When the price of gold all the way soaring, gold jewelry, investment gold bars and even“gold watches“are pushed to the wind. Shenzhen Shui Bei goldsmiths, is with craftsmanship and brand redefinitionof “Chinese gold jewelry“.

InSeptember2025, Shenzhen Xiphone Precision Technology was listed on the Hong Kong Stock Exchange, with a market value of nearly 10 billion Hong Kong dollars, this“domestic Rolex“not only represents the rise of Chinese jewelry manufacturing, but also provides inspiration for Chinese enterprises to go overseas.

Nowadays, more and more jewelry brands are beginning to set their sights on Singapore,a golden new port with transparent regulation, friendly tax system and radiation in Southeast Asia.

I. From Putian Beigao to Shenzhen Shuibei:

Ahistory of the evolution ofthe “gold-digger“.

If Putian is“China’s goldsmith’s hometown“, then Shenzhen Shui Bei is the“Wall Street“of gold jewelry.

SIPNI Precision Technology is the combination of these two industrial landmarks.

Founder Li Yongzhong was born in Beigao Town, Putian, Fujian Province. It is known asthe “Whampoa Military School of Chinese Gold Jewelry“:7 out of 10 goldsmiths come from Beigao. The art of goldsmithing has been passed down since the Ming Dynasty, and the craftsmen have been taught by masters and apprentices, and their sons and fathers have inherited their skills for a hundred years.

In2002, the Shanghai Gold Exchange was established, the Shenzhen Municipality to promote Shui Bei become a gold jewelry industry cluster, the North High people south to start their own business, thus setting off a wave of gold manufacturing.

In2013, the Li Yongzhong family established the predecessor company of Shenzhen SIPNEY;in2014, it launched China’s first mass-producible full-gold watch. In ten years, SIPNEY has grown from a foundry to a manufacturer with its own brand.

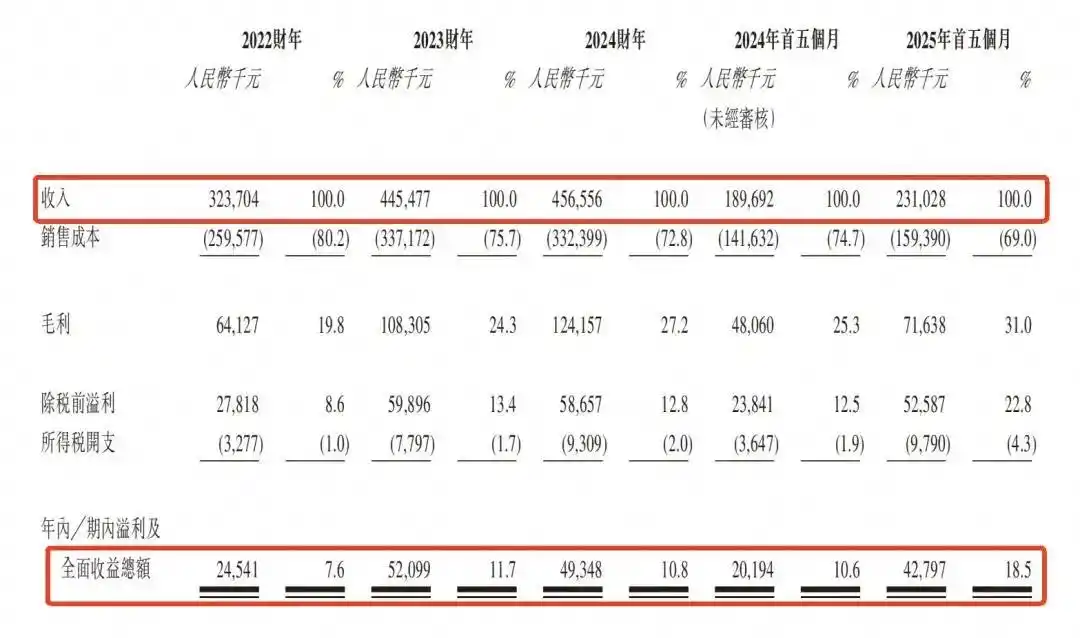

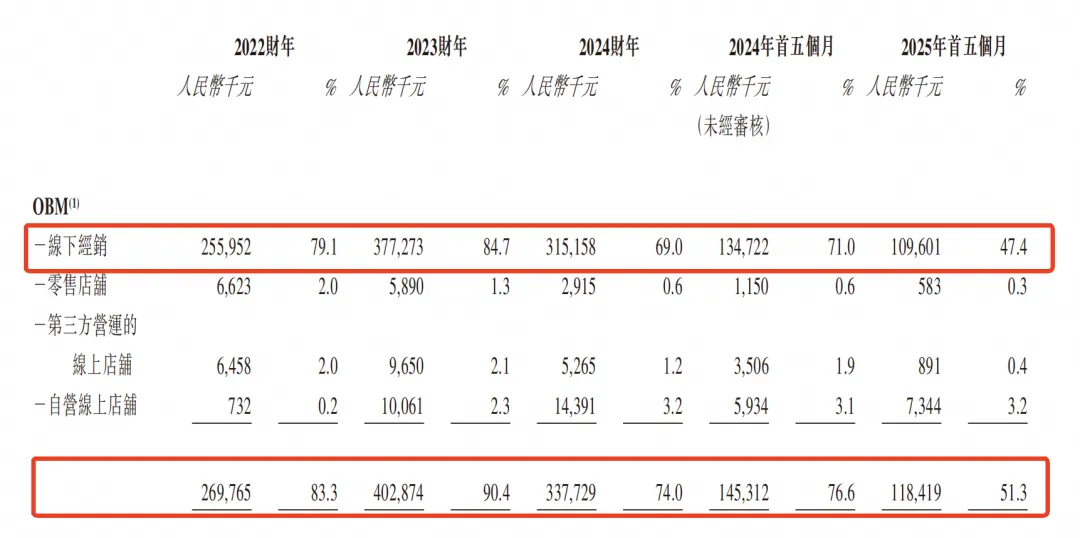

As of2024, the company’s revenue reachedRMB457 million with a market share of27%, making it the largest foot-gold precious metal watch brand in China.net profit for the first five months of2025amountedto RMB42.8million, an increase of86%year-on-year.

Source: 21st Century Business Review

This“Putian+Shenzhen“genes of the company, with process innovation to open a new market segment:gold+watches.

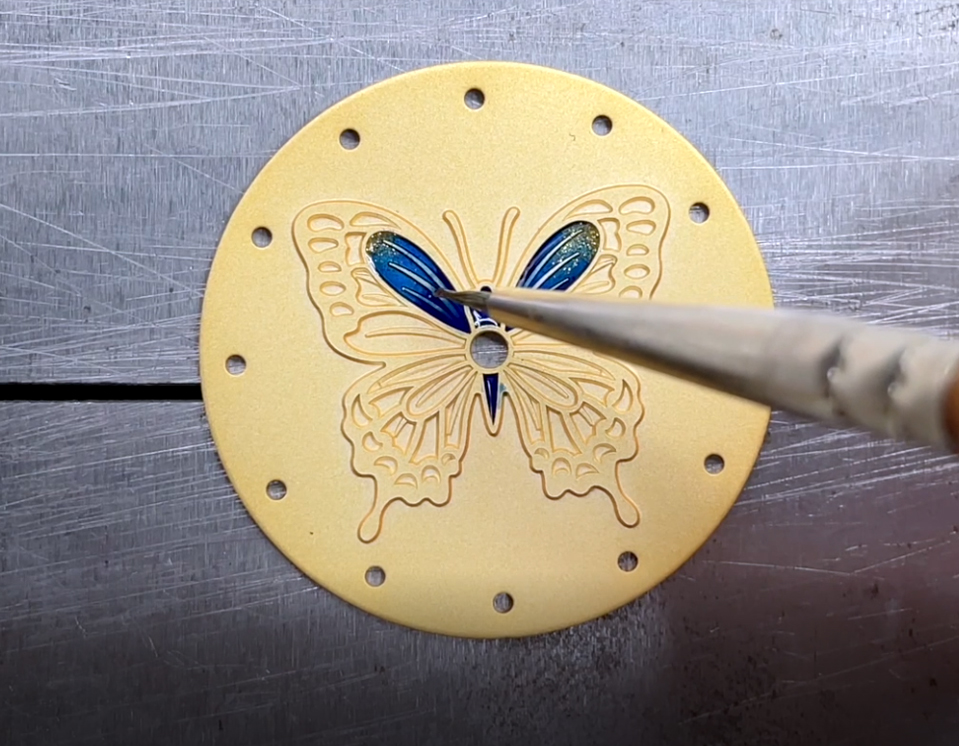

Photo credit: Siphone

Second, from foot gold watches to smart gold watches:

A new“growth curve“for the gold industry

SIPNEY is not satisfied with traditional gold jewelry, but seizesthe opportunity of“cross-border innovation“.

Its two brands represent the dual direction of gold watches:

HIPINE:High-end gold watch, the main“gold hardening process“, to solve the problem of pure gold easy to wear;

Goldbear:intelligent gold watch with embedded smart chip, which can realize Bluetooth unlocking, intelligent car control and other functions.

These products are both consumer goods and investments. As Cipriani says,“Worn on the hand, it’s not just time, it’s an asset.“

Photo credit: Siphone

However, soaring gold prices pose a challenge. Since2024, the price of gold has continued to reach record highs, pushing up production costs on the one hand and suppressing consumer demand on the other. SIPNEY has adoptedthe strategy of“reduce gold but not price“, replacing weight competition with craftsmanship and design, which stabilizes gross margins in the short term, but also highlightsthe importance of“brand trust“.

In2024, China’s precious metal watch market reached26.4billion yuan, of which gold watches accounted for more than93%. Despite the small size of the market, it is growing steadily.

Source: 21st Century Business Review

Siphone plans to find incremental growth through two paths:intelligent upgradingandoverseas expansion.

In 2024, SIPNEY began to expand overseas, partnering with a Malaysian distributor and retailer in November of that year to distribute and retail gold watch products in Malaysia. In the future, SIPNEY also plans to expand into the Middle East.

This logic of transformation also provides ideas for Chinese jewelry brands to go overseas: “Not blind expansion, but using technology and brand to empower going overseas.

Photo credit: WorldNetDaily, Siphone

III. Why Singapore is

The “Second Shui Bei“of Jewelry Brands?

Singapore is not only a financial center, but also an important node for the Asian gold trade.

1.Policy and Financial Security

Singapore has long maintaineda AAAcredit rating, a stable currency andno thresholdfor100%foreignownership.

For the jewelry industry, this means free exchange, convenient trade and tax incentives.

2.Geography and Consumption Advantage

Singapore is at the core of Southeast Asia, radiating Malaysia, Indonesia, Thailand, the Middle East and other gold consumption powerhouses.

At the same time, the local community has a large number of high net worth groups, which is a natural market for luxury retail.

3.Mature industrial ecology

Singapore’s local jewelry exchange, diamond testing centers, luxury showrooms, international auction houses and other supporting facilities can provide a complete supply chain for brands.

4.Free port system

Jewelry can be warehoused, bonded for display or re-exported in Singapore’s free ports without paying additional taxes, greatly facilitating cross-border trade.

Photo credit: Siphone

Fourth, the whole process guide for jewelry enterprises landing in Singapore

1. Company registration: the first step to legal operation

All businesses dealing in diamonds, gold and silver must be registered in Singapore.

The registration authority is ACRA(Accounting and Corporate Regulatory Authority)and the process is as follows:

Submission of company name and articles of association;

Designate at least1director (may be a foreigner);

Provide registered address with company secretary;

Foreign businessmen are required to apply for a CorpPassfor subsequent tax filing and banking purposes.

The registration process usuallytakes1to2working days to complete.

If you plan to operate for a long period of time, you should register as a Private Limited Companyinorder to enjoy tax benefits and brand credibility.

Tip:Find a professional accounting firm that can assist with registration, which can be done simultaneously withBizFilefiling and tax registration.

2. Bank account opening: focus onKYCand funds compliance

The Singapore banking system strictly enforces the Anti-Money Laundering (AML) regime, especially for gold and jewelry businesses.

The following documents are required to open an account:

Proof of registration ofthe companyBizFile;

Directors’ and shareholders’ identification documents;

Business plan, description of sources of funding;

Description of key customers and trading patterns.

Mainstream banks include DBS,OCBC,UOB, Standard Chartered Bank.

If it is difficult to open an account initially, you can use digital banks (e.g.Wise,Airwallex,Aspire) to open an accountfirst and then switch to a local bank later.

Tip:If the enterprise is involved in gold import or re-export trade, it is necessary to prepare the procurement contract and supply chain description, so that the bank can review the legitimacy of the funds.

Source: Internet

3. Operating licenses and industry licenses

In addition, jewelry companies must establish internal anti-money laundering mechanisms, including customer identity verification (KYC) and transaction reporting systems.

4. Tax and accounting systems

Corporate income tax:17%, the first100,000 profit inthe first three years of a new companyis fully tax exempt;

Goods and Services Tax (GST):GSTregistration is required for anannual turnover of more thanS$1 million;

Tax filing cycle:1timeper year,regulatedby Inland Revenue Authority of Singapore (IRAS).

You can appoint a licensed accounting firm to do your bookkeeping and tax filing for you at a cost ofS$2,000toS$4,000per annum.

5. Employment of staff and work permits

Employers are required to register CPFaccountsand make CPF contributions for local employees;

Foreign employees are required to have a valid working document:

Employment Pass(EP): for executive or professional positions;

S Pass: for technical or sales positions;

Work Permit: For skilled labor positions;

Singapore’s labor law requires a44-hourworkweek, with mandatory health insurance and paid leave.

Tip:Jewelry companies can hire local sales and marketing staff for store and brand promotion, and core craftsmen can beintroduced to senior Chinese goldsmithsthroughEP.

Photo credit: Siphone

V. 3 Insights of Chinese Goldsmiths Going Overseas

Insight 1: From manufacturing to branding, process innovation is the starting point for going overseas

Gold jewelry has long moved from“selling by the gram“to“selling by design and culture“.

The example of Siphone shows that only in the process of innovation (such as gold hardening technology, intelligent integration), in order to obtain a premium in the international market.

Insight 2: Choose the right landing spot

Chinese enterprises are no longer blindly chasing after“low-tax zones“, but rather looking formarkets thatcantake into account financial stability, trade freedom and brand image.

Singapore is the ideal“springboard“for jewelry brands.

Insight 3: Compliance and Financialized Operations

The jewelry industry itself involves precious metal trading and anti-money laundering regulation. By choosing to list on the Hong Kong Stock Exchange, Siphone is building credibility through capital market compliance. For jewelry brands that want to go global, compliance and trust are more important than profits.

Photo credit: Siphone

Conclusion: From“goldsmith“to“golden brand“, the golden road in the new era of going overseas

Ten years ago, Chinese jewelry enterprises were mainly engaged in OEM and low-priced export;

Ten years later, the new generation of enterprises represented by Sipuni is going global with the goal of branding, capitalization and internationalization.

Singapore, is becoming an ideal starting point for them.

It has a well-developed financial system, a transparent regulatory environment and a broad regional market.

More importantly, it allows“Chinese goldsmiths“to tell the story of Chinese craftsmanship in the international language.

From the goldsmith store in Beigao, Putian, Fujian, to the jewelry street in Shui Bei, Shenzhen, and then to the gold window in Orchard Road, Singapore: this is the trajectory of China’s manufacturing overseas, but also a generation of jewelers‘ “Golden Journey“.

Note:References fromthe 21stCentury Business Review, the world’s online business, Siphone, China Gold Network, SingaporeACRA,CPF,IRAS,GoBusiness,MOM, the United Morning Post, comprehensive news reports collated, reproduced must indicate the source, infringement of the deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations