Singapore International Headquarters Program

According to the statistics from the Singapore Economic Development Board (EDB), there are currently over 7,000 multinational corporations operating in Singapore, with 4,200 of them establishing regional headquarters in Singapore, making it the leading city for regional headquarters in Asia.

Many Asian businesses also use Singapore as an internationalization platform, with companies such as the Japanese sportswear and sports equipment manufacturers Asics and Mizuno having established their regional headquarters in Singapore.

Singapore has signed 27 Free Trade Agreements (FTAs) and approximately 100 jurisdictions have signed Double Taxation Agreements (DTAs), allowing headquarters companies conducting cross-border business in Singapore to enjoy tax advantages. One of the well-known initiatives is the Singapore International Headquarters (IHQ) program.

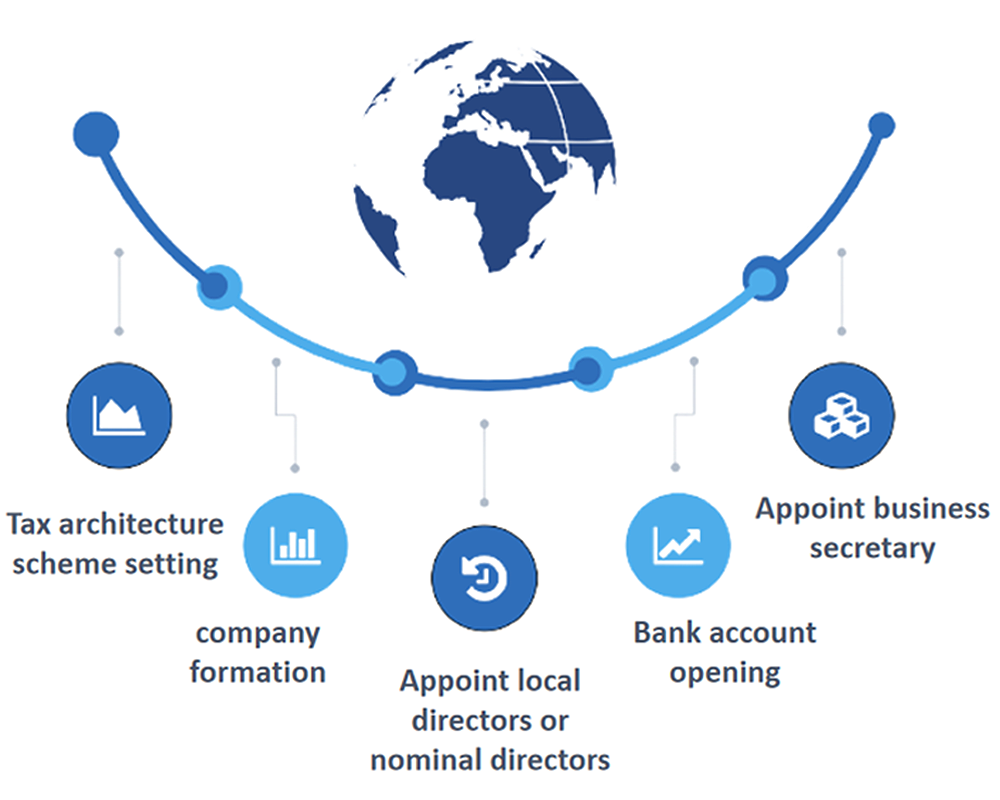

Step One: Singapore International Headquarters Structure

Step Two: Building the Singapore Team

Project Workflow

The personal bank account opening service involves assisting individual clients in opening bank accounts in Singapore. The following are the relevant steps of the process:

01

Prepare Business Plan

We provide professional business plan writing services to help you clearly articulate your company's goals, strategies, and financial plans.

02

Apply for Headquarters Program and Other Subsidies

Assist you in applying for the headquarters program and relevant government subsidies to obtain financial support and preferential policies to promote your development in Singapore.

03

Headhunting and Recruitment

Provide you with professional headhunting and recruitment services to help you find high-quality talents that meet your needs to support your company's development and expansion.

How does the IHQ work?

For the portion of functional income related to the headquarters activities that exceeds the income from non-headquarters activities, a preferential tax rate of 10% will be applied. Its income should be the income from the headquarters activities.

Headquarters activities only include the following:

- Group business activity management, coordination, and control functions

- Procurement management

- Supply chain management

- Marketing control and planning

- Human resources management

- Legal services

- Financial services

- Brand management services

Income from non-headquarters activities will be taxed at the normal corporate tax rate. According to Section 37A of the Income Tax Act, any loss (i.e., residual exempt income, losses, or donations) arising from headquarters activities will be treated as a preferential tax loss.

IHQ Terms

a) Preferential Tax Rate: 10%

b) Duration: 5 years

c) The corporate entity needs to meet the following conditions, as well as all the standard conditions in the Letter of Award (LOA):

- Conduct at least one headquarters activity in Singapore – committed to developing research and development capabilities (e.g., technology, skill sets, proprietary technology)

- Employ at least 15 technical employees additionally, and all employees should be based in Singapore within 3 years – (including skilled, professional, and qualified employees)

- Achieve at least S$5.5 million in additional annual total business spending within 3 years – generating economic derivatives

- Employ at least 25 technical employees additionally, and all employees should be based in Singapore within 5 years.

- Achieve at least S$9 million in additional annual total business spending within 5 years

Note: The terms are subject to change over time.

Government Funding Programs

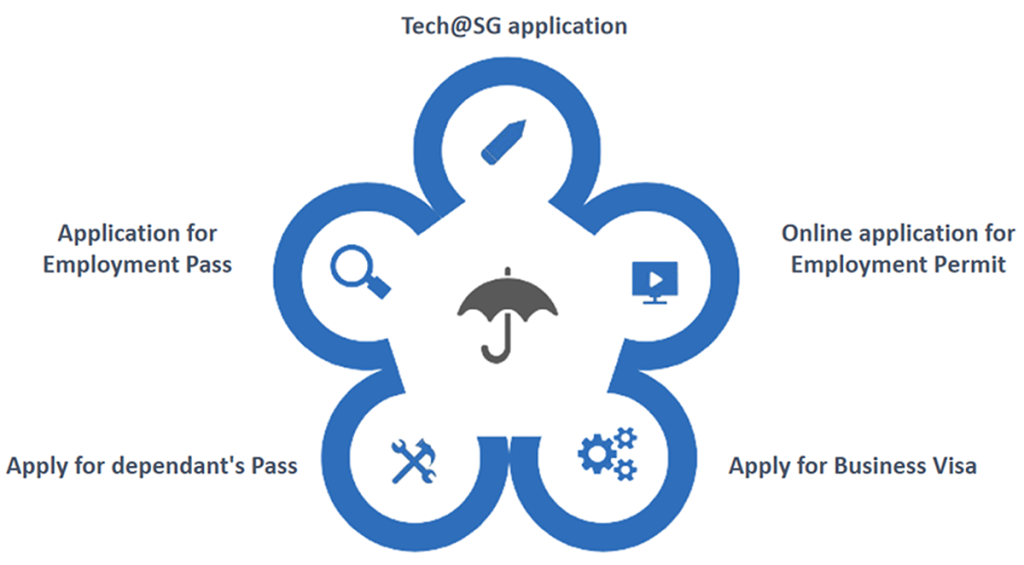

Tech@SG

The Tech@SG program aims to help fast-growing companies obtain the critical talent they need to develop and expand their businesses in Singapore and its territories.

The program is jointly managed by the Singapore Economic Development Board (EDB) and Enterprise Singapore.

If your company meets the criteria, you can expect to receive:

Up to 10 new Employment Passes (EPs) for foreign employees who will become core members of your company’s team in Singapore within two years; subsequently, the scope covered by each new EP obtained through the program’s first renewal (each renewal valid for up to three years)

Tech. Pass

Tech.Pass is a technology visa that allows renowned technology entrepreneurs, leaders, or experts from around the world to engage in cutting-edge and disruptive innovation in Singapore. The pass is managed by the Singapore Economic Development Board (EDB).

Once the tech pass is approved, the holder can start a business locally, work for or invest in a company based in Singapore, and serve as a director, etc.

The holder can also serve as a lecturer at a university, mentor or advisor for Singapore’s technology companies, conduct corporate training or seminars, etc.

IHQ Tax Incentives

Under the headquarters incentive scheme, companies enjoy a preferential tax rate of at least 5% or 10% for five years.

Headquarters functional activities only include the following:

- Group business activity management, coordination, and control functions

- Procurement management

- Supply chain management

- Marketing control and planning

- Human resources management

- Legal services

- Financial services

- Brand management services

Income from non-headquarters activities will be taxed at the normal corporate tax rate. According to Section 37A of the Income Tax Act, any loss (i.e., residual exempt income, losses, or donations) arising from headquarters activities will be treated as a preferential tax loss.

Other Incentive Schemes

To encourage companies to engage in high-value and substantive economic activities in Singapore, the EDB offers various incentive measures and programs to enhance their capabilities or expand their business operations in Singapore.

- Tech.Pass

- Singapore trademark registration

- Intellectual Property (IP) Development Incentive (IDI)

- Special Situation Fund for Startups (SSFS)

- Pioneering Certificate Award (PC) and Development and Expansion Incentive (DEI)

- Financial and Treasury Center (FTC) Incentive Measures

- Aircraft Leasing Scheme (ALS)

- Company Training Grant (TGC)

- Resource Efficiency Grant for Energy (REG(E))

- Land Intensification Allowance (LIA);

Case: Company B sets up an international headquarters in Singapore to accelerate the process of global diversified business layout

Company B is an iconic brand and leading video platform for the younger generation in China. Video combines people and the world in an intuitive, vivid and informative manner, has quickly become the main medium for communication, entertainment, and information transmission.

The trend of combining videos with various daily life scenes in Company B is called “video based”. The adoption of videolization will lead to a substantial expansion of the pan video market. According to iResearch Consulting, by 2025, China’s video users will exceed 1180.2 million, and the resulting market revenue will exceed 1.8 trillion yuan.

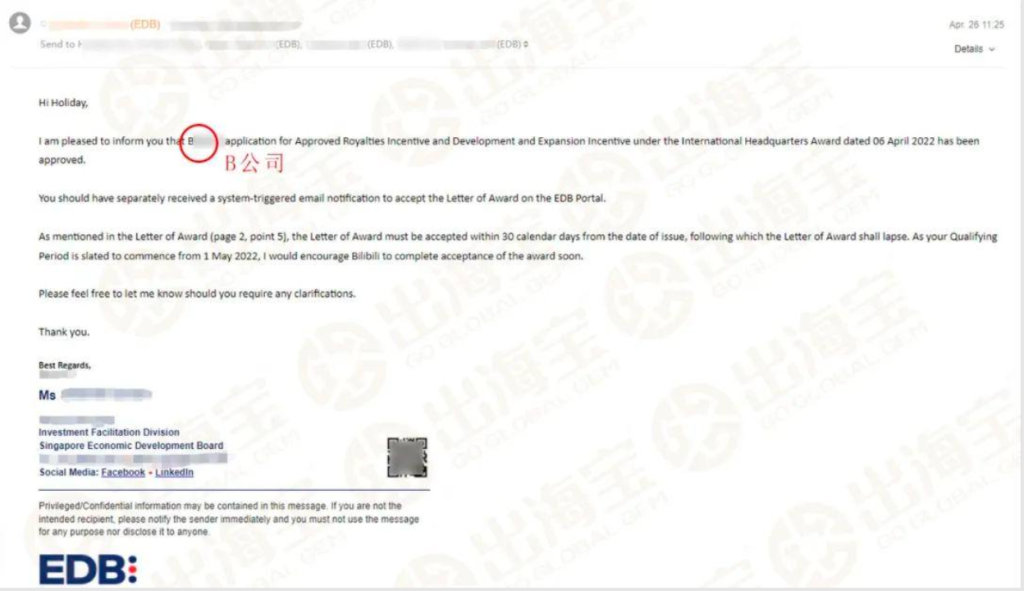

Singapore has a superior geographical location and a favorable business friendly market environment, and its economy is in line with global standards. Moreover, the preferential policies of the International Headquarters Program launched by Singapore are highly attractive for enterprises hoping to explore the international market. After comprehensive evaluation, Company B has chosen to establish an international headquarters in Singapore. With the full help of Go Global Gem, Company B has successfully obtained IHQ-DEI approval, accelerating its global diversification process!

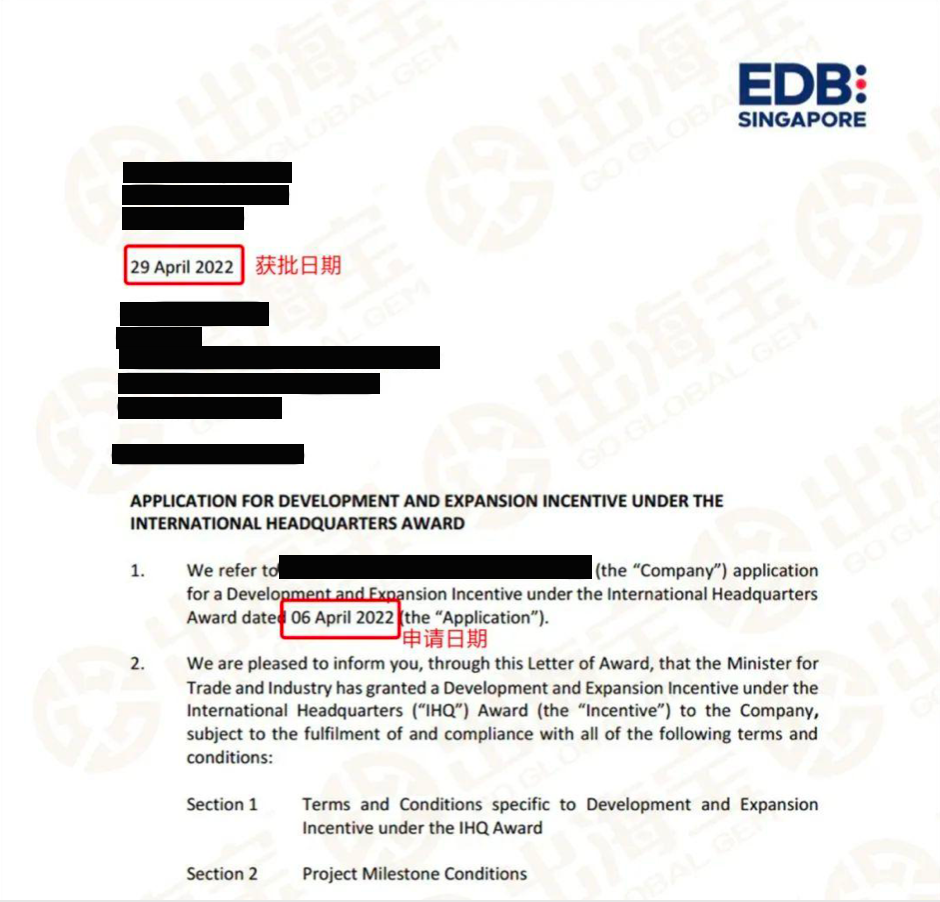

Case: Congratulations to Company C for promoting the rapid development of the company through the Singapore headquarters plan

Company C is a chip design company with a diversified business strategy of “blockchain+AI”, positioned in the digital new infrastructure computing power, and a development vision of “improving social operational efficiency and improving human lifestyles”.

Company C is one of the few companies in the world that has accumulated advanced technology in the ASIC design process, with research and development centers located in Beijing, Hangzhou, Shanghai, and Shenzhen, China. Company C has established an efficient computing department and artificial intelligence business group, with a dual wheel drive of “AI+efficient computing” to create the core computing engine for digital new infrastructure.

In the process of enterprise development, Company C will further diversify its business and explore new markets globally. After in-depth investigation and analysis, Company C has decided to explore new business in Singapore.

Go Global Gem developed a suitable plan for Company C based on its business development needs. Through our active effort of preparing materials, fully coordinating and following up, they have successfully passed the Singapore EDB audit on April 29th this year!

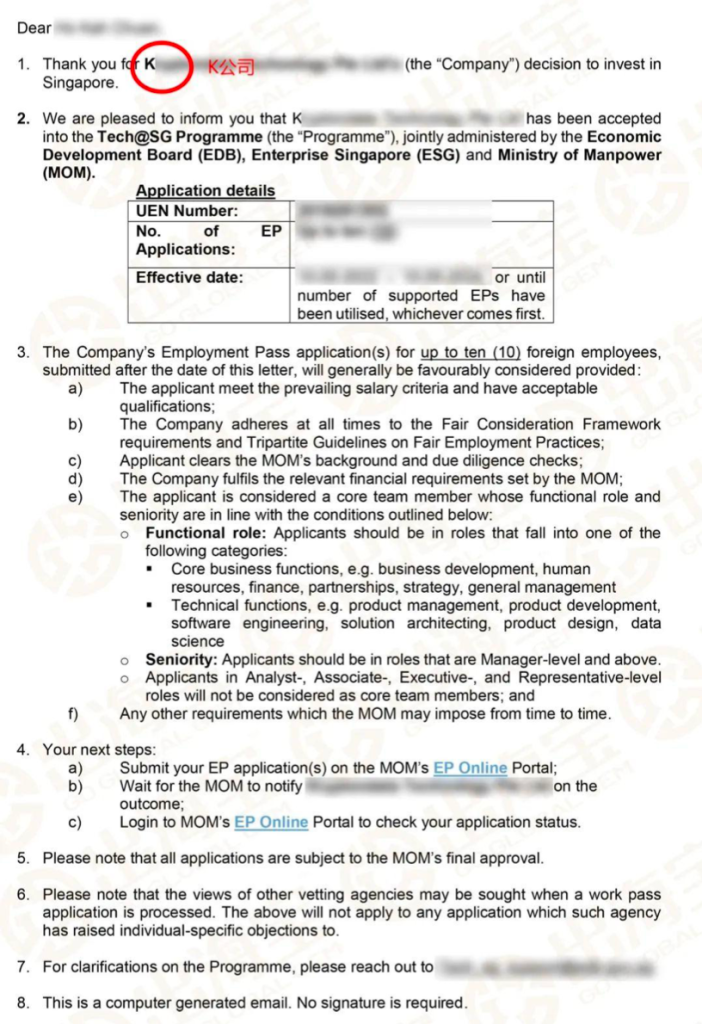

Case: K Company's Technology Sails Abroad and Successfully Expands into the Singapore Market

Tech@SG The plan is jointly managed by the Economic Development Board of Singapore (EDB) and the Enterprise Development Board of Singapore, aiming to help fast developing companies acquire the key talents they need to develop and expand their business in Singapore and the region.

Since the release of this plan, it has attracted the favor of many domestic technology entrepreneurs. Recently, with the full assistance of the Go Global Gem team, Company K has been accepted by the Singapore Economic Development Board (EBD) and successfully expanded into Singapore.