Last year,Mr.C, who does international trade,came to us. He was mainly annoyed by3things:

One ishow to manage the money earned from your business to be safer and grow faster;

Secondly,my children will be going to school soon and I want to go to a place with good education and a stable environment;

Thirdly,parents are getting older and want to be conveniently brought to live with them.

We told him that many business owners in a similar situation to him choose to set up a “single family office“in Singapore. Simply put, it means setting up a company that specializes in taking care of your family’s money. He listened with some interest, but was most concerned about two practical questions:“How much will it cost?“and“Can I get a whole family status?“

We gave him a clear answer: the core is to satisfythe 13Oprogramof theMonetary Authority of Singapore (MAS).We did some math for him. To meet the application threshold, he had to do3mainthings:

1, Put at leastS$5 million for investment, this is the start-up capital to prove that you are really here for asset management.

2、雇至少两个专业投资人,不能是光杆司令,得有实际运营。

3. Spend at leastS$200,000a year locallyon wages, rent, etc. to contribute to the Singapore economy.

After doing these3things, the biggest reward is to be able to apply for anEmployment Pass (EP)in Singapore.ThisEPcarries a very high value and is equivalent to a work status, which can help his spouse, children and parents to apply for a long term residence visa, thus solving his concern about the status and education of the whole family at once.

Mr.Cfelt that the path was clear and decided to launch. The whole process was like“breaking through three barriers“:

Level 1: Set up a company and prepare for the“exam room“.

This step was simple. We helped him register an investment management company through the Accounting and Corporate Regulatory Authority of Singapore’s online system, which is the“shell“of his family office. The fees were fixed and the process was quick.

Level 2: Preparing materials and passing“background checks“

This isthe most critical step after2025. In order to prevent money laundering, Singapore has added a new mandatory requirement: to apply for the

The applicant must Prove the source of funds and the innocence of his historybydoing a background check reportthroughseveral large organizations (e.g. Ernst & Young, KPMG) appointed byMAS.

We assisted him to prepare a complete business plan, proof of assets, and contacted the investigation organization. This“proof of innocence“was the key to a smooth approval.

Level 3: Formal Application, Waiting forthe “List“

OnSeptember 9,2025, we formally submitted all the documents to MAS, together with the crucial background investigation report.

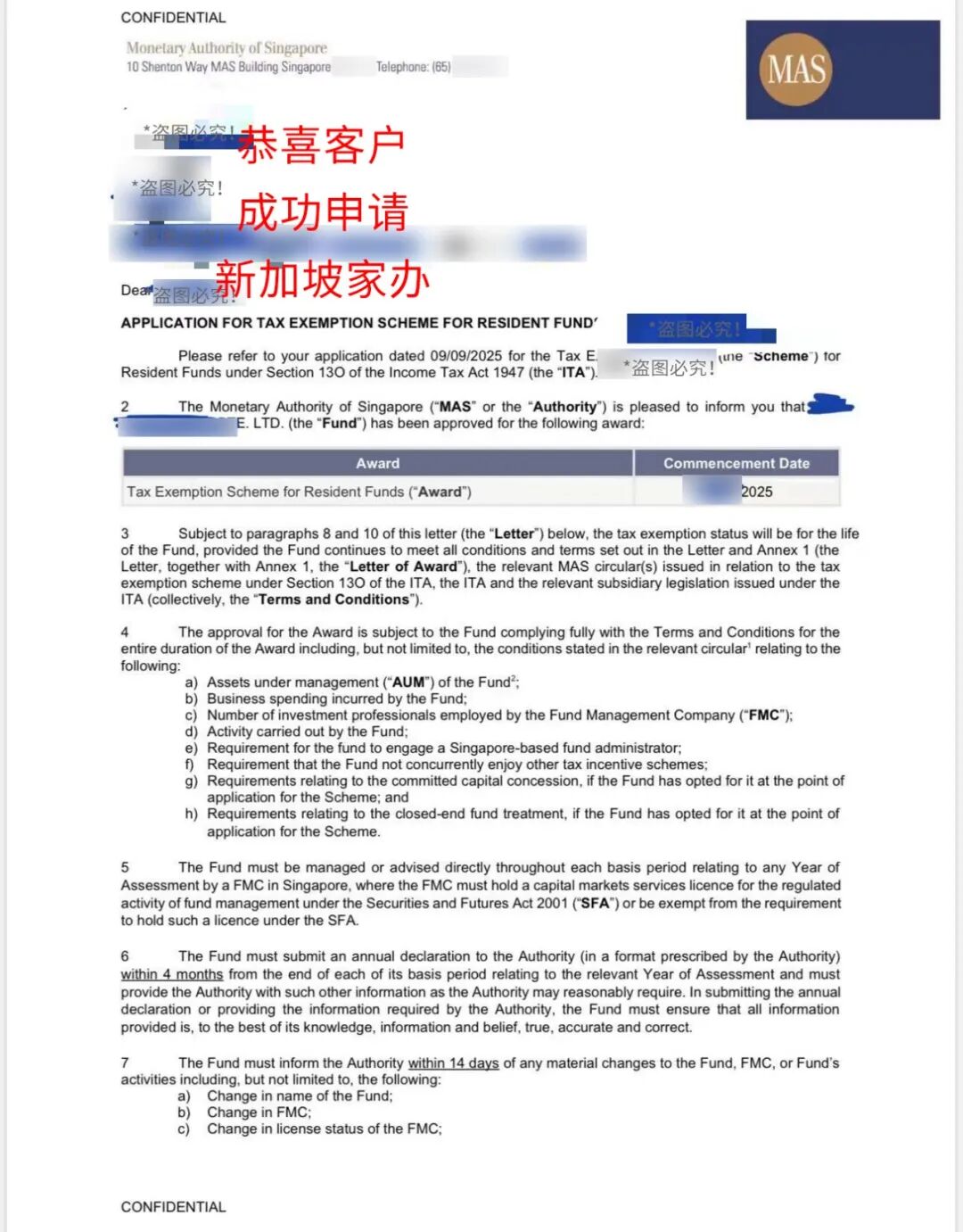

Because the documents were solid,the approval cameabout3 monthslater,before the end of2025, andMr.C‘s family office was officially granted13Otax exemption.

Photo/Client applied for a tax exemption through the Home Office, stolen image!

What exactly does this approval address when it arrives?

1. Money matters

Specific income generated from family-run investments (e.g. overseas dividends, interest) can be claimed as tax-free. There is no capital gains tax in Singapore itself, making it easy to pass on wealth. He can manage business funds and family assets separately for greater security.

2. Identity and education issues

With his status as a director of the family office,Mr.Capplied for anEPfor himself, which was thenused as the basis for his wife, children and parents to obtain a Long Term Residence Permit. The children were soon enrolled in international schools in Singapore, and the education pathway picked up.

3. Future planning issues

The whole structure is built in Singapore, a place of financial and legal reliability, and he is rather more at ease in the face of the global trend of tax information transparency. The Family Office has also become the official platform for managing family wealth and setting rules for inheritance in the future.

To summarize the main points:

Mr.C‘s case is typical. The Singapore Family Office is not a fictitious concept, it is acompliant solutionwith a clear investment and expense in exchange for identity and tax optimization for the whole family.

There are just two keys to success:

One is totruthfully fulfill those few requirements regarding the amount of investment, hiring, and local spending;

Second,background checks are taken seriously to prove the legitimacy of the source of funds.

The whole process is not esoteric, just step by step according to the rules. Forbusiness ownerslikeMr.C, who have multiple needs in terms of asset planning, children’s education and family residence, this is apragmatic choicethat canaddress their core concernsin one package.

*Reference source: SingaporeMAS,IRAS,ACRA, United Morning Post, comprehensive news reports collated, reproduced with attribution, infringement and deletion of contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations