A seemingly ordinary property declaration, two tech giants of heavy transactions, the international city of Hong Kong, China, is becoming a common choice for wealth from different backgrounds.

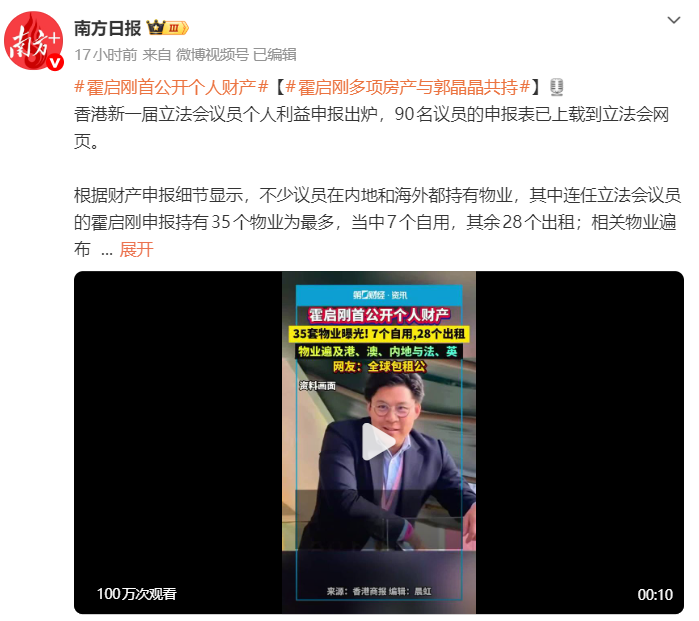

The title“Global Charterer“spread rapidly with a document on the website of the Legislative Council of Hong Kong, China.

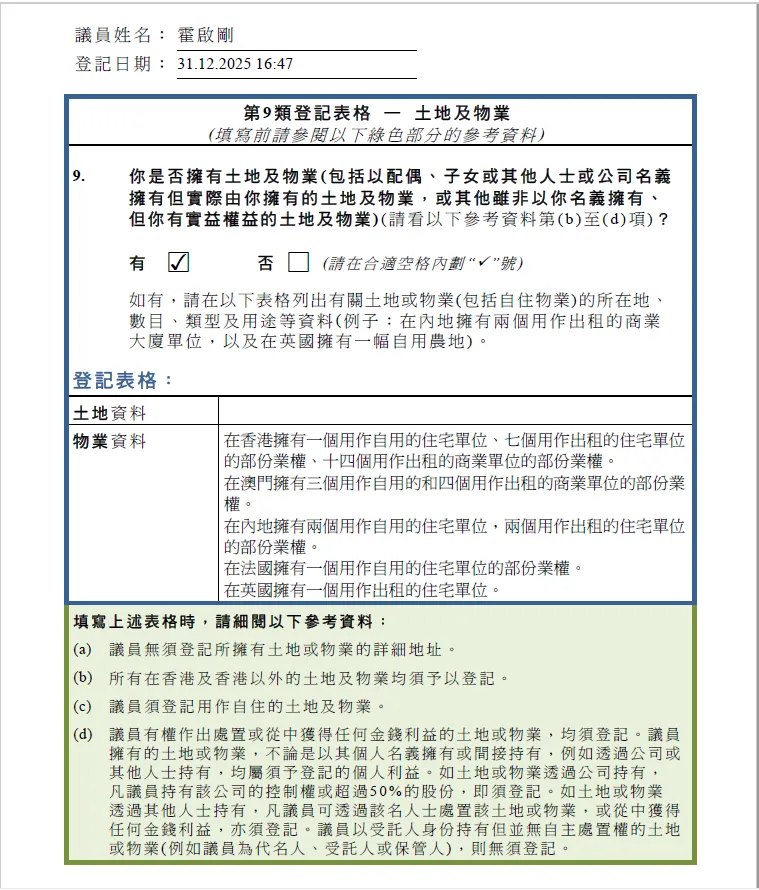

Fok Kai-kong, a member of the Legislative Council of Hong Kong, China, who has always kept a low profile,listed35properties across Hong Kong, the mainland, Macau and overseas inhis property declaration in early2026, of which28were being rented out and onlysevenwere self-occupied.

In just a few weeks, Alibaba announced that it hadbought Hong Kong’s largest office building in four yearsforHK$7.2billion, followed by Jingdong‘sHK$3.5billion purchase of a core property in Central, creating an interesting intersection between the tech giants’ asset allocations in Hong Kong and those of family wealth.

What is the logic behind the choice of Hong Kong, China, when all these different backgrounds of wealth at the same time?

Photo credit: Red Star News

I. Councillor’s declaration reveals wealth map, Fok Kai-kong‘s 35properties draws heated debate

OnJanuary11,2026, the Legislative Council of Hong Kong, China, routinely publicized information on the properties of its new legislators, and a seemingly procedural document unexpectedly came into focus.

Documents show that Fok directly holds35properties around the worldunder his personal name, including22inHong Kong,fourinthe mainland,seveninMacau, andoneeach in France and the United Kingdom.

Source: Nanfang Daily, deleted

Of these properties,28are for rental and onlysevenare for self-use, with the rental ratio as high as80%. Looking more closely, all of his mainland properties are concentrated in the Greater Bay Area, including Zhuhai, Dongguan and Zhongshan, which is seen by analysts as a bet on the development prospects of the Guangdong-Hong Kong-Macao Greater Bay Area.

Of particular interest is thata number of properties are jointly held by Huo Qigang and Guo Jingjing after their marriage, and this property arrangement is viewed as a frank attitude towards the marital relationship. This originally routine property declaration has unexpectedly become a window for the public to understand the asset allocation strategies of HNWIs.

Source: Nanfang Daily, deleted

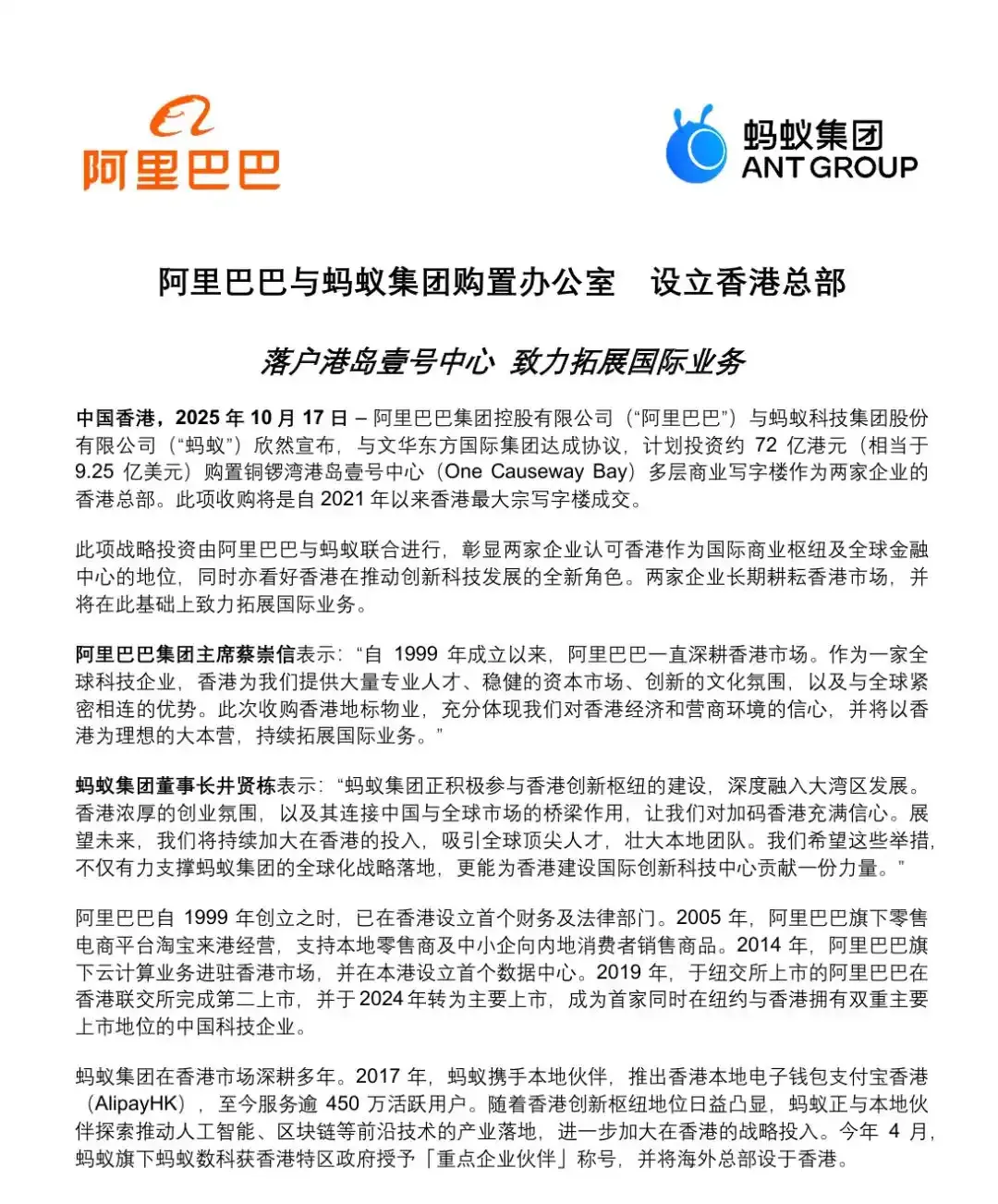

Second, Ma Yun out of7.2billion to buy a building, take Hong Kong’s largest sale in four years

Almost at the same time that Fok’s property was made public, the Hong Kong, China, real estate market ushered in a landmark deal.2025InOctober, Alibaba and Ant Group jointly announced that theywould spend approximatelyHK$7.2billion to acquire the multi-storey property of One Center, a landmark office building in Causeway Bay.

Source: Alibaba, deleted

The deal is thelargest office transaction in Hong Kong since2021. For Ali, it marks a strategic shift from Hong Kong tenant to landlord.

In a statement, Alibaba Group Chairman Jonathan Tsai emphasized thatHong Kong is the“ideal home base“for Alibaba’s internationalization strategy, and that the deal fully reflects the group’s confidence in Hong Kong’s business environment.

From theestablishment of the first financial department in Hong Kong in1999to theacquisition of a permanent headquarters in2025, Ali’s Hong Kong layout has completed a complete closed loop. Analysts pointed out that in the context of increasing global economic uncertainty, Hong Kong’s stability and openness has become an important fulcrum for technology companies to build international trust.

Source: Alibaba, deleted

Third, Liu Qiangdong smashed3.5billion Hong Kong dollars to follow up, to create their own operations center

With the afterglow of Alibaba still lingering, the Hong Kong, China, real estate market is welcoming another heavyweight buyer.2025InDecember, Jingdong, through an offshore investment entity,purchaseda50%interest ina27-story office building at3Connaught Road Central in Centralfor nearlyHK$3.5billion.

Jingdong has made it clear thatthe property will be used for its own purposes and ispart ofitsHong Kong strategy of“continuous investment around the supply chain“. This is not only Jingdong’s first property in Hong Kong, but also a key step in building its localized ecosystem.

Image source: Jingdong, deleted

Jingdong has already launched a series of layouts in Hong Kong, China:in August2025, it acquired local supermarket chain“Jiabao“for aboutHK$4 billion;inSeptember, it announced that it would open a large-scale offline store JingdongMALLin Wan Chai.

The acquisition of owned office space provides a stable base of operations for these growing businesses, andis much more than a simple investment; it is more like acquiring“infrastructure“for a long-term strategy.

Source: Sina Finance

Fourth, the rule of law and low tax environment is stable, Hong Kong has become a“safe haven“forwealth.

As traditional families and tech giants coincide in allocating heavy assets to Hong Kong, China, what is the attraction behind the city?

Hong Kong’s common law system, free flow of capital and simple tax regimeform the institutional basis for attracting global capital. A corporate income tax rate of up to16.5 per centand the fact that only Hong Kong-sourced profits are taxed make it highly attractive to international businesses.

After the market correction,the valuation attractiveness of core assets in Hong Kong is gradually recovering.The market expects the Federal Reserve toenter a rate-cutting cycle in2026, which will lower financing costs and favor real estate value restoration.

For industrial capital,owning properties can lock in long-term costs and avoid the risk of rental fluctuations.Jingdong’s emphasis on property“self-use“reflects this logic. For family wealth, Hong Kong assets play thedual role of“ballast“and“safe haven“.

Source: Sina Finance

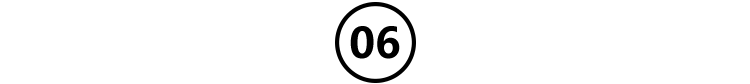

V. Fast-tracking of the Highly Talented Persons Scheme, with three categories to meet different needs

Along with asset allocation, Hong Kong, China has seen a boom in identity planning, withthe launch oftheHighly Qualified Persons(HQP) programat the end of2023becomingone of the most popular fast-tracks.

The program is divided into 3 types of application pathways:

CategoryAis forthose withan annual salary ofHK$2.5million or abovein the year before application;CategoryBis for undergraduate graduates of the world’s top 100 universities withat leastthreeyears of work experience; andCategoryCis for undergraduates of the top 100 universities graduated within the past five years, with a quota of10,000per year.

The biggest advantage of the HSP is that you do not need to have secured a job in Hong Kong at the time of application, and you can stay in Hong Kong forup to 24months (36monthsfor CategoryA)after approval, which gives you plenty of time to look for opportunities or start your own business in the territory.

Figures show that the number of applicants after the launch of the Highly Talented Persons (HSP) scheme has far exceeded expectations, reflecting the strong market demand for Hong Kong identity.

Photo/Talent List – Partial, Source:HK Ming Pao

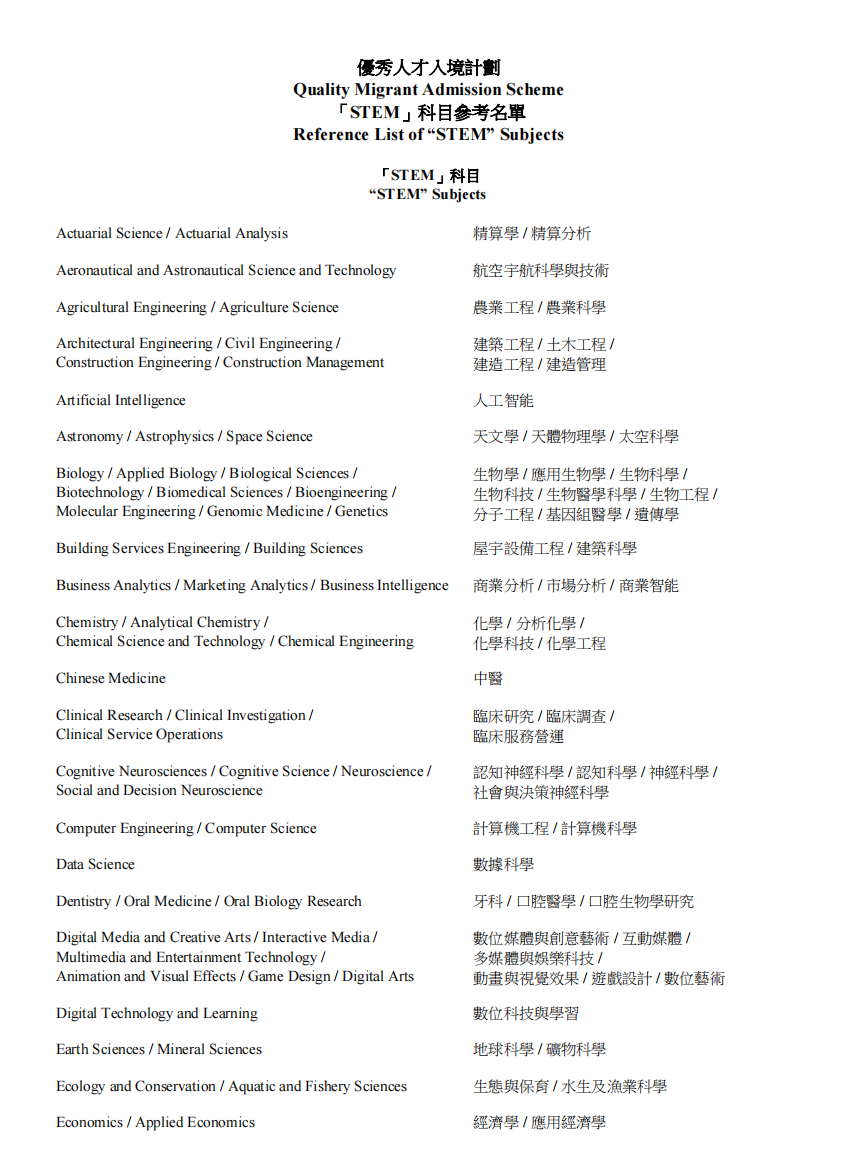

Reform of the vetting criteria of the QMAS, placing more emphasis on substantive contributions

Compared with the Highly Talented Person Scheme,the Merit Schemewill undergo a significant change in2026by abolishing the traditional points-based system and replacing it witha “12-item assessment framework“for selection.

The new criteria are more specific: applicants should holda master’s or doctoral degree from one of the205qualified universities inthe world, or have an annual taxable income of not less thanHK$1 millionin the year prior to the application, and should also have at leastthreeyears of relevant working experience.

Upon successful application,the validity of the initial visa has been extended tothreeyears, providing a more adequate adaptation period for talents. However, the requirements for the renewal of the visa have also been made clearer:proof of“two addresses and two documents“, i.e. proof of residential and company address, and salaries tax and profits tax returns,are required.

The renewal rate of less than35%for applicants who are purely residents without work or business start-upsis a clear indication that Hong Kong, China, places greater emphasis on the substantive economic contribution of talents to the local economy.

Chart / List of majors and schools – Partial, Source: HK One-Stop Shop

[Conclusion]

From Fok’s35global properties, to Jack Ma’s HK$7.2billion acquisition, to Liu’sHK$3.5billion purchase of an operations hub,Hong Kong, Chinais becoming a meeting point for different forms of wealth.

Traditional families diversify their asset risks through Hong Kong, while technology giants use it as a fulcrum for their internationalization strategies. And the optimization of the High Talent Pass and the Premium Talent Scheme provides an institutional channel for the inflow of talent.

In this city’s wealth map, asset allocation and identity planning are forming an increasingly close correlation, together building a unique ecology connecting China and the world.

*Source: Nanfang Daily, Red Star News, Daily Economic News, China Hong Kong Legislative Council, Sina Finance, Alibaba, Jingdong, comprehensive news reports, reprinted with attribution, infringement and deletion contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations