be assessed in advance;

5. Apply for mediation or arbitration(SLA,Small Claims Tribunal):those whoseamount is less thanS$30,000can go through the summary arbitration procedure;

6. Litigation route:only as a last resort in case of breakdown of negotiations, requiring the hiring of a lawyer (costly but highly enforceable).

Practical advice:

If the business still needs to operate in Singapore in the future, it should aim to settle the case first, as being reported as a“defaulting tenant“by the landlordcould affect future leases and credit ratings.

Photo credit: United Morning Post

V. The“6words“of enterprise leasing

andthe “3principles“of risk control

1. Six sentences summarizing the truth about leasing:

Read the terms and conditions more before you sign and it will be harder to change them afterward;

Don’t say you’re out of the leasewithout Break Clause;

The deposit is a floor, not a ceiling;

Contributed capital, while not the basis for compensation, determines negotiating leverage;

Guarantees have boundaries and personal responsibility should be spelled out;

Outside of a contract, reputation is the greatest capital.

2. Three major risk control principles:

Legality is prioritized: verification of landlord’s title, use (URA/HDBapproval).

Transparency of terms:Break Clause, warranty, and indemnification must be clearly written.

Credit management: keeping the company’s capital sound and records in good standing to pave the way for future leases.

Photo credit: United Morning Post

Conclusion:

Renting in Singapore, enterprises are not only faced with“rental costs“, but also“contractual credit“and“system gaming“.

Beforesigning thatthree-year contract, think: do you still want to continue after two years? If the answer is probably“not sure“, then write Break Clause inadvance, otherwise, even the deposit may only be the beginning of compensation.

Note:References fromHDBSingapore,URA,ACRA, United Morning Post, comprehensive news reports collated, reproduced with attribution, infringement and deletion contact.

…

👇 Add WeChat enters Singapore’s largest outbound community 👇

Past Recommendations