Tax compliance is a mandatory course in the globalization journey of an enterprise. For a Chinese company aiming to reach out to all corners of the world, understanding and complying with the tax rules of the target market is not only a legal obligation, but also a cornerstone for building a sustainable competitive advantage.

Acrane manufacturerwith over30years of experience:

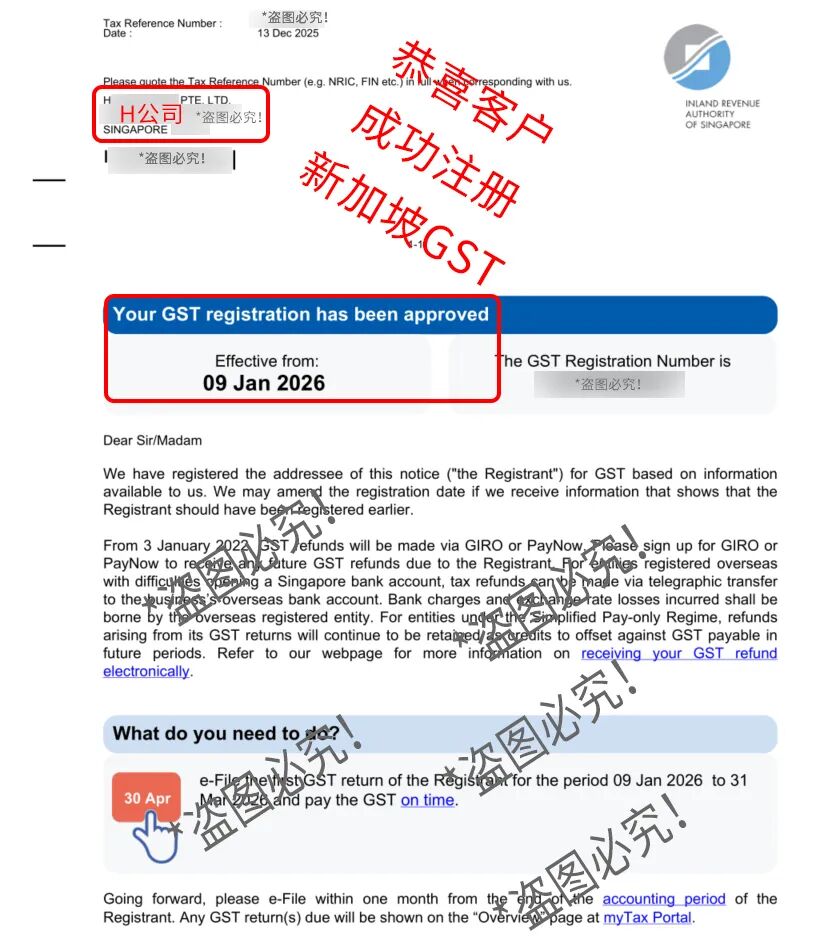

It is through the successful completion of SingaporeGSTregistration and compliance thatCompanyHhas established a sound financial and legal foundation for its Asia-Pacific business expansion, turning potential tax challenges into structural advantages that drive business growth.

This article takes thereal situation ofGSTregistration as an example, and systematically explains the registration rules, triggering conditions and specific operation process of Singapore GST.

I. How much turnover has been achieved

Trigger subject to mandatory GST?

CompanyH, a Chinese company specializing in the manufacturing of lifting machinery. As its internationalization strategy advances, Singapore has become one of its important overseas markets.

After obtaining initial business progress,CompanyHreasonably predictedthat itstaxable turnover in Singapore would be in excess ofS$1 millionover the next12 months, based on an analysis of signed orders and firm enquiries. This forecast was based on specific draft contracts and written intentions from customers, rather than purely market estimates.

This triggereda mandatory GST registration obligationunder Singapore tax law.Hsubmitted its registration application through the Inland Revenue Authority of Singapore online system within30days of making its forecast.

Under the new regulations, itsGSTregistration became effective two months after the forecast date. This enabled it to comply with its legal obligations and to claim input tax credits on subsequent purchases.

OnJanuary9,2026,H’s SingaporeGST registrationbecame effective.

Photo/Customer successfully registered with GST, stolen image must be taken as a warning!

II. Core rules:

When must I register forGST?

GSTregistrationin Singaporeis not voluntary but is mandatory when statutory conditions are met. The criteria centers aroundwhetherthe“taxable turnover“exceedsS$1 million.

1. What is taxable turnover?

Taxable turnover is thetotal value ofalltaxable suppliesmade by an enterprise in the course of its business in Singapore.It mainly includes:

Standard rate supply: The rate is currently9%, e.g. local sales of goods in Singapore, provision of services, and fromJanuary 1,2023,sales of imported low-value goodstolocal consumers whoare not registered forGST.

Zero-rated supply: tax rate of0%, e.g. export of goods, international supply of services.

Note the exclusions: exempt supplies (e.g., specific financial services), transactions outside the scope of business, and sales of capital assets (e.g., plant, large equipment) are not included in the taxable turnover.

2. Two specific rules for compulsory registration:

Retrospective rule: At the end of any calendar year, if a company‘s actual taxable turnoverfor the past12months has exceededS$1 million, it mustapply for registration byJanuary30 ofthe following year, with an effective date ofMarch1 ofthe following year.

Anticipation Rule: At any point in time, if it is reasonablyforeseeablethat the taxable turnover forthe next12months will exceedS$1 million,an application for registrationmust bemade within30daysof making such a projection.

If the projection date isbeforeJuly1,2025, registrationis effectiveon the31stday after the projection.

If the projection date is onor afterJuly1,2025, registration becomes effective two months after the projection date (this is thenew grace period announced for2025).

3. Voluntary registration and exemptions

Enterprises may voluntarily apply for registration if they do not meet the mandatory thresholds, but once registered they must normally remain so for at least two years and comply with all compliance requirements. Enterprises may apply for exemption from registration if their turnover is wholly or mainly derived from zero-rated supplies.

III. Operational processes:

From assessment to compliance

Step 1: Accurate Assessment and Document Preparation

Businesses need to continuously monitor their revenues from their operations in Singapore. Ifregistration is requiredbased on the“anticipation rule“,supporting documents must be preparedto justify the projections.

Valid documents include signed sales contracts, firm orders (POs)from customers, service agreements with fixed fees, and financial statements showing a rapid growth trend in turnover. Forecasts based solely on business plans or market objectives are not considered valid.

Step 2: Submit your application within the time limit

Once the obligation to register has been determined, it is important to strictly adhere to the application deadlines (retrospective rule isbyJanuary30 ofthe following year; prospective rule iswithin30daysof projection).The application is mainlydone onlinethrough the Inland Revenue Authority of Singapore’smyTax Portaland requires company details, nature of business, turnover data and information on responsible persons.

Step 3: Respond to Audit and Effective Implementation

After the IRS audit is approved,aGSTregistration noticewill be issued, specifying the uniqueGSTregistration number and effective date forthe business. The business must:

GST(currently9%) willbe charged on applicable sales from the effective date.

The GSTregistration numberis clearly displayed on the invoice issued.

Filing ofGSTreturns at prescribed intervals (usually quarterly).

Step 4: Ongoing Compliance and Record Retention

Upon registration, businesses are required to file and pay their taxes on time and mayclaim input tax creditsforGSTpaid on their business expenses.All relevant business and accounting records must be kept for at least5years.

IMPORTANT:Delayed registration will result in the registration being backdated to the date it should have been registered, and businesses will be required to pay backGSTon sales made during the backdated period(even if they were not charged to their customers at the time), and may face penalties. Proactive disclosure of the delay can hopefully reduce the penalty, but the tax will still need to be paid back.

[Conclusion]

In summary,GSTregistrationin Singaporeis a legal obligation with clear numerical thresholds and timeframe requirements.

Fora fast-growing business like CompanyH, conducting accurate tax assessments in advance and strictly following the process is a key step in ensuring compliance and sound operation of overseas business.

*Source of reference:IRASSingapore,ACRA, synthesized from client’s oral presentation, reproduced with attribution.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations