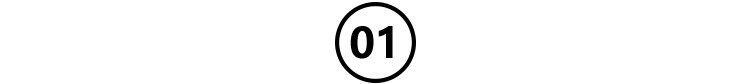

A recent news about the significantly lengthened retroactive period for Chinese tax residents to pay back taxes on their offshore income has sparked heightened concern among cross-border investors and high net worth individuals. According toa report byCaixin and CaixinonJanuary15,2026, the tax authorities have lengthened the retroactive period from the previous one toas early as2020and even2017,according to areport byCaixin and Caixin.

Since2025, a number of tax residents have been notified of the requirement to self-check and make additional declarations of inbound and outbound income. This development is not an empty threat, but rather a sign that China’s tax administrationhas entered a new phase of greater precision and depth under theInternational Tax Transparency (CRS)framework.

In the face of the extension of the retrospective period, theso-called planning programs suchas“using the passport of a small country to convert tax status“have been discussed inthe market.However, an in-depth analysis of official policies and practical cases reveals that, in the increasingly tight global tax information network,compliant declaration and proactive planningare the fundamental ways to deal with risks.

I. Policy depth:

Extension of the period of retroactivity andregularization ofthe “five-step approach“

The adjustment of the retroactive period for back taxes is part of a series of initiatives by China to strengthen cross-border tax management and combat tax evasion. According to a report by Caijing, the retroactive scope of back taxesis mainlywithin thelastthree years,mainlyin2022and2023, but for cases with clear clues, the retroactivity can be extended to earlier.

Meng Yuying, director of the International Taxation Department of the State Administration of Taxation (SAT), has publicly stated that the new situation calls for more comprehensive cross-border tax services and guidance for taxpayers.

The State Administration of Taxation (SAT)conducted the third revisionof the “Going Global“Tax Guidelinesin2024, expanding tax-related service matters to120and adding new chapters on tax policies for new foreign trade businesses, which both serve taxpayers and signal the refinement of regulation.

At present, the tax authorities have formed a set of mature processes for handling tax-related issues. After the discovery of clues, it will becarried outin accordance withthe “five-step working method“of “prompting reminder, supervising rectification, interviewing and warning, filing and auditing, and public exposure” inan incremental manner. This means that if taxpayers cantake the initiative to correct their mistakesin the“prompting and reminding“or“supervising and rectifying“stage, they will be able to effectively avoid the subsequent harsher legal consequences.

Press Release/Source: Caixin, First Finance

II. Retrospective limits:

A Two-Dimensional Perspective onCRSData Exchange and Tax Law Provisions

Understanding this lengthening of the backdating period requires looking at the limits from two dimensions:the limits of the data that theCRSmechanism can provide, and the limits of accountability under China’s tax laws.

1,Data Retrospective Limit ofCRS:2017

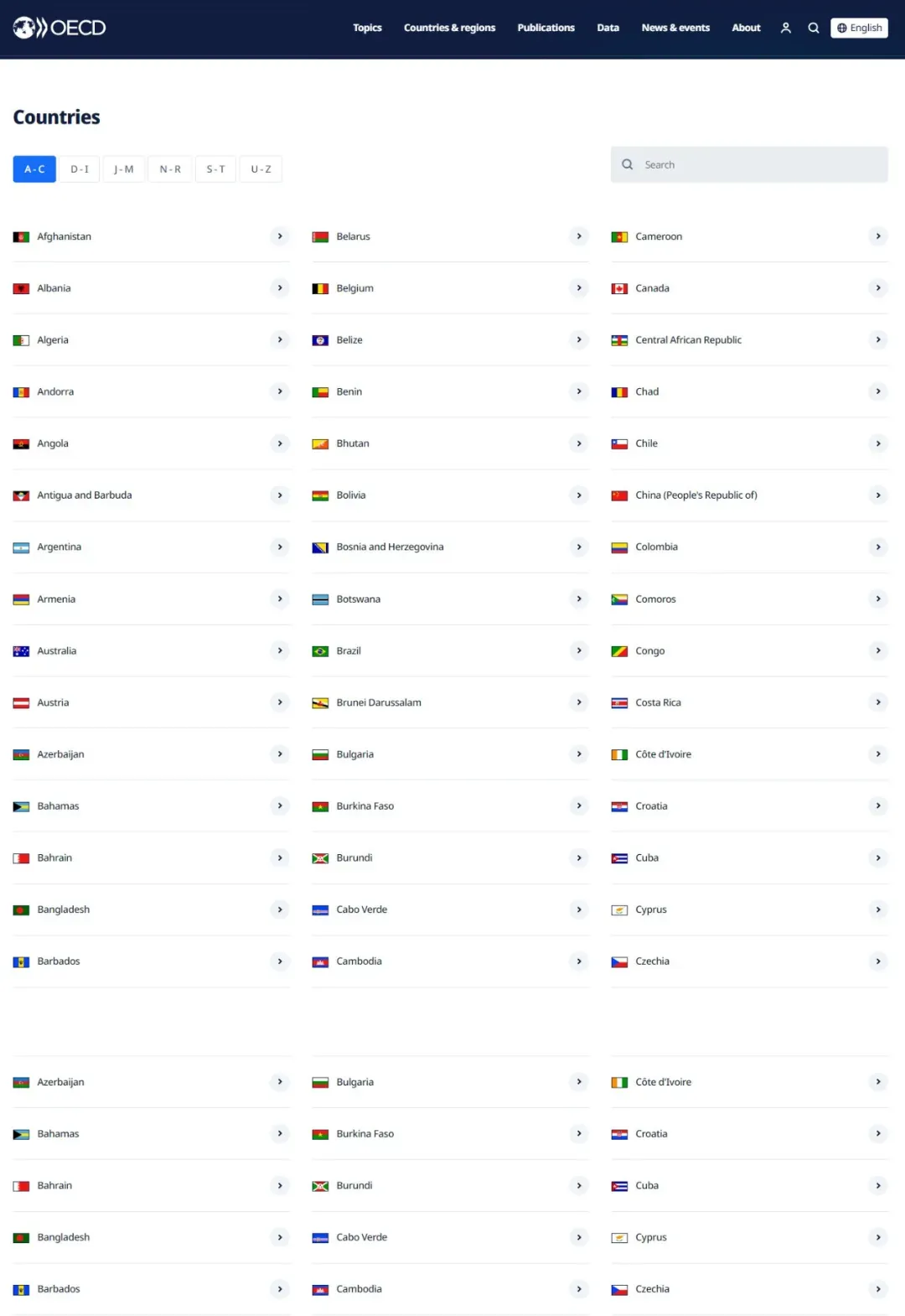

CRSisa global standard for automatic exchange of financial account information led bythe Organization for Economic Cooperation and Development (OECD).According tothe information on theOECD‘s official website, Mainland China, as thesecond batch ofjurisdictionscommitted to the implementation ofCRS,completed its first external information exchange in September 2018, and it is thefinancial account information for the year2017that was exchanged.

Technically, this is the earliest starting point for data on Chinese residents’ overseas financial assets that tax authorities can obtain in bulk through international cooperation.

Schematic diagram, source: United Daily News

2. Retroactive and Penalized Limits in Chinese Tax Laws

The Law of the People’s Republic of China on Administration of Tax Collection provides for different periods of retroactivity for acts of different natures:

Taxes and late payment fees: For unpaid or underpaid taxes caused by taxpayers’ miscalculations and other non-subjective and intentional reasons, the recovery period is generallythreeyears, and can be extended tofiveyearsunder special circumstances.However, for tax evasion, tax resistance and tax fraud, the recovery periodis unlimited.

Administrative penalties: According to article 86 of the Act, if an act in violation of tax laws or administrative regulations is subject to administrative penalties andis not detected within five years, no further penalties will be imposed.

Criminal penalties: Pursuant to article 87 of the Criminal Code, the statute of limitations for tax-related crimes ranges from5 to 20 years, depending on the statutory maximum penalty.

On the whole, althoughthe CRShas provideddata“ammunition“since 2017, the tax authorities will exercise discretion within the legal framework according to the nature of the violation and the severity of the circumstances in the actual enforcement of the law.

The recent retrospective focus on the last three years is both consistent with the jurisprudence and reflects the current efforts to strengthen regulation.

Press information/source: United Morning Post

III. Program identification:

Can I“avoid” CRSby switching my status?

In the face of regulatory pressure, theso-called“solution“ofobtainingpassportsfrom low-tax jurisdictions or“small countries“and then using them as a springboard to apply for residency status in places such as Singapore, in order to“avoid” CRSscrutiny and information transmission, hasbeen rumored on the market! Thesolutionis to“ avoid” the CRS scrutiny and the return of information . In this regard, we must rationally analyze the information based on official information.

1.Thedetermination of“tax resident“statusunder the CRSis the core of

The exchange of information underthe CRSis not based on the nationality of the passport, but on thestatus of tax resident. Tax residency is usually determined by a combination of factors such as the number of days an individual has resided in a country, permanent residence, and economic and social ties.

Merely holding a passport of a particular countrydoes not automatically make one a tax resident of that country, much less directly sever the link with China as a tax resident. The Chinese tax authorities will make a comprehensive determination as to whether an individual constitutes a tax resident of China.

2. Singapore is not an“information black hole“,EPthreshold is being raised significantly

Singapore is anactive participant inthe CRSand has been engaged in the automatic exchange of financial account information with China for many years.The path ofobtaining a passport from a small country and then applying for a Singapore Employment Pass (EP) is not only unable to circumvent the information exchange, but its feasibility itself is also decreasing dramatically.

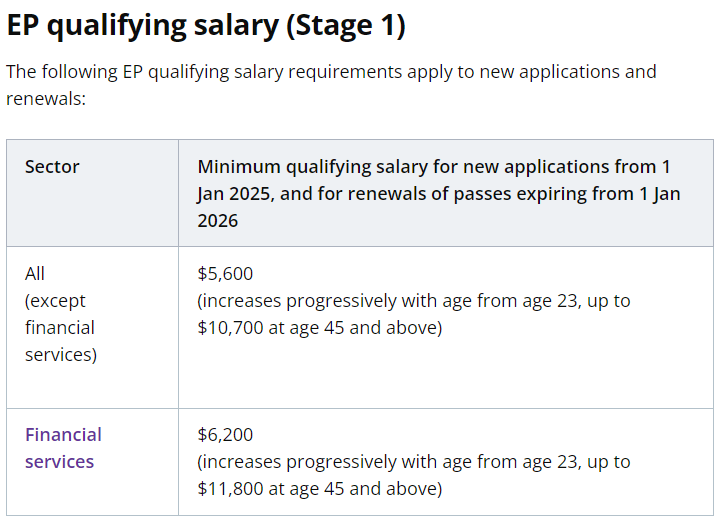

According to reports, Singapore’s Ministry of Manpower (MOM) has continuously raisedthe threshold for EP applications. From2025, the monthly salary threshold has been raised toS$5,600for non-financial sectorsandS$6,200for financial sectors.

In addition, all new applicants (with the exception of a few highly paid exemptions) will have to pass the newCOMPASSscoring system, which provides a rigorous assessment on a number of dimensions, including salary, academic qualifications, the degree of diversity of the company’s workforce, and support for local employment.The path oftrying to obtainEPby setting up a shell company for self-employmentis no longer sustainable in the audit.

Figure/Singapore EP Reference Wage, Source: MOM Singapore

3. Risk Warning: Improper Planning May Lead to More Serious Concerns

Adopting an aggressive identity change strategy that lacks business substance may not only fail due to non-compliance with the resident determination rules of each country’s tax laws, but may also be labeled as ahigh-risk targetby each country’s anti-money laundering and tax authorities due to the unusual flow of funds and change of identities, triggering a more stringent scrutiny, which is often more than worth the loss.

Fourth, compliance with the right path:

Proactive declaration and professional planning

In the era of globalized tax transparency, the way to cope with the situation is to“ease“rather than“block“, i.e., to shift from passive avoidance to active compliance management and long-term planning.

1. Proactive sorting and declaration

Taxpayers should immediatelysystematically sort outtheirglobal income and assets since2017.For undeclared income that has already occurred, they should take advantage ofthe preliminary window ofthe tax department‘s “five-step working method“and take the initiative to make supplementary declarations, in exchange for the opportunity to be exempted from penalties and even criminal liability by paying back taxes and late fees.

2. Accurate determination of tax resident status

For those who have been shuttling between China and abroad for a long period of time, they shouldaccurately determine their tax residency status for each tax yearby taking into account the domestic laws and tax treaties of each country, which is a prerequisite for the correct fulfillment of their reporting obligations.

Figure/CRS Membership List – Partial, Source: OECD

3. Making good use of internationaltaxagreements

China has signed tax agreements with more than 100 countries for the avoidance of double taxation. Taxpayers can, through professional consultants,legally and compliantly apply the provisions of the agreementsto optimize the taxing rights and tax rates on dividends, interest, property gains and other income, which is an internationally accepted means of legal planning.

4. Seek professional and authoritative advice

Cross-border tax issues are highly complex and dynamic. When dealing with major asset planning, it is important to consult withlawyers, tax accountants and other professionals who are well versed in Chinese and international tax laws, and to stay away frommarketing trapsthat sell“universal tax-avoidance status“.

Schematic diagram, source: United Daily News

[Conclusion]

The wave of global tax transparency has become irreversible. From China’s extension of backdating to Singapore’s raising of the immigration threshold, national policies are sending the same signal:

Tax compliance, based on real economic activity and facts of residence, is the only reliable cornerstone of wealth security.Any“tricks“that seek to exploit information gaps or loopholes in the systemare rapidly being reduced in the face of increasingly powerful data networks and regulatory collaboration.

The only way to navigate through change is to address it early and plan for it professionally.

*Reference sources: the first financial, financial news agency,OECD, Singapore MOM,the United Morning Post,the synthesis of news reports collated, reproduced must indicate the source, invasion and deletion of contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇