Black Friday is coming and the battle is on.

Temu,SheinandTikTok Shopswept the global e-commerce battlefield, while Mingchuang Youpin and Bubble Mart broke through with their branding power, opening a new chapter for Chinese e-commerce platforms to seize the market with technology.

From price wars to cultural export, Made in China is evolving into“China Brand“. Who will remain invincible in this global frenzy?

i. from markets for technology.

to technology for markets

For Chinese enterprises, behind this battle is thegame of“market for technology“and“technology for market“.

Once upon a time, Chinese enterprises used thestrategy of“market for technology“to accelerate the improvement of their own strength through joint ventures, learning and introduction of advanced manufacturing and management experience.

Now, with the rise of technology and Internet enterprises, this logic is being reversed:“technology for market“has become a reality:TikTok, ByteDance and other enterprises are using their own algorithms andAIcapabilities to exchange for market accesswhen they lay out their overseas markets; and traditional retailers are exploring new modes of digitalization upgrading and global market expansion.

Source: Xinhua, deleted

On the global cross-border e-commerce track, the game of technology and market is getting more and more intense.

On the one hand, Chinese companies rely on technology, data and innovation to compete for overseas traffic and market share; on the other hand, overseas markets are“forcing“companiestoinnovate continuouslythrough policy rules, consumer preferences and regulatory requirements. This dynamic game is shaping the new retail landscape and making cross-border e-commerce competition more complex and multi-dimensional.

Now, as Black Friday approaches, this global retail event has become an important node for major e-commerce companies to test their strategy and execution.TikTokaccelerates commercial realizationwith the help of the algorithm-drivenGMV Maxsystem, Meitong Yupingexplores offline experience upgradingthrough thetransformation ofstores andIPs, and Bubble Martexpands rapidly into the overseas marketon the basis of theIPs oftrendy games.

The interaction between technology and market, the integration of online and offline, and the competition between innovation and strategy make this year’s Black Friday not only a consumer carnival, but also a cross-border e-commerce all-round competition.

Source: Xinhua, Lianhe Zaobao, deleted.

II. Meijuana: from“selling groceries“

Strategic TransformationtoIPRetail

1、Famous brand: how to go from0to10billion?

When it comes to the rapid rise of retail companies in China, Mingchuang Yuping is an inescapable case. Founder Ye Guofu shared on the program “Luo Yonghao’s Crossroads” that Mingchuang Yuping has achievedrevenuefrom0to10billion injust a few years!

At its peak, it opened more than1,000storesa year, and its growth rate was even described by himself as exceeding Jack Ma’s early pace. Behind this rapid expansion is a keen capture of market demand and efficient execution of supply chain and store management.

However, with the maturity of the market and the upgrading of consumer demand, Mingchuang Yuping is also constantly adjusting itself. Ye Guofu proposed that in the next two years to“vacate the cage and replace the bird“, plans to close80% ofthe stores to reopen, so as to change the store model and product mix.

This initiative is not only an optimization of store space, but also an attempt to transform from traditional retail to cultural and creative retail. By strengtheningIPproducts and enhancing the consumer experience, Famous Brand hopes to make customers fall in love with shopping again, and make offline stores a carrier of brand and cultural experience rather than just a simple shopping place.

On a strategic level, the upgrade of Famous is also inextricably linked to the cross-border layout. In the past few years, it has rapidly entered overseas markets through the franchise model, while its future cultural andIPtransformation will provide more differentiated competitiveness in the international market.

At a global promotional node like Black Friday, the adjustment of stores and product innovation of Famous Brand will directly affect the shopping experience and brand recognition of overseas consumers.

Photo credit: Luo Yonghao’s Crossroads

2. Luo Yonghao’s Crossroads: New Retail and Cross-border E-commerce Choices

Outside of Famous, Luo’s Crossroads program offers an alternative perspective on the retail industry. The program invites famous multiple entrepreneurs to share their experiences and discuss the path of combining offline retail, live bandwagon and cross-border e-commerce. For Chinese companies, Black Friday is not only a sales node, but also a time to test digitalization and global operation capabilities.

The program revealed that some enterprises are not only focusing on single-store profitability, but also on data-driven operation andIPcontent constructionwhen exploring new retail models. Through social media, live interaction and membership systems, companies can accumulate user data, gain insight into consumer preferences in a short period of time, and increase the repurchase rate through refined operations.

During the Black Friday period, these kinds of digital capabilities become the key to winning for companies. For example, in conjunction with the store upgrade program of Famous Goods, the model of online content diversion and offline experience undertaking can result in higher conversion rates during global holiday promotions.

Image source: Famous Creations

Third,TikTok: algorithm-driven

New forces in cross-border e-commerce

If we say that Meichuang Youpin represents an innovative attempt of traditional retailing, thenTikTokis atypical case of“technology for market“.Over the past year,TikTokhas gone through several rounds of organizational restructuring in the U.S. and the global market, reorganizing its core product team, live broadcasting and e-commerce team, with the aim of replicating the success of China’s Jitterbug in overseas markets.

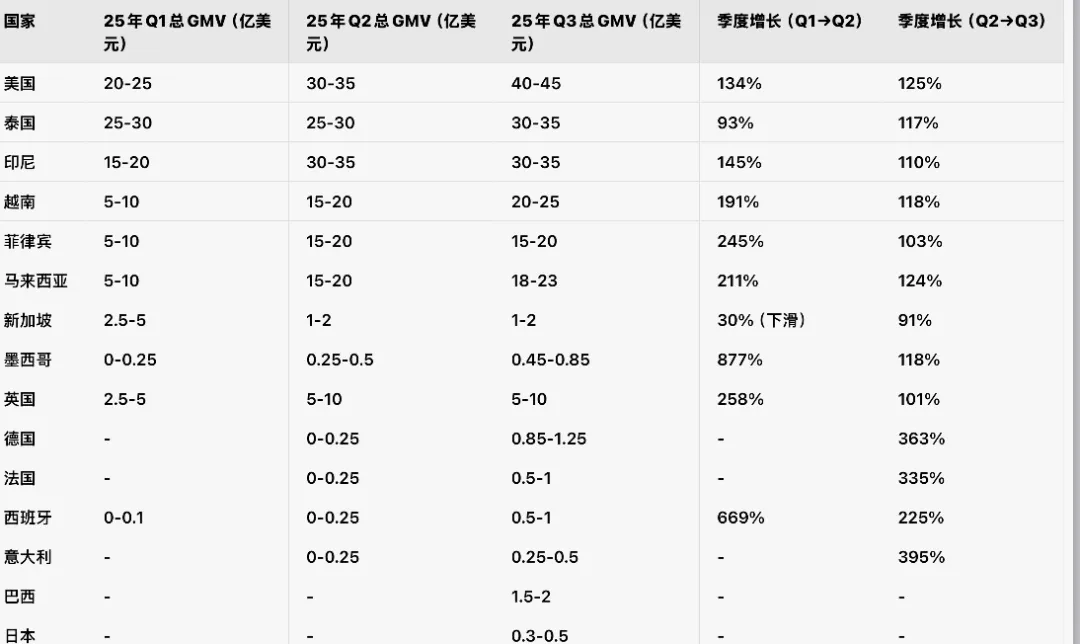

TikTok‘sGMVtarget is as high as$100 billion, whilethe GMVfor the first three quarters of2025is about$10billion,$15billion, and$19billion,respectively, with the U.S. market contributing the most.

Chart/TikTok e-commerce business Q1-Q3 GMV data 2025, source: tiktok quarterly war report

TikToke-commerce made two core moves ahead of Black Friday:

One of them is the launch ofGMV Maxmode, whichautomatically optimizes flow castingthroughAIalgorithms. Merchants only need to set budgets andROItargets, and the system will intelligently allocate advertising resources in the global flow to achieve efficient conversion;

The second is to support original short videos, optimize the content ecosystem, and improve the efficiency of advertising and merchandise conversion. This series of actions makesTikToknot only a traffic platform, but also a core hub for global cross-border e-commerce.

However,TikTok‘s new model also brings challenges. For small and medium-sized merchants,the cost of learning and material preparation forAIcasting streams has increased significantly, and they may face unstable returns on investment in the short term.

Large merchants need to adapt to the algorithmic rules by setting up specialized content teams, while debugging the placement strategies for new and old products in the run-up to Black Friday.TikTokis using this technology to drive cross-border e-commerce into a more efficient, data-driven phase of operation.

In the context of Black Friday,TikTokhopes to use its powerful algorithm and content ecosystem to help merchants rapidly increaseGMV, while validating the feasibility and sustainability of its own business model. As industry insiders say, this year’s Black Friday will be akey battle forTikTokto prove itself in the US market.

Image source: Mirror Phase, deleted

Four, Bubble Mart:

Global Expansion of theIPTide Play Model

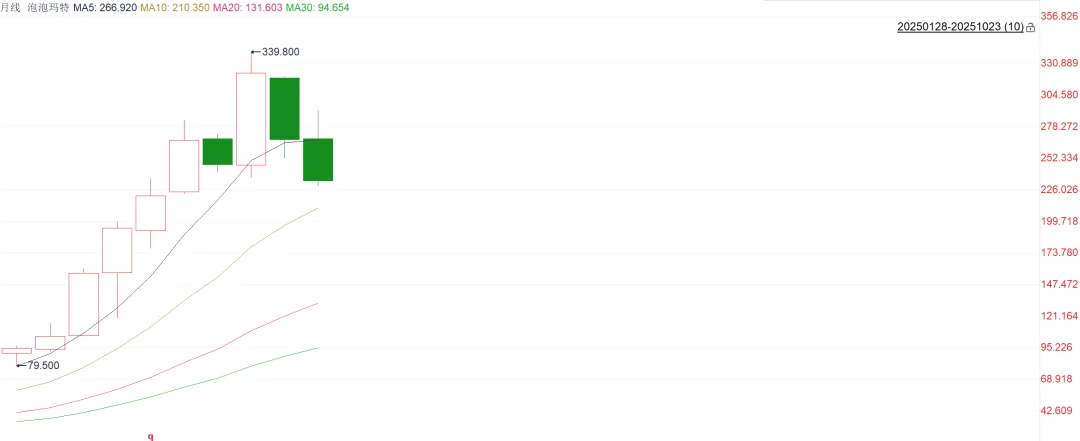

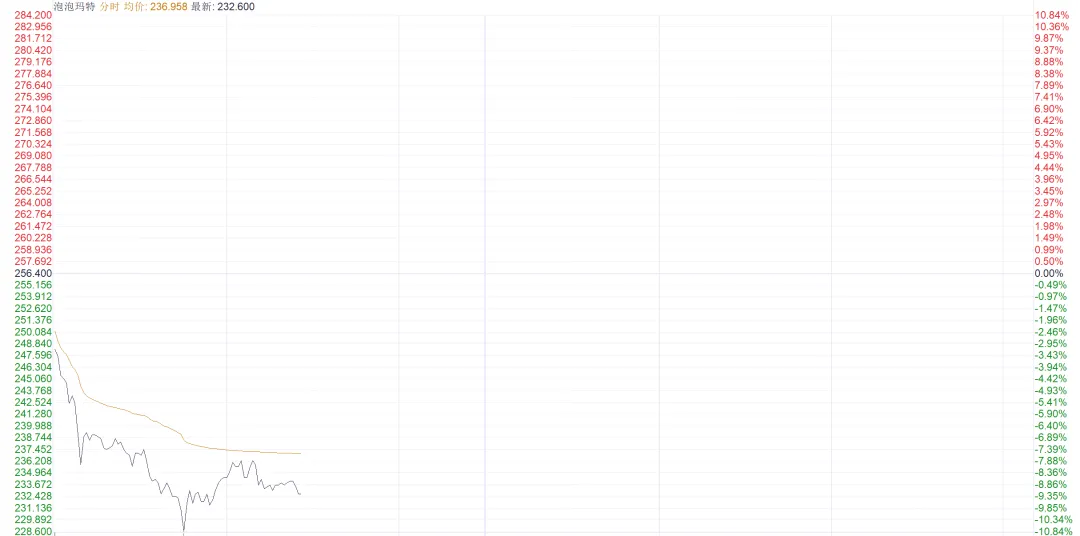

UnlikeNamek andTikTok, Bubble Mart representsan IP-driven consumer model. Although the stock has experienced a pullback of about30%in recent times, the company’s business growth in global markets continues to shine.

In the third quarter of2025, Bubble Mart’s overall revenue grew by245%-250%year-on-year, with China’s market growing at185%-190%, and overseas markets making a365%-370%leap, with the Americas growing at a whopping1,265%-1,270%year-on-year.

Chart / Bubble Mart’s performance + monthly performance, source: financial news agency

Bubble Mart’s success relies onthe continuous innovation and globalization ofits IPproducts.the Labubuseries products continue to be in short supply globally, and the company has been able torapidly promoteits IPproducts to the international marketthrough its overseas stores, online channels, and cross-border logistics network.

Prior to Black Friday, Bubble Mart also actively prepared for promotions, combining limited edition products, member exclusives and content marketing to boost consumers’ purchasing enthusiasm and brand stickiness.

The capital market remains divided on Bubble Mart’s high growth potential. Some investors are worried that the revenue growth rate will be unsustainable from a high base, while JPMorgan and China Merchants Securities are optimistic about thevalue ofitsIPand its ability to expand overseas. In any case, Black Friday will be an important point for Bubble Mart to test its global market strategy, inventory management and marketing capabilities.

Source: Xinhua, deleted

V. Black Friday layout of other cross-border e-commerce giants

In addition to Famous,TikTokand Bubble Mart, global cross-border e-commerce giants are also actively adjusting their Black Friday strategies.platforms such asTEMU,SHEIN, and Sizzler are competing for the attention and purchasing power of overseas consumers through data-driven precision marketing, optimization of overseas warehouses, and the construction of logistics networks.

TakingSHEINas an example, the platform predicts the hot-selling categories during Black Friday in advance through big data analysis and pre-adjusts inventory in different regions, while utilizing social media andKOLmarketing for grass-raising.

TEMU, on the other hand, works on price competition and logistics timeliness, emphasizing low price and efficient delivery and cross-border experience optimization. Speedway, on the other hand, integrates Ali’s ecological resources to enhance consumers’ shopping experience through cross-border payment, overseas warehouses and localized customer service.

The common characteristics of these platforms are that they carry out territory-wide marketing layout in the pre-Black Friday period, combine online and offline data, optimize inventory and logistics, and improve user experience and conversion efficiency. At the same time, algorithms andAItools are widely used in advertising and product recommendation to achieve accurate reach and maximize results.

Source: TEMU

VI. Black Friday:

The annual exam room for cross-border e-commerce

Black Friday is not only a consumer frenzy, but also a concentrated test of cross-border e-commerce strength. For branded retailers like Famous Goods and Bubble Mart, it is atestof product supply chain, store experience andIPoperation capability;

Fordigital platforms likeTikTok,SHEIN, andTEMU, it’s a test of algorithmic capabilities, stream casting strategies, and global operational efficiency.

In the global market, holiday promotions are not only a competition for sales, but also a key opportunity to build brand influence and user data. Successful businesses are able to not only boost short-termGMV, but also build long-term brand recognition and user loyalty in the global marketthrough Black Friday. Those merchants who fail to prepare adequately may lose market share in the fierce competition.

In addition, the Black Friday competition of cross-border e-commerce also reflects the changes in the global business ecology. From“market-for-technology“to“technology-for-market“, the role of Chinese enterprises in global retail and e-commerce is becoming more and more critical. Through technology and operational capabilities, enterprises can not only win the market, but also take the initiative in rule-making and business model innovation.

Photo credit: United Morning Post

Conclusion: A new track for cross-border e-commerce

Black Friday 2025is just around the corner, and the layout of major cross-border e-commerce platforms is already in full swing.

From the offline store upgrades andIPtransformation ofMingchuan Yuping, totheGMV Maxalgorithmic stream casting ofTikTok, to the globalIPexpansionof Bubble Mart, as well asthe precision marketing and logistics optimization of platforms such asSHEINandTEMU, each company is providing a better shopping experience for global consumers, while testing its own competitiveness in the global market.

In the future, the winners and losers of cross-border e-commerce will not only depend on prices and promotions, but also on technical capabilities, content operations and supply chain management. Black Friday is the annual node and epitomizes the strategic game.

Companies that can continue to invest in data, algorithms and branded content will occupy a more favorable position in the global retail ecosystem. For Chinese companies, Black Friday is not only the peak of sales, but alsoa concentrated practice of the logic of“technology for market“in reality.

In this global race of cross-border e-commerce, every click and every transaction may determine the future pattern of the market and the position of enterprises on the global stage. Black Friday is not only a consumption carnival, but also a new track, new rules and new opportunities for cross-border e-commerce.

*References from: Xinhua,Tktok, Bubble Mart, Mingchuang Youpin,TEMU,SHEIN, Luo Yonghao’s Crossroads, Sina Finance, Caixun, United Morning Post, comprehensive news reports collated, reprinted with attribution, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations