In recent years, many Chinese entrepreneurs and affluent individuals have begun to reexaminewhere their capital resides, where their assets are allocated, and where they might go public in the future,as the world has long since entered an era of free capital flows in tandem with heightened regulation.

Especiallyunder the trend of“CRS(Common Reporting Standard)+ Increased Transparency in Global Taxation“, the repatriation of funds has become an inevitable choice for many people, and the choice of which market to list in the capital market has become a very strategic choice.

Inan interview with Bloomberg TV in mid-October2025,Mr. Paul Chan, Chief Secretary for Administration of Hong Kong, China, revealed thatmore than200companies are lining up to list in Hong Kong.According to Mr. Chan, Hong Kong’sIPOpipelineis “very strong, “and for mainland companies, Hong Kong is the preferred platform for accessing global financing and talent pools.

Behind this figure is a deeper trend: against the backdrop of tighter global tax regulations and intensified competition in the capital markets, Chinese entrepreneurs have become more cautious in deciding where to go public, and are more inclined to“return overseas“or“choose the best platform“.

I. Background: financial repatriation,

Are investors more cautious, a trend or a phase?

1. Drivers of financial repatriation

①Regulation and Transparency Trend Pressure

CRS,AEOI, cross-border regulatory cooperation, anti-money laundering regulations, and inter-country tax information exchange mechanisms are rapidly spreading, and manyoffshore and financial regions that wereonce considered“hidden asset positions“are gradually losing their safe-haven function.Under the pressure of“transparency“,fundsare more and more inclined to return to the investor’s home country or regulatory-friendly jurisdictions.

(ii)Reduced“arbitrage“opportunitiesin the capital markets

In the past, some companies may choose to list in markets with high valuation and good liquidity to obtain valuation premiums. However, with the tightening of regulations on cross-border capital flows and listing and financing in a number of countries,the room for“cross-border arbitrage“is shrinking.

RMB Internationalization and Attractiveness of Chinese Market

China’s huge market, the gradual improvement of the capital market ecosystem, and the advancement of RMB internationalization have made more and more companies feel that“listing in the local or neighboring market“is closer to their core customers and capital.

④Investors’ awareness of risk control increased

In an environment of rising global interest rates, increasing policy uncertainty and rising macro risks, the capital market as a whole has entered a period of increased caution. Many early-stage and cross-border investors prefer to stay inmarkets withclear regulation and mature lawsto minimize potential unknown risks.

Photo/Financial Secretary Paul Chan, Source: HK Press Release

2. Investors are more cautious: from passion to rationality

Against the backdrop of volatile capital markets and an uncertain macro environment, investors, especially institutional investors, have become more sensitive to the quality of listed companies, their governance structure, transparency, and choice of listing locations. A few reflections:

The scale of fund-raising and valuation premiums have declined:thepaststyle of“risk-taking and high growth“is gradually giving way tothe investment logic of“stability and signaling“.

Stricter due diligence requirements: more in-depth scrutiny of financial transparency, governance structure, and legal compliance; cross-border listings, off-site accounts, and history of capital transactions become sensitive points.

Preference for platforms with clear regulation and clear exit paths: a platform that can be trusted by investors, has a mature market system, sufficient liquidity and a certain legal environment is naturally more attractive.

Therefore, the“safety“, “predictability” and “liquidity“of the listing locationare key considerationsfor entrepreneurs.

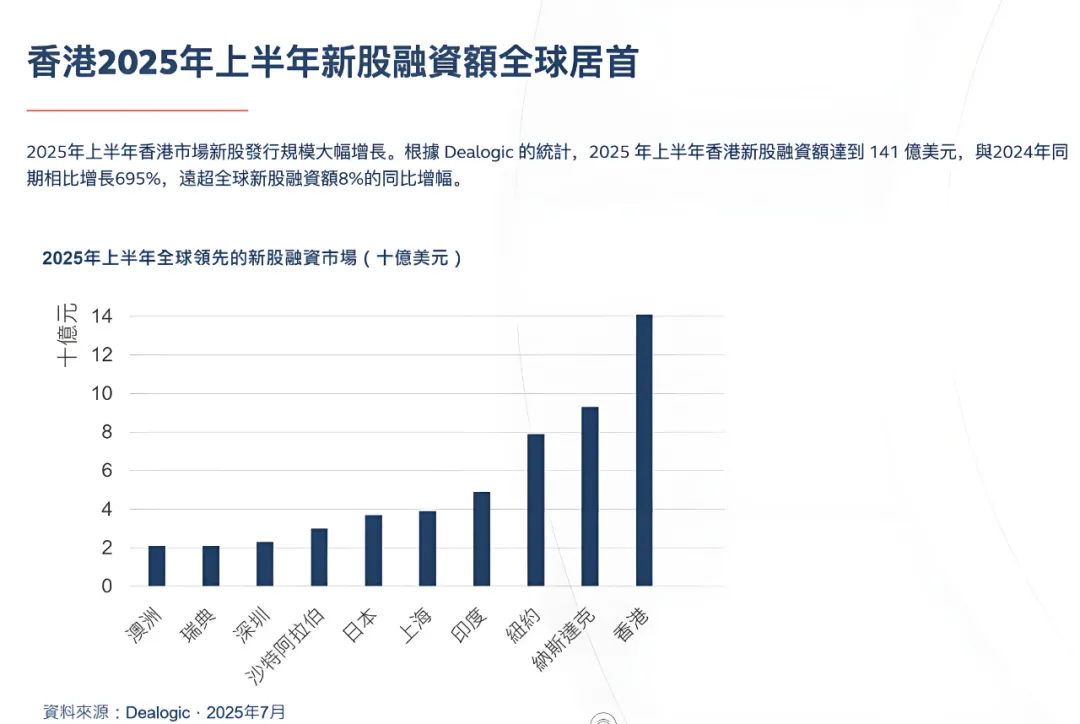

Image source:Dealogic

II.CRS and global taxation:

From“underground“to“sunshine“

The key institutional context is theadvent of the “CRS +Global Taxation“era. In order to understand why“repatriation” and “choosing a regulated platform“have become a trend, it is necessary to clarifythe CRS, the global taxation mechanism, and its substantive impact on wealth and entrepreneurs.

1、What isCRS? Transparency in global financial accounts

CRS, or Common Reporting Standard, isa standard for the automatic exchange of tax-related information on cross-border financial accounts (one of the components ofAEOI )introduced bythe OECDin2014.

Financial institutions ineach participatingcountry/region are required to identifythe financial accounts of their“non-resident customers“and report account balances, interest, dividends and transaction information to the tax authorities on a regular basis, which are then exchanged among the tax authorities, thus providing a high degree of traceability of a taxpayer’s overseas assets and income.

According to statistics, up to nowmore than100countries/regionshavesignedthe CRSand are gradually carrying out information exchange. Mainland Chinahas realized the automatic exchange of financial account informationwith106countries/regions.

The implementation ofCRShas effectively broughtthe areas of“offshore accounts“, “cross-border asset flows” and “cross-border investment income“into the light of day.

Photo credit: United Morning Post

2. Global taxation:“global obligations“of tax residents

In the tax law systems of many countries (including China),the status of“tax resident“implies an obligation to tax global income. In other words, both domestic income and interest, dividends, capital gains, etc., from offshore financial accounts need to be declared for tax purposes.

Organic combination ofCRSand global taxation:CRSprovides tax authorities with the“key“to obtain cross-border account information, while the global taxation system gives tax authoritiesthe “power to tax“. With the support of information, tax authorities are able to more accurately identify undeclared cross-border income, assets and capital gains, and propose back taxes, penalties or retrospective measures.

For example, China’s media has already disclosed moves to tax the overseas investment income of high net worth individuals, and even wealthy individuals have been put on notice to check whether they are earning offshore income and to declare it on time. In an era of increased tax transparency, the scope for using offshore accounts to hide assets or gains is rapidly narrowing.

3.The three waves of impact brought about byCRS

The impact ofthe CRSon entrepreneurs and private clients can be divided into three“waves” , according to theanalyses ofspecialized institutions (e.g.EY):

Increased pressure for disclosure and compliance

Financial institutions become“obligated“to report non-resident accounts, andindividuals/businesses with offshore financial accounts must face the reality of passive disclosure.

Restructuring and Tax Reorganization Needs

Asset replacement, trust structure, offshore holding, choice of company domicile, etc. may be subject to re-examination to optimize tax burden and risk under the legal compliance framework.

Tax Retroactivity and Back Tax Pressure

Past undeclared overseas income may be subject to retrospective taxation, late payment fees, penalties and even criminal liability after tax authorities obtain cross-border data. This is particularly sensitive to high net worth individuals, family offices, and business owners.

Against this backdrop,“putting your money where the regulations are clear“and“choosing a listing where you can be trusted“have become increasingly strong logical choices.

Photo credit: United Morning Post

III. Why do Chinese entrepreneurs prefer Hong Kong listings?

Institutional Strengths Insight

In an era of repatriated capital and tighter regulation, more and more Chinese companies are setting their sights on the traditional high ground of Hong Kong. In particular, as mentioned at the beginning:more than200companies are lining up to list in Hong Kong.

1. Hong Kong’s market performance in recent years and the return of confidence

1)IPOactivity picks up

Bloomberg and other media noted that Hong Kong’s equity issuance market (including IPOs, directed offerings, and large financing transactions) recordedits best performance in more than four years in Q32025, withfinancing volume injustthree monthsexceedingthe full-year2024level.

Some analysts even said that about40IPOshave been conducted in Hong Kongin the first half of the year, raising more thanHK$108 billion.

② Mainland Policy Support and Market Connectivity Enhanced

At the national level, continued emphasis has been placed on supporting Hong Kong’s financial markets, with the simultaneous launch of the interconnection mechanism between the Bejing Stock Exchange (BSE), Shenzhen Stock Exchange (SZSE), and Shanghai Stock Exchange (SSE) and Hong Kong’s capital markets. Hong Kong has also signed a memorandum of cooperation with the Middle East (e.g. UAE) to promotemutual recognition and cross-listing ofETFs.

③ Market valuation and liquidity advantages

Hong Kong’s capital market has internationalization, a mature investor base, a deep pool of funds, a better system, more transparent regulation and other advantages, which makes the large volume of high-quality companies are more willing to choose Hong Kong as the“home base“. Some analysts point out that Hong Kong still has advantages over Singapore in terms of liquidity, valuation premium and institutional trust.

④ Positioned as a bridge to the world

For mainland companies wishing to tap into the international capital markets, Hong Kong offers a combination of“familiarity“(Chinese capital background, language convenience, financial disclosure standards, etc.) and internationalization access (participation of overseas institutional investors, access to global capital). This makes Hong Kong thepreferred springboard formainland companiesto “go global” and “list internationally“.

2. Institutional and institutional advantages: why is Hong Kong preferred?

The following are some of the institutional advantages of Hong Kong in attracting mainland (and even international) enterprises to list:

① Relatively flexible listing thresholds

Hong Kong has a number of boards (Main Board, GEM, red chip structure, same share different rights structure, etc.) that allow Chinese companies to adopt more flexible structures, for example,theVIE(Variable Interest Entity) structure has been widely accepted in the past. In contrast, some exchanges have stricter requirements on shareholding structure and profitability records, and it may be more difficult for emerging companies to meet the criteria.

② Strong international investor base and liquidity

The Hong Kong market has long been in line with international capital, withETFs, funds, insurance funds, pension funds and family offices all active in Hong Kong. International funds are more familiar with and involved in the Hong Kong market, which is conducive to quality companies receiving valuation premiums and stable support.

③ Exit mechanism and capital refinancing convenience

After listing in Hong Kong, it is easier for a company to carry out operations such as follow-on issues, mergers and acquisitions, reorganization, equity incentives and secondary market circulation. It is also easier for listed companies to carry out operations such as buybacks, dividends and capital operations.

④ Relatively clear regulatory and legal environment

Although regulation in Hong Kong has tightened in recent years, its regulatory system, legal tradition, litigation environment, and rights protection mechanisms have a certain degree of transparency and credibility in the international arena. For capital market participants, this is the key to practicing risk boundaries and predictability.

⑤Geographic and Cultural Advantages

For Chinese enterprises, Hong Kong is more closely aligned with the Mainland in terms of culture, language, legal traditions, business interactions, financial habits, etc. Thissense of“barrier-free connectivity“has unparalleled added value when choosing a listing venue.

(vi) Internationalization Channels and Capital Attraction

As Hong Kong strengthens its mutual recognition of funds andETFs with the Middle East, Southeast Asia and Europe, its attractiveness as a financial hub will be further enhanced.

Therefore, against the background of the return of capital, the search for outlets for capital and the enhanced demand for cross-border financing, Hong Kong has undoubtedly become the first choice of many Chinese entrepreneurs.

Photo credit: United Morning Post

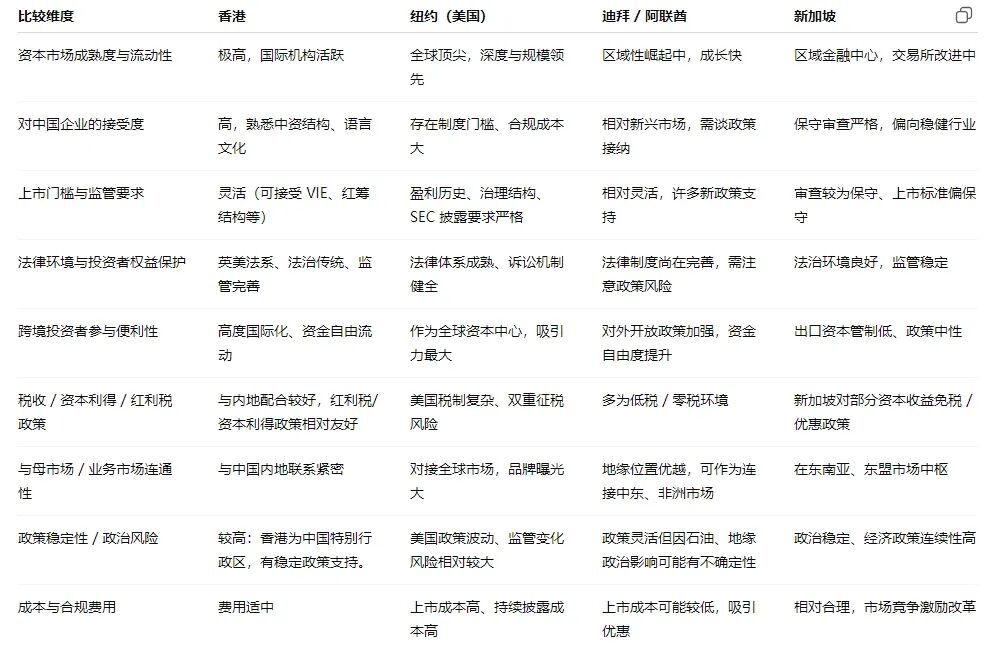

IV. Comparison of four listings:

Hong Kong.Dubai.New York.New York.

Despite the many attractions of Hong Kong, the international capital market is now highly competitive, and various places are attracting the listing of quality enterprises through various policies and mechanisms.

For Chinese companies interested in choosing a listing route, in addition to Hong Kong, they should also seriously consider Dubai, New York and Singapore as alternatives. Below we compare the advantages and limitations of the four locations in a number of dimensions.

Figure / Comparison of the advantages of the four places, click on the large map to see details

More in-depth comparisons are made in the following points.

1. Hong Kong, China: outstanding advantages but not zero risk

As mentioned earlier, Hong Kong has a natural advantage in the listing of Chinese enterprises. Its institutional arrangements, internationalized investment base, valuation levels and liquidity are all core selling points.It is worth pointing out in particular:

Hong Kong has been enhancing its attractiveness, for example, through strengthening mutual recognition of funds with overseas markets andthe cross-listing mechanism ofETFs .

Against the backdrop of the recent pick-up in financing activity, Hong Kong’s capital marketshave already significantly surpassedthe full-year 2024 level in3Q2025.

Although Hong Kong’s regulation has tightened in recent years (e.g., increased requirements for disclosure, corporate governance, and share incentives), its mature legal tradition and international trust base remain its core competencies.

Of course, Hong Kong also faces challenges:

There is potential uncertainty about geographic risk and system change risk.

It is also highly affected by the volatility of the global capital markets, and the volatility of the Hong Kong market may increase if international funds are withdrawn.

Valuation pressures and competition for large tech and innovative companies are also intensifying.

With the intensification of competition in the global capital market, Hong Kong can no longer rely solely on its“natural advantages“to attract quality companies to list in the market, and it must continue to reform and innovate, and upgrade its institutional support.

Image source:unsplash

2. New York (U.S.A.):a “high-threshold option“for a global capital center

In the minds of many entrepreneurs, being able to list in New York means access to the center of global capital, access to the world’s deepest and most active institutional investors, and a significant increase in brand and visibility. But being as good as New York also comes with a high threshold and a high price tag.

①Advantages

Extremely High Exposure and Brand Premium:

Listing in the U.S. can be recognized by global media, institutions, and capital markets, which is conducive to brand building, financing, and international expansion.

Liquidity and Funding Depth:

The U.S. stock market is large and extremely liquid, making it particularly attractive to large-volume companies.

Mature legal protection and regulatory framework:

The SEC, judicial system, and investor protection mechanisms are more mature, with strict institutional support for governance and disclosure of large public companies.

Ease of participation by global investors:

Nearly all global capital can participate in the U.S. equity market, facilitating direct injection of international capital.

②Disadvantages/Risks

Heavy regulatory and compliance burdens:

High listing thresholds (earnings, earnings history, corporate governance, audit requirements,SECdisclosures) and extremely stringent ongoing obligations.

For Chinese companies, there may also be exposure to foreign corporate accountability acts (e.g., U.S. requirement to disclose Chinese company audit floor information, specific disclosure obligations).

Double taxation and tax conflict risk:

Cross-border tax regimes, U.S. dividend tax, capital gains tax, and anti-avoidance provisions may create tax complexity.

Valuation Pressure and Sensitivity to Market Volatility:

The U.S. market is extremely sensitive to performance and growth expectations, and even companies with excellent fundamentals are susceptible to shocks due to macro factors or public opinion fluctuations.

High Barriers to Entry:

A U.S. listing may not be cost-effective for small and medium-sized companies, start-ups that are not yet mature.

Overall, the U.S. is symbolic of a top-tier capital market for very large, sophisticated companies with good governance structures and a willingness to incur high disclosure and regulatory costs.

Image source:unsplash

3.Dubai/UAE: Emerging“Capital Depression“and Hub of Choice

In recent years, Dubai (and the UAE more broadly) has been actively building itself as a financial hub in the Middle East and Africa connecting Asia and Europe, attracting global capital and companies to list with tax incentives, free zone policies, and liberalization of foreign investment.

① Advantage:

Tax incentives and low tax environment:

The UAE has long had no personal income tax or capital gains tax at the federal level, making the tax burden extremely light for many businesses and high net worth individuals. Listed companies are eligible for incentives under certain conditions.

Policy support and free zone incentives:

Several free zones (e.g., DIFC) provide support for financial, technology, and innovative companies to register, operate, and go public. Policy flexibility is high.

Geographical advantage and cross-regional radiation:

Located in the Middle East, it is geared towards West Asia and Europe, and can also serve as a bridgehead into Africa and South Asia. It is of strategic significance for companies wishing to have a layout in the Middle East and African markets.

Lower listingthresholds/attractive policies:

As an emerging market, it may be more accommodating and supportive of emerging industries and innovative businesses, with flexible thresholds and fast approvals.

②Disadvantages/Risks

Market depth and liquidity are weak:

Compared to mature markets such as Hong Kong and New York, the Dubai securities market is still growing in terms of its investor base, trading depth and capital pool.

Policy risk and institutional uncertainty:

Policies in emerging markets may change quickly, legal systems and regulatory standards may not be fully mature, and details of regulations are still being adjusted.

Differences in corporate valuation perceptions:

Investors’ evaluation criteria for certain industries and business models may differ from those of the European, American and Asian markets, and the risk of valuation discounts exists.

The degree of internationalization of the capital market has yet to be enhanced:

Although policies are promoting capital liberalization, it will take some time before a high degree of freedom of international capital flows and ease of cross-border participation are truly achieved.

Dubai can be an attractive optionforcompanieswishing totake advantage of opportunities in the “emerging markets bridgehead“role, and with a MiddleEast/Africa strategic orientation, but only if they are aware of the growth stages and risks involved.

Image source:unsplash

4. Singapore: stable and secure, but challenges remain

Singapore is one of the financial centers in Southeast Asia and has long been known for its rule of law, stability, business environment and international trust. For many Chinese / Asian companies, Singapore is an ideal“Asia Pacific Headquarters+Capital Platform“choice.

However, therehas also been competitive pressureto attractIPO activityin recent years.

① Advantage:

Political stability and the rule of law are excellent:

As a small country, Singapore has a strongsense ofpolicy continuity and expected stability, whichisinvaluable in the capital markets.

Clear tax system and concessionary regime:

Singapore offers preferential or relief arrangements for certain capital gains, overseas income, regional headquarters, reinvestment, etc.;tax incentives such as theNOR(Non-Ordinary Resident) regimeare also available for foreign HNWIs.

Geographic advantage of a regional hub:

Located in the center of Southeast Asia, with access to ASEAN, South Asia, and Indo-Pacific markets; geographic proximity for companies wishing to expand in Southeast Asia.

Improved Financial Markets+Steady Reforms

The Singapore Exchange (SGX) has also been pressuring for reforms in recent years to makeits IPOs moreattractive.The SGXrecentlyannounced that it has“the strongestIPOpipelinein recent years“.

②Disadvantages/Challenges:

The investor base is relatively conservative and valuations are less aggressive:

Singapore’s capital market entry is more mature and robust, so there may not be as much room for valuation of high-growth, start-up companies as in Hong Kong and the United States. Some companies had originally planned to list in Singapore when they decided to go public, but switched to Hong Kong for a higher valuation.

Market size and liquidity limitations:

Compared to Hong Kong and New York, Singapore’s market size and liquidity are relatively limited and may not be sufficiently leveraged for large volume companies.

Increased Competition/Pressure on IPOAttractiveness

With Hong Kong’s active financing and policy tilts in recent years, Singapore isat risk ofbeing“robbed of projects“.

Listingthresholds/reviews are conservative:

Requirements for certain industries, equity structure, and profitability are more conservative, and the listing review cycle may be longer.

As a result, Singapore, as a platform with high stability and low policy risk, is more attractive to platforms that wish to grow steadily, have a presence in Southeast Asia, and prefer institutional transparency. However, Singapore may not be the first choice for companies that wish to raise capital quickly, enter the international capital circle and achieve high valuations.

Image source:unsplash

V. Comprehensive comparison and trend determination:

Hong Kong remains attractive, but alternatives should not be overlooked

The above analysis leads to several judgments:

1. Hong Kong still has an edge in listing attractiveness

For quality companies from China in particular, Hong Kong strikes a balance between familiarity and internationalization, with a relatively mature system, a large capital pool, and significant valuation and liquidity advantages, making it the first choice for many companies. Coupled with the fact that there are currentlymore than 200 companies lined up for listing, the Hong KongIPOpipeline is operating at a high level.

2. New York is a top-tier capital pool, but with high thresholds and costs

For very large, multinational companies willing to bear the costs of rigorous disclosure and regulation, New York remains the world’s most exposed and capital-deep platform. But for most mid-sized or technology innovation companies, the threshold in New York may be too high.

3, Dubai and other emerging markets with policy advantages and strategic value

Although there are still limitations in liquidity and institutional maturity, Dubai offers tax incentives, the possibility of geo-connectivity to the Middle East/Africa market, andits positioningas a“bridgehead“is attracting some companies to participate in the layout.

4、Singapore as a sound platform has the attraction, but facing competitive pressure

Singapore has obvious advantages in the rule of law, economic stability, transparency of the tax system, etc.; but it needs to continue to break through in attracting high-growth listed companies, providing valuation premiums, and capital market size and activity.

5、CRS+Global Taxation Environment,“Platform Security” and “System Reliability“Become the Primary Consideration

Under the trend of financial account transparency, corporations and the affluent pay more and more attention to compliance risk, tax risk and regulatory predictability. Therefore, when choosing a listing location, not only do they look for incremental financing opportunities, but also for institutional stability, regulatory transparency and legal protection.

Therefore, for Chinese companies: Hong Kong may still be the best choice, but it does not mean the only choice. When making a decision, it is important to weigh factors such as industrial attributes, financing volume, future internationalization strategy, investor composition, tax structure, and so on.

Source: OECD

VI. To entrepreneurs, investors and

A few takeaways and recommendations for policymakers

Strategiesforentrepreneurs/proposed listings to think about, advance global tax and structure planning:

Under the pressure ofCRSand global tax redlining, companies should conduct cross-border structural design, tax compliance assessment, and holding structure optimization before listing preparation. Each of these structural adjustments may be of great relevance if they choose to list in Hong Kong, Dubai, Singapore, or the US in the future.

1, choose the most appropriate listing platform, rather than blindly chasing high valuations

Although the temptation of high valuation is small, if the capital platform is unstable, the compliance cost is high, and the investor base is weak, the long-term cost may be greater. Comprehensive consideration based on soundness and sustainable development is a more rational path.

2. Strengthening corporate governance and information disclosure capabilities

Regardless of which market you are listed in, a sound governance structure, transparent financial reporting, and compliant operational logic are always the basis for passing investors’ trust. The more strictly regulated the market, the higher the requirements for corporate governance and compliance.

3. Flexibility to respond to market changes and policy adjustments

Many market policies (tax incentives, listing system reform, cross-border capital liberalization, etc.) are still evolving. Enterprises need to be strategically forward-looking, able to seize opportunities in policy windows while retaining room for adjustment.

4. Considerdual/multiple listing paths

For companies with strong core business and capital strength, they can considerthecombination strategy of“main board+secondary listing“or“main market+regional market“to diversify policy or institutional risks.

Image source:unsplash

Conclusion: How to stand up in an era of institutional transparency?

In an era of transparency in global capital governance and tighter tax regulations, both companies and capital markets are facing new choices and challenges. The return of capital, revaluation of local platforms, investor caution, and increased regulatory pressure have all contributed to the fact that listing has become astrategic decision point thatinvolvesnot only“financing“but also“long-term institutional security, tax risk prevention and control, and sustainability of the governance structure. The decision point.

For Chinese entrepreneurs, Hong Kong remains an attractive first choice due to its institutional maturity, capital pooling advantages, cultural connectivity and policy support. This does not mean, however, that consideration of platforms such as the United States, Dubai and Singapore should be abandoned. The former is unrivaled in terms of global capital exposure, while the latter may have differentiating advantages in terms of regional layout, low-tax policies or a stable environment.

Ultimately, good entrepreneurs in the future will not“look at which market is better“, but“look at which market matches their strategy, capital structure, risk appetite and long-term layout“. In the era of institutional transparency, choosing a more reliable capital platform, building a more robust legal and tax structure, and maintaining governance and compliance capabilities are the keys to the future.

Note:Reference from the source of the Hong Kong Economic Times, Hong Kong Commercial Daily, HK News Bulletin, OECD,Dealogic,Sohu Finance, South China Morning Post, Yahoo Finance, South Window, SingaporeSGX, United Morning Post, Ernst& Young, comprehensive news reports, reproduced must indicate the source of the infringement of the deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations