The“parallel lives“of two top schoolboyshave different endings.

On the one hand is Tsinghua schoolboy Wu ship, young in Wall Street quantitative fund to break through a day, but because of insider trading by the U.S. Department of Justice is wanted globally, can only stay in mainland China, never dare to step out of the country.

On the other side is Sun Yuchen, a senior student at Peking University, who became famous with Wavefield Coin and owns a huge amount of wealth, but because of the suspicion of illegal fund-raising, he has been under border control for many years, and he can only maneuver overseas and can’t go back to China.

Onecannot leave the country, the othercannot return.

They are both“alternative samples“of the financial and virtual currency systems in China and the United States, as well asmirror charactersunder the regulatory differences between the East and the West.

I. Wu Ship: From Tsinghua to Wall Street

“Quantitative Wizards“for 10 million dollars a year.

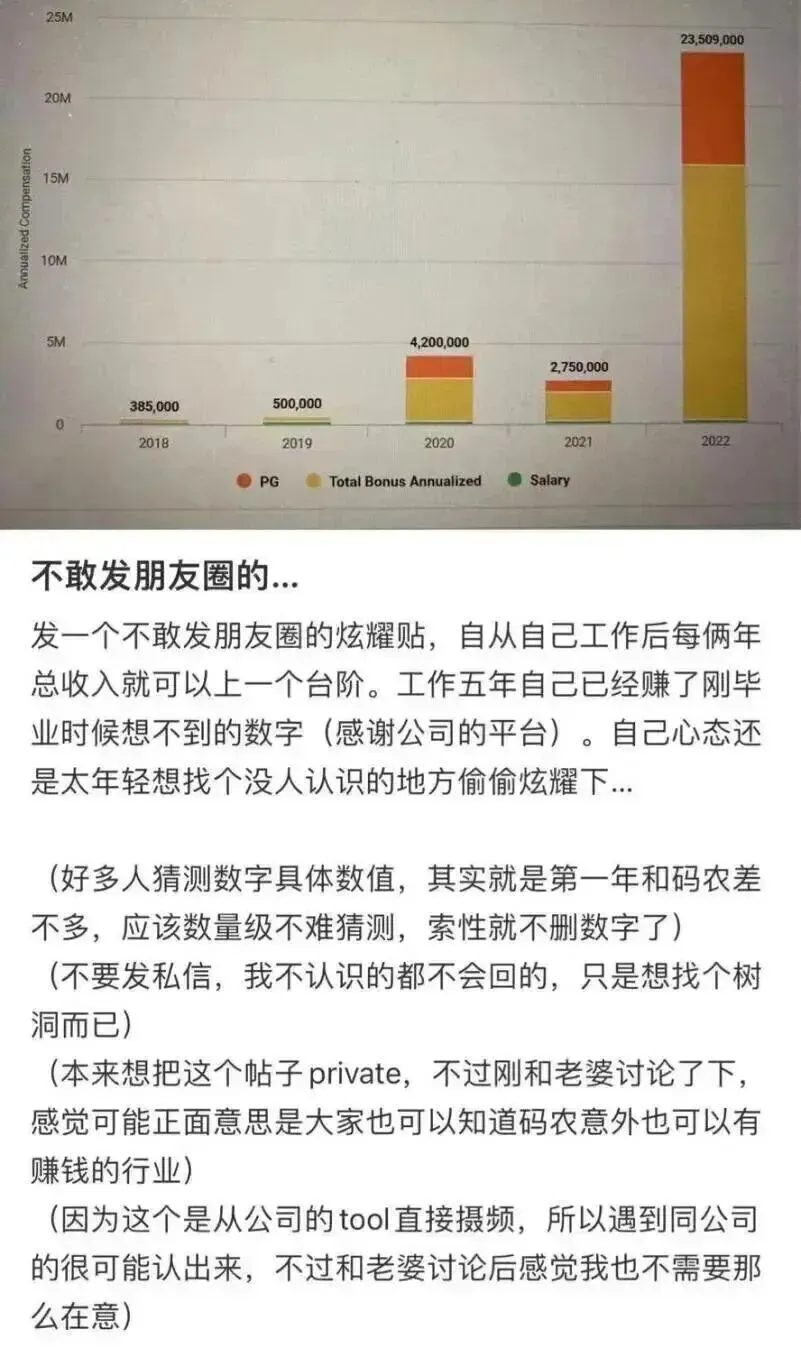

There are reports thatin2023, Wu ship in the small red book “quietly show off the rich”, but also said that “do not dare to send a circle of friends, their mentality is still too young, and would like to find a place no one recognizes to secretly show off……”. The first time I saw the movie, it was a very good one, and it was a very good one.

Source: Internet, deleted

Born in Hefei, Anhui Province in1990, she won the first prize in both Physics and Mathematics competitions;

Guaranteed admission to Tsinghua Automation andgraduated from undergraduateprogram in 2011;

He went to Cornell for his Ph.D. andreceived his Ph.D. in Operations Research in 2017;

Interned at Citadel, a top Wall Street hedge fund;

JoinedTwo Sigmain 2018and was promoted to Vice President for three years andSenior Vice President in2023.

Figure / Wu ship, source network, infringement of deletion

On Wall Street, a million dollars a year is already the top level. Wu ship but in the little red book“show off“, sunshine annual salaryof23.5million U.S. dollars (about167million yuan)payroll. This move not only triggered the financial circle, but also led to an investigation.

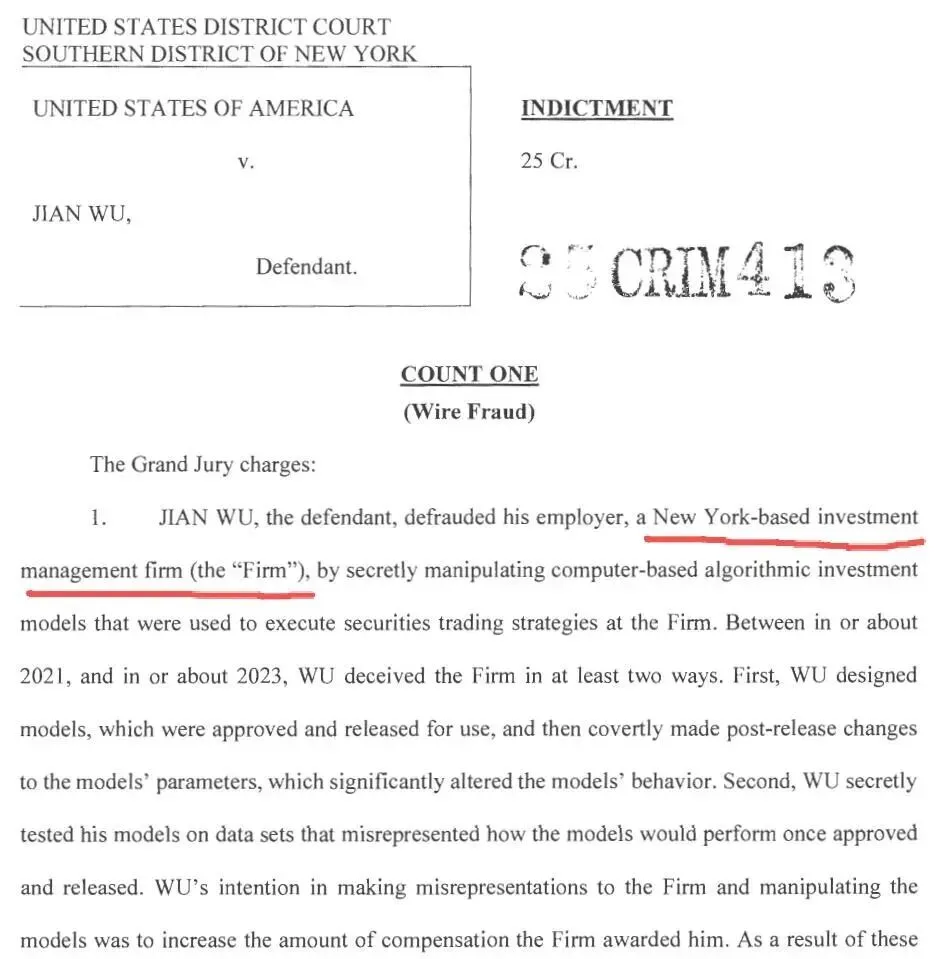

The U.S. Department of Justice accused him of using algorithmic models to manipulate trades that allowed the firm’s internal executives and employees to invest in funds that made an extra$450 million, while external clients lost$165 million.

Figure / Algorithm modeling diagram, source Sina Finance

The result:clients were compensated; company insiders netted$290million;

The odds are thatWu Shipwill not be caught whenhe gets his$167 million annual salary and returns home safely, as long as he doesn’t set foot in the United States or a U.S.-allied country.

The United States Department of Justice issued a warrant to symbolically“bring justice“.

To put it bluntly, Wu’s“crime“is not an isolated incident, butthe tip of the iceberg ofWall Street‘s “systemic conflicts“. Clients and insiders have opposing interests, and the genius quantitative modeling has become a cover. Wu ship is just the latest“cook“, for Wall Street to complete a money feast.

II. Sun Yuchen:

The “Coin World“of a talented guy from Peking University.

If Wu Shu is the“fintech elite“, Sun Yuchen is therepresentative ofthe “cryptocurrency jungle“.

In 2017, Sun Yuchen manipulated the Wavefield Coin (Tron)ICO, pulling it up from a few cents to$2, a 100-fold surge. He took advantage of the high point to sell6billion wave field coins, cashing out about2billion yuan, the coin price plummeted 20%the next day.

Picture/Sun Yuchen, source from the Internet, infringement and deletion

In 2019, Caixin disclosed that hehad been border-charged by Chinaas early as2018in connection with illegal fund-raising and money laundering. Since then, he has never been able to return to China, but continues to“high-profile business“overseas:

Claims to be Grenada‘s Ambassadortothe WTOwith“double absolute immunity“;

This year, hewasinvited to Trump’s private dinner in Virginiabecause he wasthe “largest holder” of1.43million Trump coins.

But the “magic” is that he was banned in China, but can play in the U.S. political arena. This contrast revealsthe difference in attitudes toward cryptocurrencies between China and the United States.

Photo/Sun Yuchen on Forbes Magazine, source online

III. The new China-US-Hong Kong:

Comparison of attitudes towards virtual currencies in four places

1. Mainland China: Strictly Banning Virtual Currencies, Looking Cautiously at Stablecoins

Chinahas completely bannedICOssince2017andeven declared all cryptocurrency transactions illegal in2021. The reason is realistic:

Preventing capital outflows;

Protection against financial risks;

Avoid speculation that shocks the economic order.

As for stablecoin, the official attitude is even more ambiguous.2025InSeptember, Caixin.com reportedthat “Chinese banks and central enterprises may hold off on applying for stablecoin licenses in Hong Kong“, which was later deleted. This means:

China’s attitude towards stablecoins remainshigh pressure and wait-and-see.

2. Hong Kong, China: Piloting stablecoins and establishing a regulatory sandbox

In2023, Hong Kong, China, put forward a“blueprint for the development of virtual assets“, allowing virtual asset trading platforms to operate under licensed conditions;in2024, the Stablecoin Ordinance was passed, andfrom August2025, applications for licenses were formally accepted.

As ofAugust,77organizationshaveexpressed interest in applying, including banks, technology companies and brokerages. However, Caixin reports that Chinese financial institutions are cautious, worried about“risk transfer“.

Hong Kong, China, has chosen thepath of“orderly opening“, trying to find a balance between the internationalization of the yuan and international financial center.

Photo credit: United Morning Post

3. The United States of America: repression and acceptance at the same time

Regulation of cryptocurrencies in the U.S. has alwaysjumped from side to side:

The SEC(Securities and Exchange Commission) has frequently sued the exchanges and program parties (including Sun Yuchen);

At the same time, however, Congress is pushing fora “Stablecoin Act“that would provide a compliance framework for the industry.

The logic of the United States is clear:speculation can be combated, but innovation cannot be abandoned.

Bitcoin and ethereum are still legitimate assets in the United States, andUSDC, the dollar stablecoin issued byCircle, has become an important tool for global payments.

4. Singapore: Open and Compliant, Embracing Stablecoins

In stark contrast to the US and China, the Monetary Authority of Singapore (MAS) has chosen toembrace and regulatethe path:

In2020,XSGD, the SGD-pegged stablecoin, went live andwas issuedbyStraitsXand held1:1reservesat DBS and Standard Chartered Bank;

In2023,StraitsX receiveda MAS-approved major payer license;

InSeptember2025,XSGDlanded onCoinbaseas a stablecoin that can be traded directly between users in Singapore and around the world.

Singapore’s goal is clear: to use stablecoins to strengthen itspositionasAsia’s digital financial hub.

That’s why, the United States tightened enforcement, China’s total ban on mainland China, Hong Kong, China, cautious exploration, while Singapore has becomethe “most welcoming place for crypto“.

Photo credit: United Morning Post

Four, two geniuses, four systems:

Who’s the real winner?

Look back at Wu Ship and Sun Yuchen:

Wu’s story on Wall Street reflects the“infinite temptation under the game of rules“in the U.S. capital market;

Sun Yuchen’s cryptocurrency adventures, on the other hand, reveal China’s heavy-handed control of the financial order.

Four place comparisons:

Mainland China: zero tolerance, risk prevention first;

Hong Kong, China: Regulatory Sandbox, Testing the Waters of Stablecoin;

United States: Combating and enabling, risk and innovation go hand in hand;

Singapore: Compliance and Innovation, Borrowing from Stablecoin to Grab the Lead.

If you put them into a coordinate system:

Wu represents“The Gray Boundary of American Innovation“;

Mr. Sun Yuchen on behalf of“Overseas Escape from Chinese Control“;

Hong Kong, China and Singapore, respectively, reflectingthe “cautious test of water“and“active embrace“.

Photo credit: United Morning Post

Conclusion: The Future Virtual Currency Landscape

Financial history has proven time and time again that regulation is not meant to eliminate innovation, but to filter out the innovation that can remain.

Wu Ship and Sun Yuchen, one tumbling through the real financial system and the other making inroads into the world of cryptocurrencies, have both ultimately becomevictims/survivorsof regulation and the system.

The future of virtual currencies may not belong to these two geniuses, but it certainly belongs to the countries and institutions that can steadily grow within the regulatory framework.

Mainland China may continue to be high-handed until the digital yuan is fully rolled out;

Hong Kong, China will become China’s“financial experimental field“;

The U.S. still swings, but takes the initiative by virtue of its dollar status;

Singapore, on the other hand, couldtruly become aglobal hub for crypto compliancewithstablecoins such asXSGD.

Wu Ship, who can not leave the country, and Sun Yuchen, who can not return to the country, are just two grains of dust in the world financial order.

The wave of cryptocurrency is still surging forward.

Note:Reference collated from Sina Finance, Tencent Finance, United Morning Post, Forbes comprehensive news reports collated, reprinted with attribution, erosion deletion contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations