Singapore’s financial reform curtain opens, three new regulations introduced on the same day, the competitiveness of the Asian financial center to upgrade.

OnOctober29, the Singapore Exchange Regulatory Corporation (SGX-ST)reportedlyannounced asignificant reduction inthe profitability test threshold for main board listings fromS$30 million toS$10 million, an adjustment similar to the practice of major international exchanges, which means that companies in emerging sectors such as artificial intelligence, green energy and biotechnology, which have strong growth potential but have yet to make a profit, will have the opportunity to apply for a listing on the main board.

On the same day, the Monetary Authority of Singapore announced plans to hand over the listing audit function to the SGX Supervisory Corporation, realizinga “single window“audit forenterprise listingsand further streamlining the listing process. In addition, the time required for the Home Office to apply for tax incentiveshas been shortenedfrom12monthsin the pasttoless thanthreemonths.

1major adjustment:

Listing threshold lowered toS$10 million

The SGX-ST Regulatory Corporation has announced thatthe profitability test threshold for Main Board listingshas been loweredfrom$30 million to$10 million, similar to the practice of major international exchanges. This means that companies in emerging sectors with strong growth potential, but which are not yet profitable, can also apply for listing on the Main Board.

SGX-ST Regulatory Corporation Chief Executive Officer, Mr. Tan Boon Jern, said the measures recommended by the Securities Market Review Panel are comprehensive, with initiatives at the corporate level helping to enhance liquidity and valuation, and initiatives at the regulatory level enhancing market efficiency.

Huang Yaoqian, president offund managerAzureCapital,noted:

“Many companies in emerging industries, including artificial intelligence and green energy companies, are still in the early stages of growth and find it difficult to achieve substantial profits in a short period of time.Moderately relaxing the listing requirements will help these companies obtain capital to expand their businesses.“

DavidJelle, president of the Securities Investors Association of Singapore,said in an interview that the lowered profitability threshold is still higher than most exchanges.

He emphasized that the quality of a company does not depend solely on how much money it makes.“If a company is doing good business, has transparent governance, has a truly independent board of directors and treats its shareholders well, then the market will reward the company accordingly, regardless of its performance in the most recent financial year.“

Source: United Morning Post, Schematic diagram

2major core changes:

Elimination of watch lists+streamlining of processes

In addition to lowering the profitability threshold, the SGX-Supervisory Corporation will alsoremove the watch list mechanismto avoid unnecessary negative impact on market confidence and access to corporate finance.

However, companies with sustained losses are still required to disclose the third consecutive year and subsequent financial years and, where appropriate, specific plans to improve their financial performance.

On the other hand, the HKMA proposes that in future, issuers will only have to interface with the SGX-ST Regulator and will not have to make separate submissions to the HKMA and the SGX-ST Regulator. This reform will significantly reduce administrative costs and speed up listing.

In Maythis year, the SGX-ST Regulatory Corporation released a public consultation paper proposing a number of reforms to create a more conducive environment for companies to list. These include simplifying prospectus requirements, expanding investor communication channels for initial public offerings, and adjusting the Main Board listing criteria.

Themove to a disclosure-based regimeis widely supported by the industry. This shift allows listing applicants to make their own disclosures while ensuring that investors have sufficient information to make informed judgments.

Source: United Morning Post, Schematic diagram

Thirdly,3favors are superimposed:

Full relaxation of home office thresholds

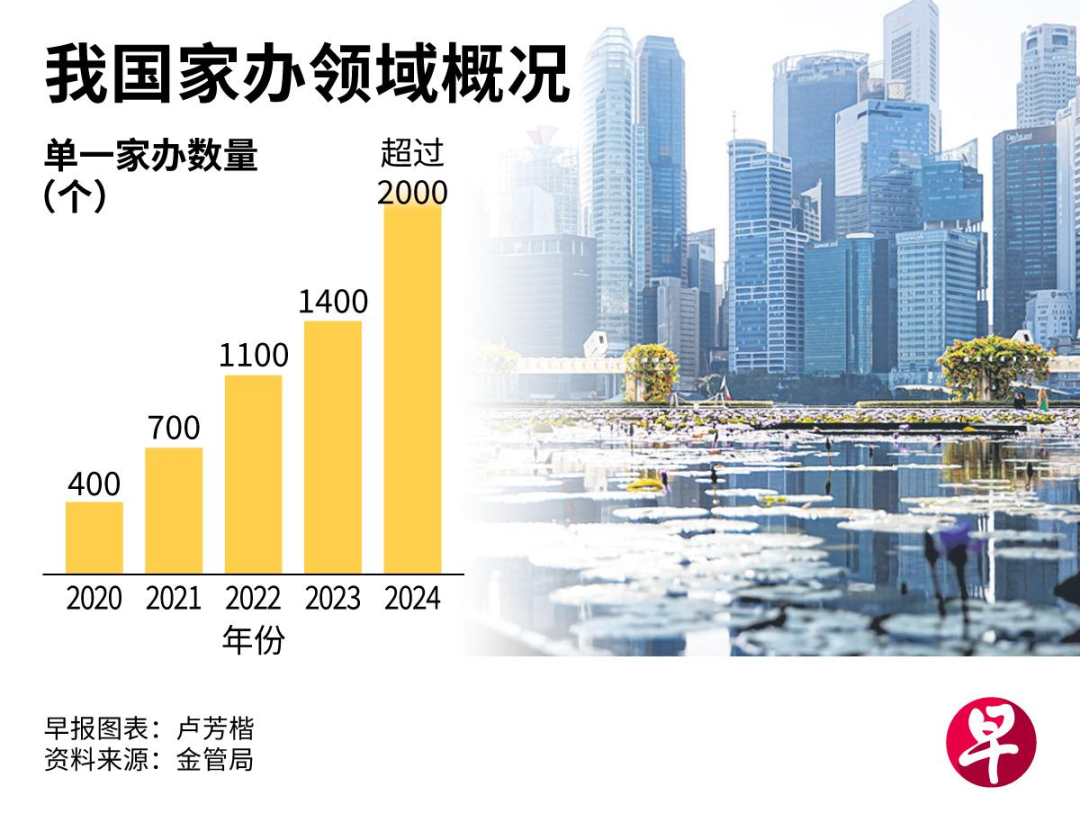

MAS is evaluating the simplification of the Single Family Office Tax Incentive Scheme (SFOTIS), and intends to build a regulatory framework that is more in line with the actual needs of the industry.This round of optimization focuses on 3 areas:reducing application documents, relaxing reporting requirements and moderately expanding the types of qualified investments.

Source: MAS, United Daily News

The streamlining of application documentswill significantly lower the entry barriers, especially for HNWIs who are setting up a family office for the first time. The HKMA plans to streamline the relevant application documents so thattheestablishment of family offices will not becumbersome.

Relaxation of reporting requirementswill reduce operational compliance burden The HKMA proposes to relax the reporting requirements to reduce the frequency and complexity of annual or progress reports, so as to allow the Home Office to focus its resources more on its core business of asset allocation and investment decision-making.

A modest expansion of the types of qualifying investmentswill enhance the diversity of investment allocations, and the asset classes that can be invested in under the future tax-advantaged schemes will be further expanded to cover more types of assets, including private equity, offshore funds, sustainable investments and alternative assets.

According to Singapore’s Minister for National Development, Mr. Chee Fong Tat, in the past, the time required for a home office to apply for tax incentives could be as long as12months, but now most applications have been shortened toless thanthreemonths.

Photo credit: United Morning Post

IV. Global ranking jumps to9th, overtaking London

In the first nine months of this year, Singapore’s IPO activity raisedUS$1.44billion(S$1.86billion),according to Bloomberg,moving it up to ninth in the global rankings, overtaking London.

This was largely driven by real estate investment trust listings. The most high-profile listing so far this year has been thelisting of theNTTData Center REIT, which raised a total of$773 million, making itthe largest local listingthis year andsince2013.

Phillip Securities research investment manager Tan Chia Cheng said that while the first three quarters’ performance reflected a recovery in listing activity, it was not yet“robust“.“We still have to look at other indicators, including the number of listings, whether they cover more sectors, post-IPO share price performance and trading volume, before we can assess whether listing activity is hot.“

Nonetheless, he also mentioned that with the Federal Reserve starting to cut interest rates, allowing the world to gradually move into an era of low interest rates, Singapore listing activities are indeed expected to become more active, especially in the trust sector.

In Augustthis year, SGX’s Head of Global Business Origination and Expansion, Mr. Paul Teck Seng, revealed thatmore than30companies were planning to list locally. In the past few days, four other companies have filed preliminary prospectuses with plans to list in Singapore.

SGX Listing, Opportunities and Challenges

Although listing activity in Singapore is gradually picking up, Tan Chia Cheng said bluntly that there are still some factors that will limit listing activity in Singapore.“Compared to markets such as the US and Hong Kong,Singapore still faces a lack of liquidity and trading volume, which tends to result in valuation discounts, and the industry is mainly concentrated in the financial, trust and industrial sectors. Some large companies may list on other exchanges as a result.“

In response to market concerns about whether lowering the profitability threshold will attract companies with poor fundamentals to list,Huang Yaoqian, president offund management companyAzureCapital,believes that if companies can make aprofit of $10 million, they already have better fundamentals and can be considered for listing.

DavidJelle, president of the Securities Investors Association of Singapore,also reminded investors to do their homework.“While regulators will review a company’s financial position and governance levels when it is listed, investors must still pay attention to the company’s announcements and performance, and actively attend general meetings.“

With this series of reforms in place, Singapore is building an efficient, open and transparent capital market environment through systemic reforms. This is undoubtedly a major boon for innovative Southeast Asian companies and regional unicorns wishing to access international capital markets.

Photo credit: United Morning Post

Conclusion:

The series of reforms to Singapore’s capital market are not simply a matter of tweaking the rules, but of fundamentally reshaping its competitiveness as an Asian financial center. The lowering of the profitability threshold has opened up listing possibilities for emerging companies, the simplification of rules for home offices has brought in fresh water to the market, and the improvement in global rankings is proof that the reforms have begun to bear fruit.

For Chinese companies seeking to internationalize, and for high net worth individuals planning to set up family offices, Singapore is showing renewed appeal.

*References from the new homeMAS,SGX,EDB, United Morning Post, Bloomberg, comprehensive news reports collated, reproduced with attribution, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations