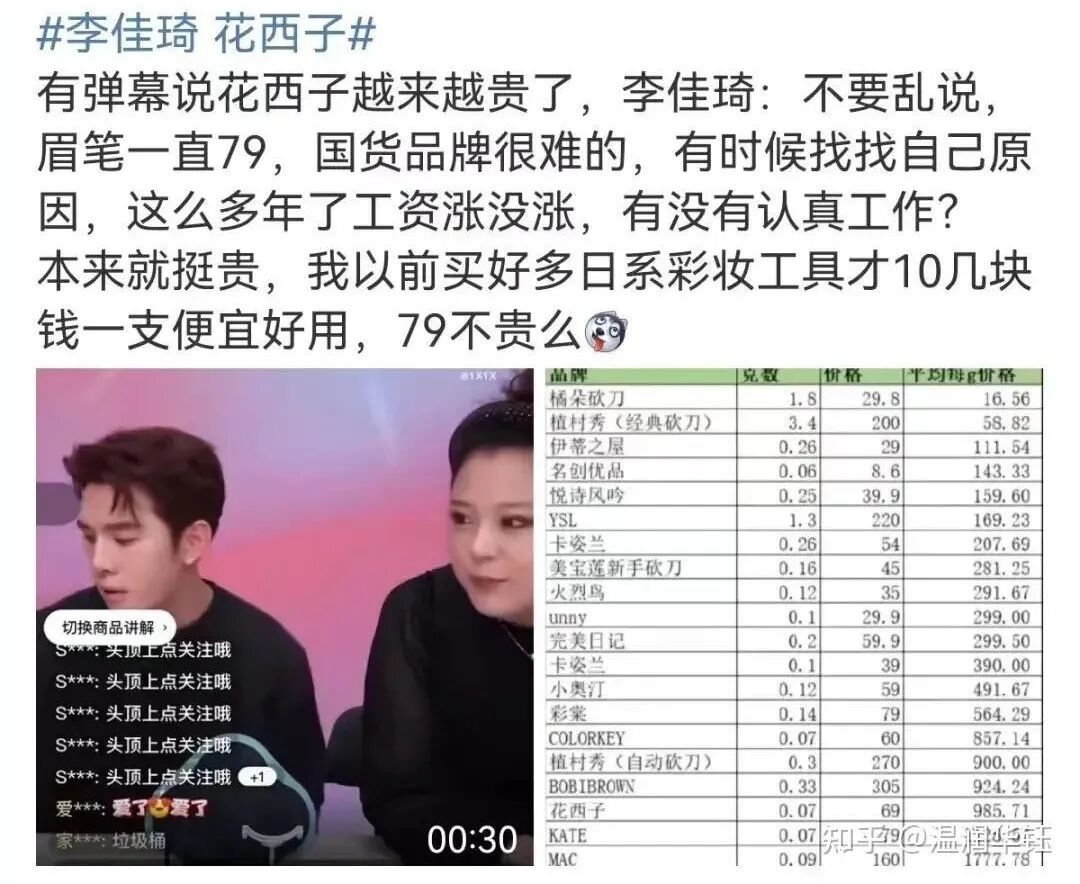

Isn’t$79for 1eyebrow pencil at0.08grams expensive?

While you’re still discussing whether it’s expensive or not, at the higher end of the market, Mogopian Cosmetics Co. delivered its first semi-annual report since going public:

Revenueof $2.588billion, up31.3%year-on-year, and net profitof$670 million, up36.1%year-on-year,were realized in the first half of2025.84.2%gross marginswere nearly twice as high as Apple’s and more than those of Hermes andLVMH.

At the same time, Huaxizi’s overseasGMVexceeded500million yuan, a year-on-year increase of66%, and it became the first Chinese beauty brand to be stationed in Paris Salmageddon department store. And in Southeast Asia, Singapore’s beauty and nail market isgrowingat an average annualrate of12%, becoming a new hot spot for China’s beauty industry chain to go overseas.

Image source: Phoenix Fashion, deleted

Contact

I.84.2%gross margin:

Mogopian’s high-end code and bottleneck

In the first half of2025, Maogopinwrote a colorful chapter in China’s high-end beauty marketwitha gross profit margin of84.2%anda net profit of670million yuan. This level of gross profit margin not only far exceeds that of international brands such as Estee Lauder, but even exceeds that of luxury giant Hermes.

Mao Geping’s breakthrough began by accurately stepping into thegap of“domestic high-end color cosmetics“.As a make-up artist’s own brand, Mao Geping has been targeting“professional-grade make-up“from the very beginning of its creation, and has been competing head-on with international first-tier brands.

What’s even more rare is that Maogobing has upgraded its beauty counters into “trust manufacturing farms“.In counters across the country, Mao Geping has more than2,800beauty consultants, equivalent to an average of6-7beauty consultantsper counter.These beauty consultants have gone through“Mao’s“systematic training, and with theservice of“one-on-one make-up teaching“, they use professional techniques to let consumers visualize the changes in their make-up.

The data confirms the effectiveness of this strategy. Officials show that the repurchase rate of Maogoping’s registered members is27.5%for online channelsand34.9%for offline channels, with offline channels being significantly stickier than online.

Mao Geping’s Makeup Artistry Training business further reinforcesthe myth ofthe “Godfather of Makeup“.2024, Mao Geping’s Makeup Artistry Training generated$150million in revenue, up45.8%year-over-year.The art training school graduated more than150,000 studentsandenrolledmore than6,000students in the same period in2024, with tuition at thelevel ofabout25,000 yuan perperson.

However, it has been said that“Mao Geping is still one‘Old Buddha‘away from luxury beauty“. There is still an invisible chasm between the brand’s reputation and a true luxury brand. Founder Mao Geping is over60years old, and his aesthetic system is deeply rooted in traditional fields such as stage plays, film and television dramas, and the pressure to transform in the face of the rapidly changing young consumer market should not be underestimated.

Image source: Evening Finance, deleted

Second,500millionGMVbreaks:

Hanasago’s four-phase overseas strategy

Sinceits establishment in2017 with thepositioning of“oriental makeup, flower makeup“, Huaxizi has integrated intangible cultural heritage such as micro-relief sculpture and ceramics into product design, and walked out of a unique brand development path.

Image source: Hanasizi, deleted

Huaxizi’s overseas strategy is characterized byfour stages: “test water–deep plowing–breakthrough–explosion“:

Trial period (2020): Trial the Japanese market through the Tmall Overseas platform, with oriental characteristics product design, 3 consecutive sell-outs in a month;

Deep plowing period (2021): the core single product, sculpted lipstick, was launched on Amazon Japan, priced at12,000 yen(about$100), and successfully ranked among the top 10 local lipsticks in terms of unit price;

Breakthrough period (2022): Establishment of counter cooperation with Isetan and Takashimaya, two high-end department stores in Japan, and successful entry intoNordstrom, a high-end department store in the United States;

Burgeoning period (2024): OverseasGMVexceeds500million yuan, the proportion of the three major markets of Japan, the United States and Europe is about4:3:3, forming a balanced and healthy globalization pattern.

The overseas success of Huaxizi stems from thesystematic synergy of culture, marketing, and R&D.At the product level, the brand integratestheaestheticsof the “Ten Scenes of West Lake“and theessence of non-heritage such as“Miao Silver“into the design, sublimating the makeup products into works of art that carry oriental aesthetics.

In terms of marketing strategy, Huaxizi accurately grasps the psychology of high-end consumption and adoptsthe luxury strategy of “limited edition+high-end customization“, launching only two global limited edition products per year, with a single sale limit of 30,000, which generates a premium of up to twice the original price in the secondary market.

R & D innovative use of “master co-branding+localized R & D“dual-track strategy, invited the formercreative director ofDiormakeup and other international experts to participate in the European and American consumers, skin color characteristics and aesthetic preferences, tailored to create exclusive color numbers.

Image source: Hanasizi, deleted

III.3,100beauty consultants:

HowMogueping’s“trust farm“works

In the country’s437counters, Mao Geping has equipped a total of more than3,100beauty consultants, building a complete set of“trust manufacturing“system. The core of this system is to transform the traditional sales scene into a field of learning and trust.

The conversion logic of“makeup with products“is the core of Maogoping’s business model. Through professional techniques, the beauty consultant allows consumers to visualize the changes in their makeup, creating adeep impression that“if you don’t use Maogoping’s products, you won’t be able to achieve this kind of effect“. This in-depth interaction significantly increases user conversion and loyalty.

Image source: Mogopian, deleted

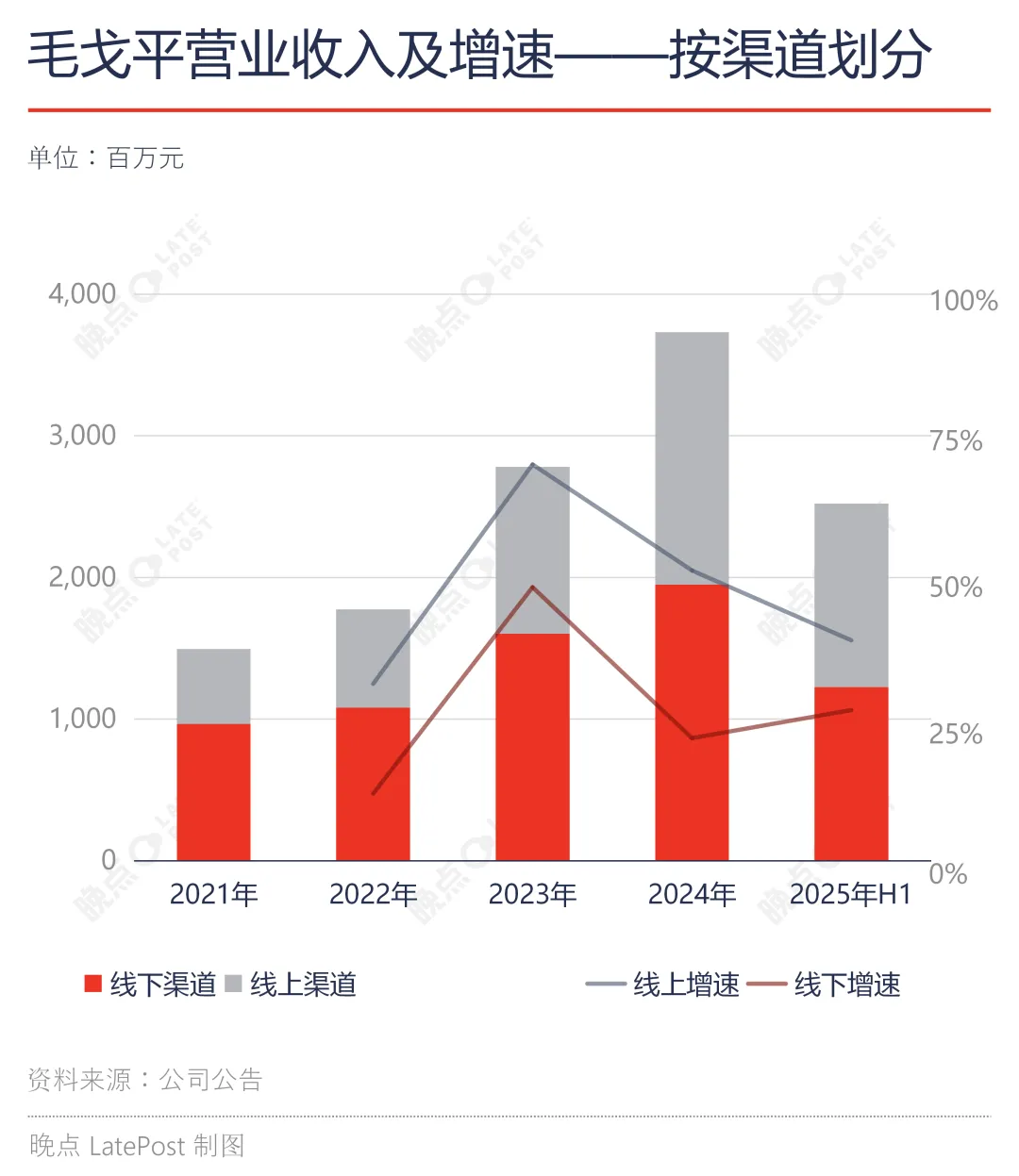

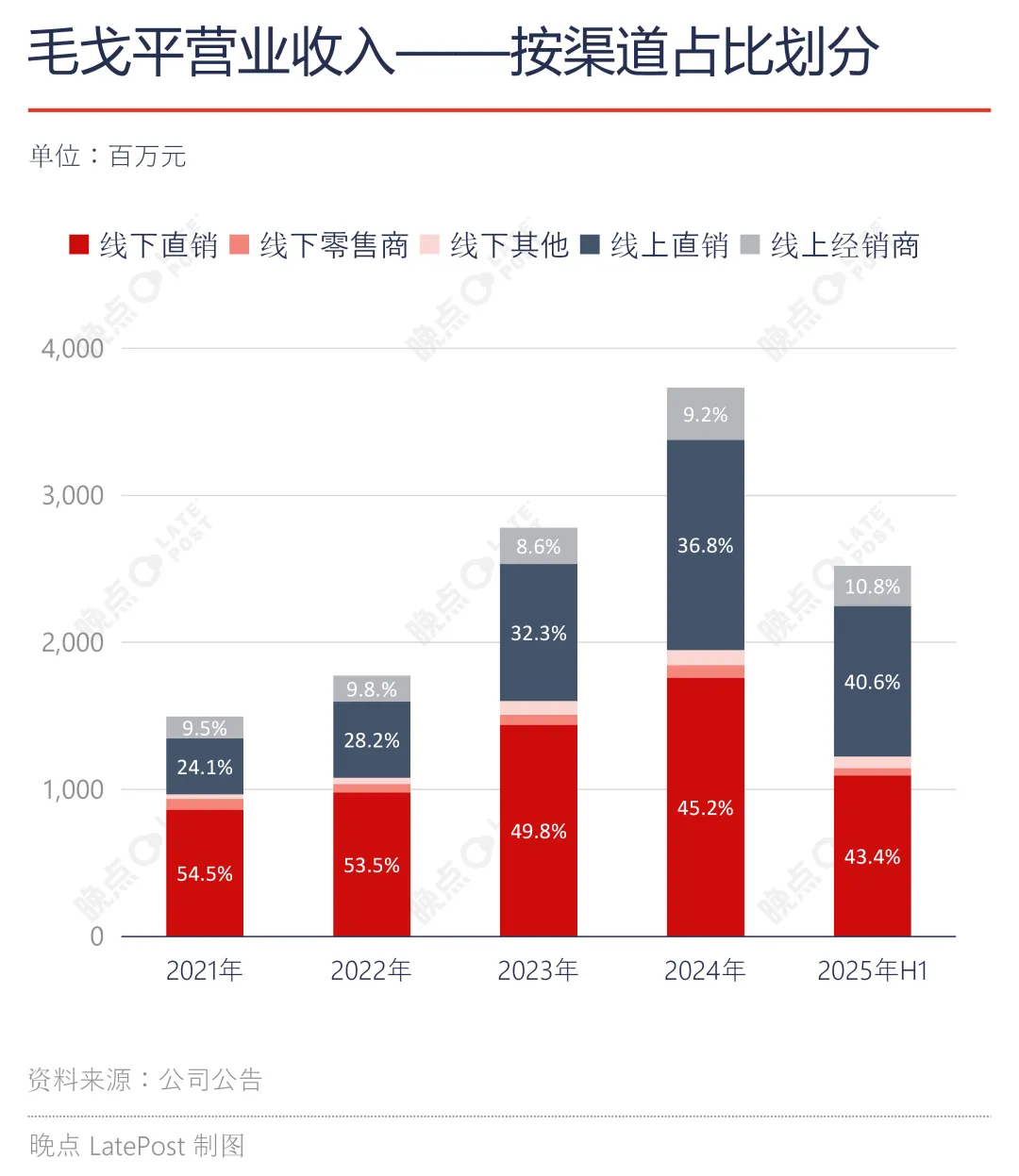

Maogoping’s channel strategy is also noteworthy.2025In the first half of the year, ithas405self-operated countersand32distribution counters, distributed inmore than120citiesin China. Although the growth rate of counters has been relatively slow in recent years, the increase in ping efficiency has led to high growth in offline channels.

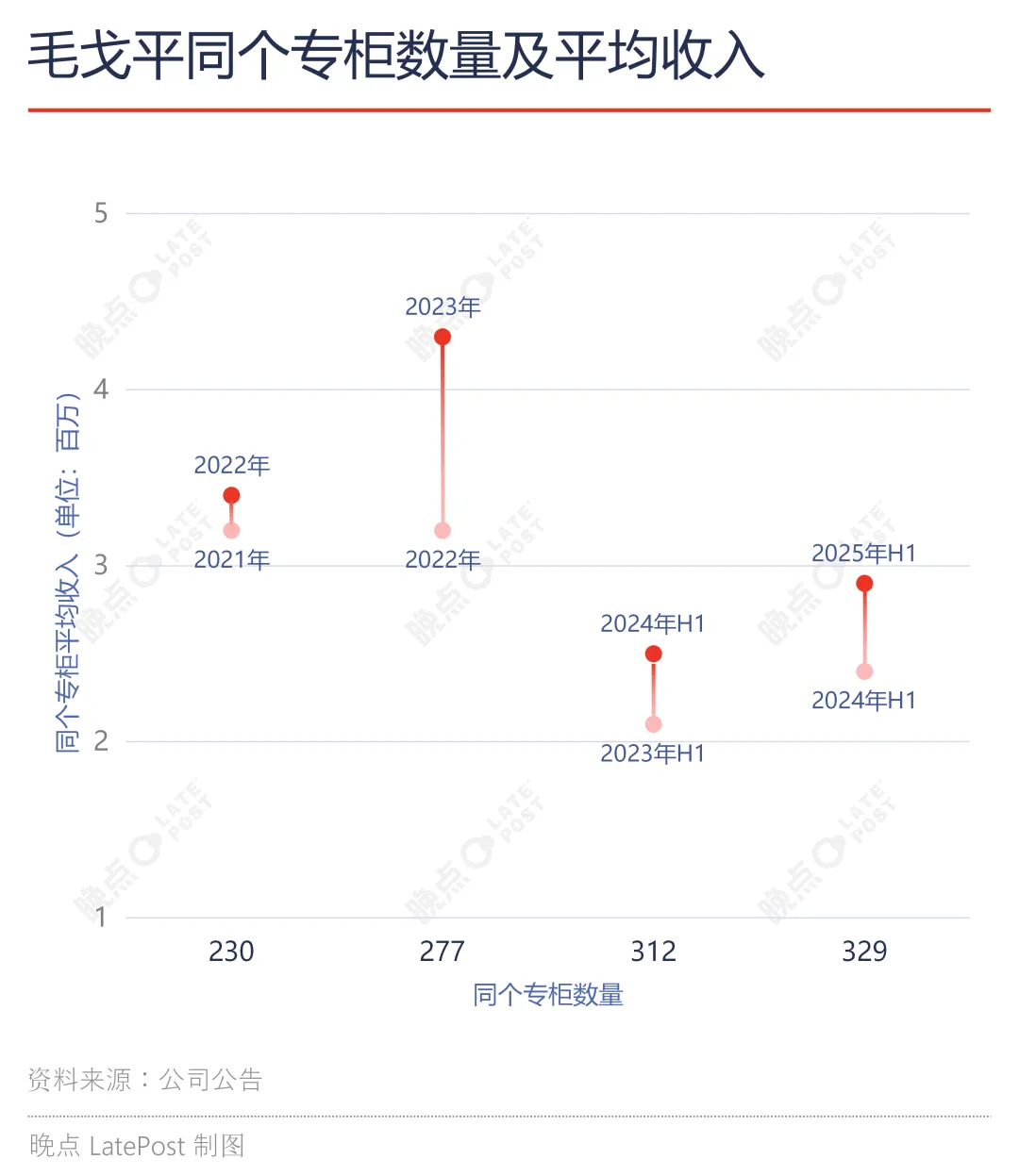

The data shows that the average revenue for the same countersgrewfrom$3.2million in2021to$4.3million in2023, and$2.9million inthe first half of2025, an increase of$0.5millionyear-on-year.

The unique advantage of the offline channel is also reflected in user stickiness. Mao Geping has realized the synchronous development of online and offline, and although the growth rate of offline channels is lower than that of online, the proportion is still maintained atabout 50%. In contrast, Perrier, on the United States and other head of the cosmetics company’s offline channel has accounted for less than10%.

IV.$1.24billion market:

The Blue Ocean of Beauty in Singapore

The Singapore beauty marketwill reachUS$1.24billionby2024, with a steady CAGRof between8-12%. For Chinese beauty brands, this Southeast Asian bridgehead offers unique market opportunities and a complete policy support system.

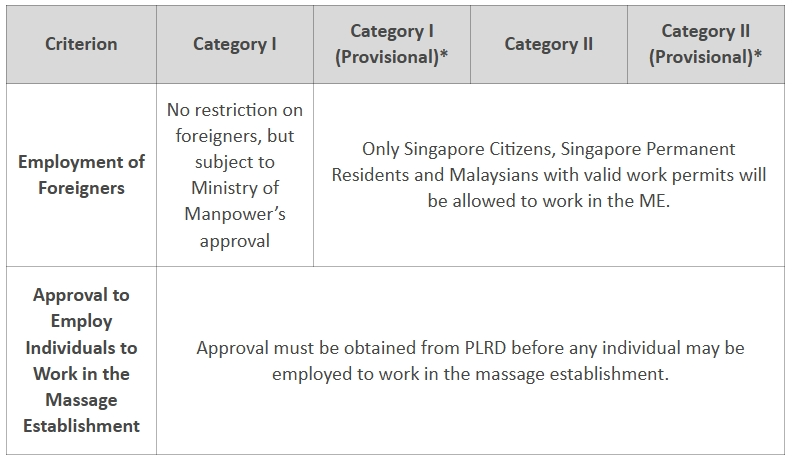

Licensing requirements for setting up a beauty salon in Singapore vary depending on the services provided. A special personal license is usually not required for simply providing hairdressing services, whereas the operation of a beauty business requires the application of the relevant business and personal licenses.

If the opening of a comprehensive store that includes beauty care and hairdressing, the basic process is relatively simple: rent a storefront that meets the requirements, apply for an environmental health permit and a medical health permit to open. However, if the service involves massage, you must apply for a massage license, the process is more stringent.

What license do I need to open a beauty and hair salon in Singapore? Complete guide to the process of opening a store and applying for a license:

1.ACRA: Company Registration and Bank Account Opening

The first step is tosubmit an application for company registrationto the Accounting and Corporate Regulatory Authority of Singapore (ACRA);

Open a corporate bank account immediately after obtaining your company’s business license;

After completing the company registration and opening a bank account, you can negotiate with the landlord for the lease of the storefront.

2.URA: Frontage Lease and Renovation Approval

Selecting a designated commercial area to lease frontage is subject to city planning requirements;

If you plan to change the original layout of the store, you must prepare detailed renovation design drawings;

Submit an application for renovationto the Urban Renewal and Planning Authority (URA) and obtain approval before construction;

Note:The issuance of new massage licenses has been stopped in specific areas such as Chinatown, Little India and Geylang.

Source: SPF Singapore

3.NEA: Environmental Health Authorization

Apply for an Environmental Health Licensefrom the National Environment Agency (NEA) ofSingapore;

Hairdressing services must meet strict hygiene standards;

If special cosmetic services such as chemical treatments are provided, additional sanitary norms need to be observed.

4.HSA: Health and Safety Authorization

Apply for a health permitfrom the Health Sciences Authority (HSA) ofSingapore;

All equipment and services are required to meet health and safety standards;

The work environment must be kept consistently clean and subject to regular inspections.

5.SPF: Massage License (if massage services are involved)

Apply onlinethrough the Singapore Police Force (SPF) eServices platform;

Application materials need to be complete and accurate, and the review process is rigorous;

IMPORTANT: Operating a massage service without a license can face serious penalties, including imprisonment.

6.MOM: Staff Recruitment and Work Permits

If employing foreign workers, you need toapply for a work permit (S Pass,WP, etc.)from the Ministry of Manpower (MOM).

Massage employees must hold a personal massage license withSPFapproval

Employee Qualification Requirements:

(As far as possible) Singapore Citizens, PR, holders of Singapore Permanent Work Permit (PWP), Malaysian nationals holding Singapore PWP, massage therapists are only allowed to work in a single premisesunless they are granteda special permit bythe SPF.

Source: SPF Singapore

7.SCDF: Firefighting authorization

Verify the store’s original fire permit status prior to leasing;

If the original scope of business was a restaurant, beauty salon, or other type of business, a fire permit is usually already in place;

If not, you need toapply for a fire permitfrom the Singapore Civil Defence Force (SCDF);

Ensure that all fire protection facilities meet safety standards.

Special Reminder: Throughout the process of opening a business, make sure that every aspect complies with the regulations of the relevant Singaporean authorities, especially when it comes to massage services, you must strictly follow the process of applying for the relevant licenses, to avoid facing legal liabilities for operating without a license.

V. From$9.90coffee to $1,000 makeup:

Consumer Grading’s Answer to Going Overseas

Responding to thequestion of whether the $9.9cup of coffee can be profitable,Ruixing Coffee Chairman Lai Huisaid,“It also depends on the category and the product, but even with such an extreme subsidy,we are still able to maintain a certain level of profitability.“

Image Source: Interface News – Video Screenshot, Deleted

The secret behind this lies in the scale effect and efficiency improvement. Throughthe huge scale of13,000 stores,Rexallhas diluted fixed costs and formed a strong cost advantage. At the same time, the digital operation system optimizes store rent and labor costs to the extreme.

The success of Ruixiang provides an important revelation:it doesn’t have to be the best, but it has to be the most accurate. Precisely positioning the target market, precisely controlling the cost structure, and precisely grasping the consumer demand can also occupy a place in the fierce market competition.

This positioning strategy is an important reference for Chinese beauty brands. Whether it’s Mao Geping’s high-end route or Huaxizi’s culture to the sea, the essence is to provide the right products and value proposition in the right target market.

Competition in the beauty industry has been upgraded from a simple price and marketing war to acomprehensive competition insupply chain efficiency, brand value and user experience.

Photo/Singapore Chinatown Shopping District

VI.$150million for training:

How Mao Geping’s art training feeds the main business

Maogoping Art Training School has over150,000graduates, and behind this number is the deep logic of brand building.2024, Maogoping Makeup Art Training generated$150million in revenue, a year-on-year increase of45.8%, and although the overall revenue contribution is limited, its strategic value far exceeds the financial data.

The arts training business has builta double moatfor Mogul:

On the one hand, the offline training school has become a precise traffic entrance and brand believer incubator–the students become brand concept identifiers and disseminators through learning, forming a continuousflow of“tap water“, which feeds the sales of Maogoping products.

On the other hand, the many graduates trained by the art training business penetrate into the makeup industry chain and between different brand businesses, creating a resonance of influence in the industry. A considerable number of these graduates eventually become beauty consultants at Mogopian counters, forming a closed loop of talent training and employment.

This unique business model makes Mao Gepingshow the strongest profitability and brand premium in the“new consumerF4″(Bubble Mart, Honey Snow Group, Old Shop Gold, Mao Geping).

In the first half of FY2025, Mogopian’s net profit margin has improved to25.9%, significantly higher than the industry average. Comparing with Estee Lauder, which is also positioned in the high-end market, the overall gross profit margin hasdeclinedfrom a high of80%year by year to74%in fiscal year2025, and the net profit margin has turned negative, with Mogopian’s performance being more eye-catching.

Image source: Mogopian, deleted

VII. Compliance and growth:

The double challenge of the Singapore market

The duality of the Singapore market is reflected in the fact that it has a well-developed business infrastructure and policy support on the one hand, and strict compliance thresholds on the other.

1、Product compliance is the first challenge faced by enterprises

As per Health Sciences Authority (HSA)Singaporerequirements:

All cosmetic products mustsubmit a product notificationthrough thePRISMsystemprior to marketing;

High-risk categories (e.g., whitening, sunscreen products) require additional safety assessments;

Product labels must be in English and clearly labeled with a full list of ingredients.

2. Tax compliance is equally critical

Singapore hasa Goods and Services Tax (GST) of8%, whichwill increase to9%by2025.Businesses are required tofile their returnswith the Inland Revenue Authority of Singapore (IRAS) on time to avoid tax risks.

Despite strict compliance requirements, the Singapore market remains attractive:

The corporate income tax rate is up to17%, with significant reductions for newly formed companies;

Intellectual property protection system is perfect, and patent registrationcan be completedin 6monthsat the earliest;

Conveniently located witha 4-hour flight circlecovering major markets in Southeast Asia.

For Chinese beauty brands, Singapore can be used as atestinggroundfor the Southeast Asian market, with small-scale pilots to understand consumer preferences before gradually expanding regional influence.

Photo credit: Screenshot of video from Mogobin-Website, deleted

Conclusion:

At Hanasiko’s flagship store in Tokyo’s Ginza district, local young people wait in line for a lipstick engraved with traditional Chinese motifs, while at the Mogobing counter, a beauty consultant performsa “head transplant“for a customer.

Meanwhile, in Singapore’s Orchard Road shopping district, more and more Chinese beauty brands are quietly settling in, bringing the concept of oriental aesthetics to this international market.

From79yuan eyebrow pencilto500million yuan of overseasGMV, from84.2%gross marginto1.24billion U.S. dollars in the Singapore market, the high-end of national beauty and the road to the sea, is witnessing a profound transformation of Chinese brands from OEM labeling to cultural confidence.

*References from: Hua Xizi, Mao Ge Ping,LatePost, “Finance” magazine, interface news, Jinan Daily, SingaporeACRA,URA,NEA,HSA,SPF,MOM,SCDF,GoBusiness, the United Morning Post, and other media, the synthesis of news reports collated, reproduced must indicate the source, infringement of the deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations