At the end of2025, the world was shocked by the news thatNicolasPiech, the 82-year-old fifth-generation heir to Hermès, atop tycoonwitha 5.7%stake inthe companyand a fortune of$15.6billion, had been revealed to be“broke“.

It was discovered that the once super-rich man traveled only huddled in the middle seat of a budget airline’s economy class.

It all started with a quarter-century-long“top killboard“that began with friendship and ended with betrayal.

Piech alleges thatEricFreund, a wealth managerhe trusted for25years,quietly changed handswith hisHermes sharesworth about$15 billionthrough concealment and deception, with the biggest buyer pointing to Hermes’ arch-enemy,LVMHGroup.

I. Hermes heir:

A25-year old“killing pan“.

andthe mystery of the $15 billion evaporation

1.The roots of the problem of“carteblanche“

At the heart of the whole tragedy isabsolute, unchecked trust.The two men met inthe 1980s, and Freund earned Piech’s complete trust through his knowledge and demeanor. Since1998, Piercy has given Freund full authority over all financial matters, including the checkbook and signing authority.

The key turning point camearound the year2000.At Frémond’s urging, Pierche converted his Hermès shares into“bearer shares“and transferred them from France to Switzerland.

The special feature of this type of stock is that its transfer can be accomplished by the delivery of a paper voucher only, without the need to register the transfer in the register of shareholders, which opens the door to the clandestine transfer of assets.

Photo/Nicolas Piech, Source: South Window

2.Lies punctured by1million Swiss francs

The scam began with a“small fortune“:in2022, Pièche asked Frémond to transfer1 millionSwiss francs to his gardener.

The gardener’s wife overheard the conversation and told Piercy that he had not received the money, a suspicion that eventually ripped open the corner of a huge black hole. The audit that followed was shocking: some6million Hermès sharesin Pièche’s name hadlong since“disappeared“.

Photo/Freund owns multiple properties filled with collectibles, and around 2015, he and his wife started an art gallery in Geneva called Espace Muraille

3. Magnificent grudges and confrontation in court

The audit showed that these shareswere sold in tranchesas early asaround2008, aperiod whenLVMHsecretly increased its stake in Hermès. This brought back an unpleasant memory for the Hermès family:in 2010,LVMHhad suddenly announced that it had taken a stake of more than14%inHermès, triggering a fierce battle for the stake.

InMay2025, Pièche tookLVMHand its chairman BernardArnault to court, accusing them of taking away his shares.

The other central figure in the case, Frédéric Freund, died in a train accident in the Swiss Alps shortly after being questioned by the French judiciary, and police ruled it a suicide. His death has left the whereabouts of the tens of billions of dollars in wealth and many key details that may remain a mystery forever.

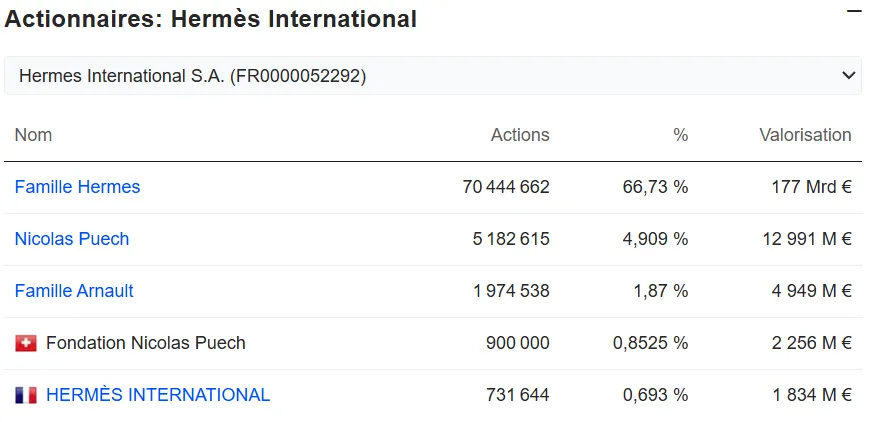

Photo/Hermèsmajor shareholder composition as of March 12, 2025, with Piech still listed as the largest individual shareholder at that time, Credit: South Window

4. Lessons learned: the fragility of personal trust and the cost of institutional failures

It is no coincidence that the tragedy of Pièche exposedthe fatal risk ofrelying onpersonal trustandsingle-point decision-makingin the traditional wealth management model:

Out-of-control delegation: Placing the management of assets in the sole hands of one person without basic oversight and checks and balances.

High-risk instruments: The use ofhighly anonymous and untraceable financial instruments, such as“bearer shares“, magnifies the risk of asset misappropriation.

Governance vacuum: As the heir to a business that was not involved in its operation, Piech lacked sufficient understanding of and sustained attention to the complex financial arrangements.

Schematic diagram, source South Window

II. Solutions for the modern high net worth family:

Institutionalized Singapore Family Office

Piercy’s encounter has sounded the alarm for the global tycoons. When the scale of wealth reaches a certain level, the traditional management model that relies on personal relationships is in crisis, and the shift to a professionalized, institutionalized and transparent wealth management structure becomes inevitable.

Against this backdrop,the Singapore Family Officeis fast emerging as the solution of choice for high net worth families around the world, especially for Asian tycoons.

Why is it the“ideal city“for Chinese HNWIs?

Singapore’s attraction to wealthy Chinese to set up family offices goes far beyond tax incentives to an integrated ecosystem:

The core strengths are:

Advantage of legal system:With efficient and transparent ZF and mature legal system inherited from the British common law, it provides a solid guarantee for the safety of assets.

Financial Center:As a wealth management center in Asia, it has a well-developed financial infrastructure and an open capital market, which facilitates global asset allocation.

Pro-business tax policy:regional taxation, no capital gains tax or inheritance tax.Tax exemption on investment income of eligible family fundsthrough the13O/13Uscheme.

Geographic location and cultural proximity:Located in the hub of Asia, with no time difference with China, a multicultural and bilingual environment, easy communication and living.

Status Planning Pathway: Setting up a family office is arecognized and effective way toobtain Singapore Residence Status (EPand hencePR).

Schematic diagram, Singapore

III. Core passages:

Explainingthe 13Oand13UProgramsin Detail

The Monetary Authority of Singapore‘s(MAS) Fund Tax Exemption Scheme, which is the legal framework for family offices to enjoy tax benefits, has two main types:

13ORequirements:

Subject to theapproval ofthe Monetary Authority of Singapore (MAS).

Minimum fund size ofS$20,000,000at the time of application and during the tax incentive period;

* Employ at least two professional investors at the time of application and during the tax incentive period, at least one of whom must be a non-family member;spend at leastS$200,000on local business.

A minimum of10%orS$10 million(whichever is lower)must always beinvested in local investment projects in Singapore, and a one-year grace period will be given to invest in local projects where immediate investment is not possible; and

*Application here refers to the point in time when the application form for tax exemption is submitted.

13URequirements:

Subject to the approval of the Monetary Authority of Singapore (MAS).

Minimum fund size ofS$50,000,000at the time of application and during the tax incentive period.

*Employment of at leastthreeprofessional investorsat the time of filing and during the tax credit period, at least one of whom must be a non-family member.

Spend at leastS$500,000on local business.

A minimum of10%orS$10 million(whichever is lower)must always beinvested in local investment projects in Singapore, and a one-year grace period will be given to invest in local projects where immediate investment is not possible; and

*Application here refers to the point in time when the application form for tax exemption is submitted.

Note: EffectiveOctober1,2024, all new applications will need to be accompanied bya background screening report froma MAS-appointed screening agency (e.g., Ernst & Young, KPMG, etc.), with a review cycle of approximately two weeks.

Photo/Pièche’s current residence, a large villa in a Swiss town, also does not belong to him, but to his foundation, source: South Window

IV. From home office to identity:

How do I getEPthrough my home office?

For families seeking to plan for their identity, setting up a family office can be an effective route:

1. Setting up the structure

Incorporation of a fund management company (single family office) and a fund in Singapore.

2、Apply for tax incentives

Submitan application for the13Oor13UprogramtoMASdemonstrating that all of the preceding conditions are met.

3. Serving as an executive and applying forEP

Family members (e.g. spouses or adult children) can take upkey positions such assenior managersorinvestment specialistsin the established family officeand apply for anEmployment Passfrom MOM in this capacity.This isa crucial first steptowards Permanent Residency (PR).

4. Application for Permanent Resident (PR)

Afterholdingan EPand operating steadily for a certain period of time (usuallyabout2 yearsis recommended), you can submit aPRapplicationfor yourself and your immediate family members.

For families with very large assets, they can also directly considerthe Global Investor Program, which requires the establishment ofa single family officein Singapore with a size of at leastS$200 million and an investment of at leastS$50 million in the local market, which will lead to directPRstatusupon success.

Schematic,stills from Blue Jasmine , source: southwinds.com

[Conclusion]

From the personal tragedy of the Hermes heir to the institutionalized prosperity of the family office in Singapore, the two form a stark contrast regarding wealth management. While the former reveals the enormous risks of tying tens of billions of dollars of assets in the hands of one person, the latter representsthe trend of the times to safeguard wealththroughprofessional division of labor, legal structure, transparent regulation and strategic planning.

The important takeaway for China’s high net worth families is this:

True wealth security lies not in finding atrustee who“never betrays“, but in building asystem thatcan function robustly even without a perfect man.This is perhaps themost expensive lesson thatPiercy bought with$15 billion, and it is also the most valuable value that the Singapore Family Office gives to the world’s rich.

*Reference sources: SingaporeMAS,EDB,MOM, United Morning Post, South Window,VistaWorld, comprehensive news reports collated, reproduced with attribution, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations