A paper from the Singapore Exchange Regulatory Corporation (SGX-ST)slashedthe earnings threshold for main board listings fromS$30 million to$10million, a67%drop.

Meanwhile, the latest report from the Singapore Institute of Directors reveals thatthe disclosure rate of listed company directors’ remunerationhas soaredfrom27.8%to67.8%, while SGX chief executive officer Low Boon Chye, who drove the change, has seen his total personal remuneration increase by3.3%to$7.82million.

These three sets of figures together outline the trajectory of deep changes in Singapore’s financial market–from internal corporate governance to external listing rules, a systematic project aimed at enhancing Singapore’s global financial competitiveness is in full swing.

I. The governance revolution:

Remuneration Transparency and Board Reconfiguration

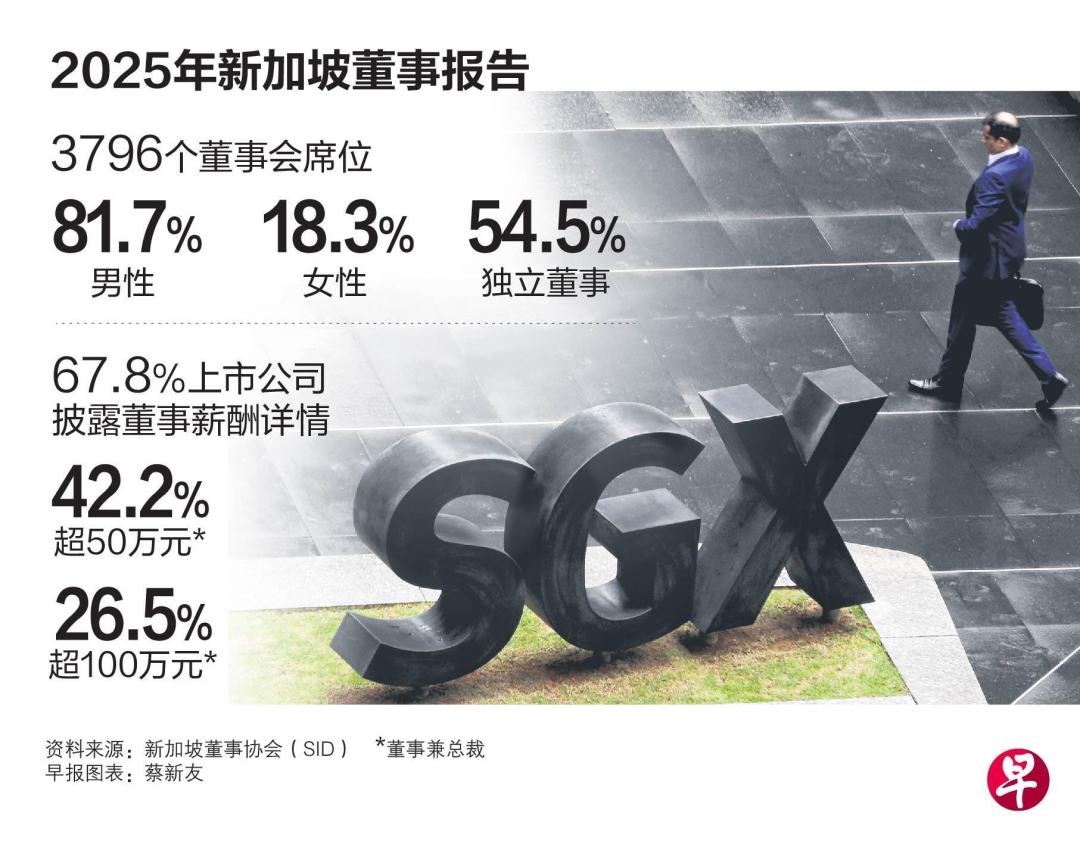

1.Soaring disclosure rate: 67.8% disclosure rate for board remuneration

The Singapore Institute of Directors (SID) released its2025Survey of Directors of Listed Companies onNov.4, revealing thatthe disclosure rate of directors’ remuneration of locally listed companieshas risen sharplyfrom27.8%in2023to67.8%,a staggering increase of40percentage points injust one year.

This change is a direct reflection ofthe power of the mandatory disclosure policy implemented bythe NSEin early2023.

The survey covered615listed companiesfrom12industries, with data up toDecember31,2024Among them,large companies performed particularly well, with a disclosure rate of88.2%, showing a more responsive attitude to regulatory requirements among sizeable companies.

However, the report also noted that19.8% ofcompaniesstillchose to disclose only the range of directors’ remuneration rather than specific figures.

Source: SID, United Daily News

2.A major turnover of independent directors: a fundamental shift in tenure structure

Deepening regulation is reshaping the board structures of Singapore-listed companies. According to the report’s data,the rate of new local independent directors reached42.6%, while the proportion of sole directors with a tenure of more than nine yearsfell sharply to just3.2%fromabout21%in2023.

This structural change stems directly fromthe independent director tenure cap provision introduced bythe SGXin early2023–capping the tenure of independent directors of listed companies at nine years. The data shows that49.3%of independent directors have a tenure of three years or less, and45.8%are first-time directors, reflecting a whole new set of forces being ushered into Singapore’s corporate governance landscape.

3.Progress in diversification goes hand in hand with governance shortcomings

Of the3,796board seats,54.5%are held by independent directors, reflecting Singapore’s continued progress in board independence. The proportion of female directors has also continued to increase, with18.3%at a record high since2014, and25.8%for large corporations.

At the same time, the ratio of all-male boards has dropped significantly to about30 percent, but it is still as high as36.5 percentin small businesses, indicating that the process of diversification varies significantly by size of business.

However, the report also reveals the unevenness of governance improvements.Only9.1 per cent ofboards disclosed the establishment of a sustainability committee, and progress remains relatively slow in non-mandatory areas such as risk management through specialized committees.

4.Talent fault crisis and systematic training needs

Ho Yiu-kee, Professor of Accountancy at the City University of Hong Kong and the main analyst of the report, has issued an important warning:Singapore’s director structure may be facing a generational gap.The median age of directors of locally listed companies is now60, and the first generation of senior directors who grew up after the founding of the country are retiring one by one.

“The heightened global economic uncertainty and the increased professionalism and responsibility of directors cannot be a‘retired part-time job‘.“Ho Yiu Kei emphasized that the ideal candidate for a director should be someone at the peak of his or her career, close to retirement but still energetic and capable.

In particular, he pointed out that, in the absence of systematic preparation, allowing the market to evolve naturally often resulted in a reliance on personal networks, leading to a decline in the quality of governance or a lack of independence. He therefore called on the market and regulators to work together to create a sustainable talent supply system, including specific measures such as front-loading governance capacity from senior management onwards and utilizing professional advisers to conduct global searches and skills matching.

Photo credit: United Morning Post

Second, performance speaks for itself:

The remuneration logic behind NSE’s glowing report card

1.The strong link between pay and performance

According to SGX‘s FY2025 Annual Reportreleased onSeptember15,Chief Executive Officer Law Boon Chye’s total remuneration increased by3.3%to$7.82millionlast financial year, compared to$7.57millionin the previous financial year.This increase in remuneration is directly related to the excellent performance he has led SGX to achieve.

The analysis of the remuneration components shows thatthe fixed remuneration of W.C. Law remained largely unchanged at$1.21million. The variable component is mainly reflected in performance-related income:

Cash bonuses increased by3.6%to$3.27million and long-term incentives increased by3.7%to$3.27million. This compensation structure fully reflects the performance-oriented compensation concept, which closely binds management’s interests to the Company’s long-term development.

Photo/SGX Lo Man Choi, Source: United Daily News

2.Best-ever performance supports pay increases

SGX‘s FY2025 results, announced in August,provided solid performance underpinning:total revenue rose11.7%year-on-yearto$1,298.2million, and net profit of$648.0 millionwas achieved,an increase of8.4%on the$598.0 millionreported in the same period last year. This is the highest revenue and net profit recorded since the company went public.

Market activity increased significantly, withaverage daily securities turnover increasing27%to$1.3billion, a four-year high, and outperforming Asean’s peers. Earnings per share were60.6cents,upfrom55.9centsa year ago.The Group paida final dividend of10.5centsper share, an increase of1.5centsfrom the same period of the previous financial year, and accumulated37.5centsin dividends for the year.

3. SGXChairman’s Deep Concern and Strategic Vision

Despite the glowing results, SGX Chairman Koh Boon Hwee issued an urgent warning in his annual report dedication, “If the best companies choose to list overseas, the impact will go far beyond the SGX itself, with the entire value chain, including investment bankers, corporate lawyers and accountants, potentially shifting to other jurisdictions.“

He pointedly noted that“Singapore may continue to be a transit center for capital, but talent, innovation and higher-value profit margins will flow elsewhere.“These words are a profound revelation of the deep crisis facing Singapore’s capital markets.

Koh believes that Singapore needs to set an ambitious vision for its capital markets that goes beyond the stock market, and a policy framework that can help realize that vision. Looking back at the local journey from industrialization to a research hub, he believes that Singapore can replicate similar success in the capital markets space.

Photo credit: Bloomberg, United Daily News

Third, the threshold revolution:

Strategic Considerations for the Significant Relaxation of Listing Requirements

1.A significant reduction in the profitability threshold

Measures to streamline the listing process announced bySGX-Supervisoryon Oct.29mark a significant turnaround for Singapore’s capital markets.The profit test threshold for Main Board listingswas loweredby as much as two-thirdsfrom$30 million to$10 million, similar to the approach taken by major international exchanges.

This means that companies in emerging sectors with strong growth potential, but which are not yet profitable, can now apply for listing on the Main Board. According to the SGX-ST, this will enhance the diversity of companies listed on the Main Board and provide investors with more choices. For life sciences companies that are not yet profitable, the listing requirements have also been adjusted to better match the characteristics of the industry.

2.A fundamental shift in the logic of regulation

At the heart of the reform is a shift from a substantive review to a disclosure-based regime. SGX-ST Regulatory Corporation Chief Executive Officer, Mr. Tan Boon Jern, said,“These measures recommended by the Securities Market Review Panel are comprehensive, with initiatives at the corporate level helping to enhance liquidity and valuation, and initiatives at the regulatory level enhancing market efficiency.“

This shift allows listing applicants to make their own disclosures while ensuring that investors have sufficient information to make informed judgments. Notably,the SGX-ST Regulatory Corporation will remove the watch list mechanismto avoid unnecessary negative impact on market confidence and access to corporate finance. However, companies with sustained losses will still be required to disclose the third consecutive year and subsequent financial years, and where appropriate, specific plans to improve financial performance.

3.Positive Response and Rational Reminder from the Industry

Wong Yiu Chian, President offund management companyAzureCapital,affirmed,“The local stock market liquidity has improved significantly so far this year, ranking among the top regional stock markets, and now that our country has lowered the threshold for the profitability test, it will surely further strengthen the willingness of regionally-oriented companies to list on the SGX.“

He further analyzed,“Many companies in emerging industries, including artificial intelligence and green energy companies, are still in the early stages of growth and find it difficult to make substantial profits in a short period of time. Moderately relaxing the listing requirements will help these companies obtain capital to expand their businesses.“

Taking an equally positive but cautious stance,DavidJelle, president of the Securities Investors Association of Singapore, noted that the lowered profitability thresholds are still higher than most exchanges and reminded investors that“while regulators will review a company’s financials and level of governance at the time of its listing, it is still important for investors to pay attention to the company’s announcements and performance, and to actively attend shareholders’ meetings.“

Photo credit: United Morning Post

IV. Ecological reconstruction:

Full range of impacts under policy synergies

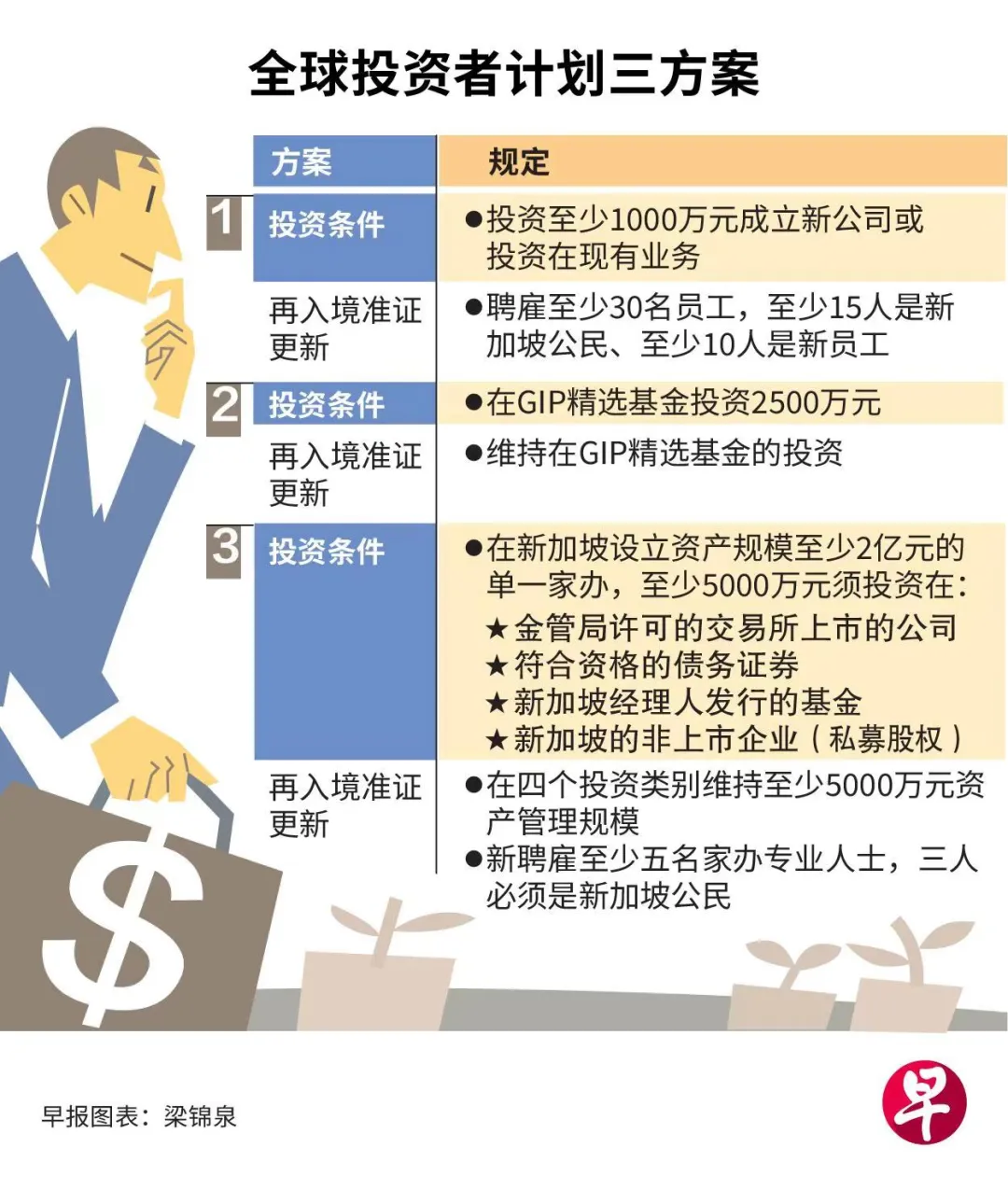

1. GIPand home office: strategic realignment of investment orientation

Singapore‘s requirementsfor the Global Investor Program (GIP) and Family Offices (SFO) are being synchronized to create a precise fit with the capital market reforms.

The most notable change is reflected in theGIPprogram–investors applying for Singapore Permanent Resident status through a family office are required toinvestat leastS$50 million in SGX-listed shares andare no longer permitted to invest in Real Estate Investment Trusts (REITs) and Business Trusts.

This adjustment is perfectly connected with the lowering of the listing threshold: more new economy companies are listed toprovide investment targetsforGIPfunds, whileGIPfunds provide liquidity support for these listed companies, building a virtuous cycle of “relaxinglisting-attractingenterprises-guiding funds-improving liquidity ” .The virtuous cycle of“ relaxing listing-attracting enterprises-guiding capital-enhancing liquidity“has been established .

The Monetary Authority of Singapore (MAS) has also stepped up its scrutiny of family offices, and has recently found that in two cases where tax concessions granted to a single family office or its funds were linked to sanctioned individuals, the granting of these concessions has been suspended, reflectingthe wisdom of the regulation of“keeping the windows open to prevent the flies from flying“.

Photo credit: United Morning Post

2.Synergies between the Headquarters Programme and the talent policy

As more companies list locally, the demand for regional headquarters and professional services is bound to grow, which will further enhance Singapore’s attractiveness as a regional headquarters hub. Under the Headquarters Scheme (IHQ), eligible companies can enjoypreferential corporate income tax ratesas low as5%to15%, much lower than the regular17%.

This program, administered by the Singapore Economic Development Board, aims to encourage multinational companies to set up their global or regional headquarters in Singapore. Companies are required to meet a number of conditions, including implementing key headquarters functions, coordinating branches in at least three countries, building a top management organizational structure and recruiting local talent.

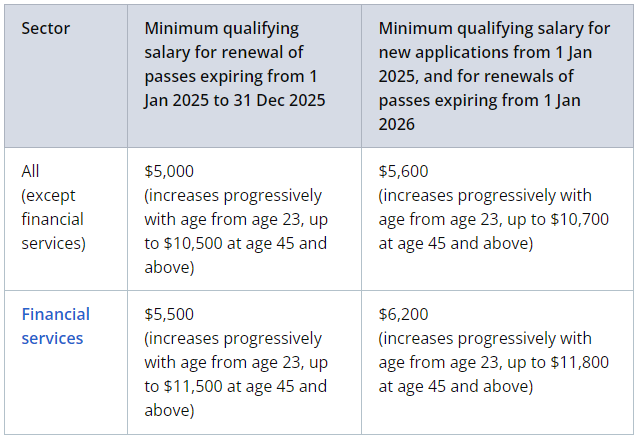

In terms of talent acquisition, the demand for directors and executives with professional qualifications and experience has risen as the governance requirements of listed companies have increased and board renewal has accelerated.

The minimum monthly salary requirement forthe Employment Pass (EP) has been raised toS$5,600, andS$6,200for the financial services sector, with acomprehensive consideration of the applicant’s academic qualifications, work experience and the employer’s contribution to the Singapore economythrough theCOMPASSassessment framework.

Photo credit: MOM

3.Hsu Wenhui’s Forerunner Warning and Ecological Construction

SGX Chairman, Mr. Koh Boon Fai, has a deep insight into the competitive landscape of the capital market:

“The first-mover advantage is critical and once mobility is created, it is difficult to transfer.“He emphasized that“Singapore can no longer rely on imitation to usher in the next stage of development. If we shy away from measured risks, we will fall behind the competition in markets that are more daring to lead.“

He singled out the huge potential of Southeast Asia’s VC market: nearly14,000startups in the regionreceive investment from VCs, and“some may list on the world’s largest exchanges, but not every company will bea unicorn with avaluation of at least$1billion, and others will require a different listing location and program.“

Koh noted that a healthy and vibrant capital market should not only serve a handful of exceptional companies, but must also support more promising companies. There is currently a gap in this area,“If capital cannot circulate smoothly, relying on M&A deals alone will not be sufficient to support the entire ecosystem.“

Photo/SGX Koh Boon Fai, Source: Lianhe Zaobao

Conclusion:

SGX Chairman Khaw Boon Hwee’s warning in his annual report rings true:“Singapore can no longer afford to rely on imitation to usher in the next stage of development. If we shy away from measured risks, we will fall behind the competition in markets that are more daring to lead.“

Director remuneration disclosure rate of67.8%,CEOremuneration of$7.82million and listing threshold reduced to$10 million!

These three sets of figures together mark the depth and determination of Singapore’s financial transformation. Singapore is no longer satisfied with being a“transit center“for capital, but rather, through sophisticated and synergistic policies, it isbuilding a self-reinforcing financial ecosystem, and carving out its own path in the increasingly fierce competition for international financial centers.

*References from: SingaporeSGX,MAS,EDB,MOM,ICA, SID, Lianhe Zaobao, Bloomberg, comprehensive news reports collated, reproduced with attribution, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations