In the world financial map, Hong Kong, China is rewriting its own golden moment.

Hong Kong’s capital market is returning to the center of the world stage.2025will see Hong Kongrank first in the world in terms ofIPOcapital raised, surpassing both New York and Shanghai, and once again demonstratingits strength asthe “Financial Capital of Asia“.

This is not only the return of capital, but also the result of institutional reform and confidence recovery. From regulatory optimization, RMB internationalization to a wave of innovative companies going public, Hong Kong is redefining the“Eastern Gravity“of global capital with a steady but innovative stance.

I. From“third“to“leader“:

Hong Kong’s Return of the King

If we were to summarizeHong Kong’s financial industry in2025with one keyword, it would be,“bounce back“.

Injustninemonths, Hong Kong has taken a number of global firsts in a row:

IPOfundraisingsurpasses New York to return to global top spot;

The Global Financial Centers Index (GFCI) ranks third behind New York and London;

Asia’s No. 1 financial center, edging out Singapore;

No. 1 in the world for economic freedom, No. 1 in the world for innovation clusters, and No. 1 in Asia for world talent rankings.

On September25,the 38threport ofthe Global Financial Centers Indexwas released. Hong Kongranked third in the worldwith ascore of764, close to London (765) and New York (766), the smallest gap in history.

This means that Hong Kong isonly one step awayfromthe “New York and London“triad.

Source: Hong Kong Economic Times

What is even more encouraging is thatHong Kong has taken three world firsts in five major indicators:

①Ease of DoingBusiness (EDB);

②Infrastructure;

③Reputation& General.

This is particularly importantin thearea of“FinTech“, where Hong Kong is the world’s number one for the first time.

It should be noted thatFinTechis the engine of the global capital market,reshaping the financial ecosystemfrom payments to transaction aggregation, from tokenization toAIinvestment research.

Hong Kong’s ability to overtake in this area shows that it is not just“recovering“, but“reinventing“.

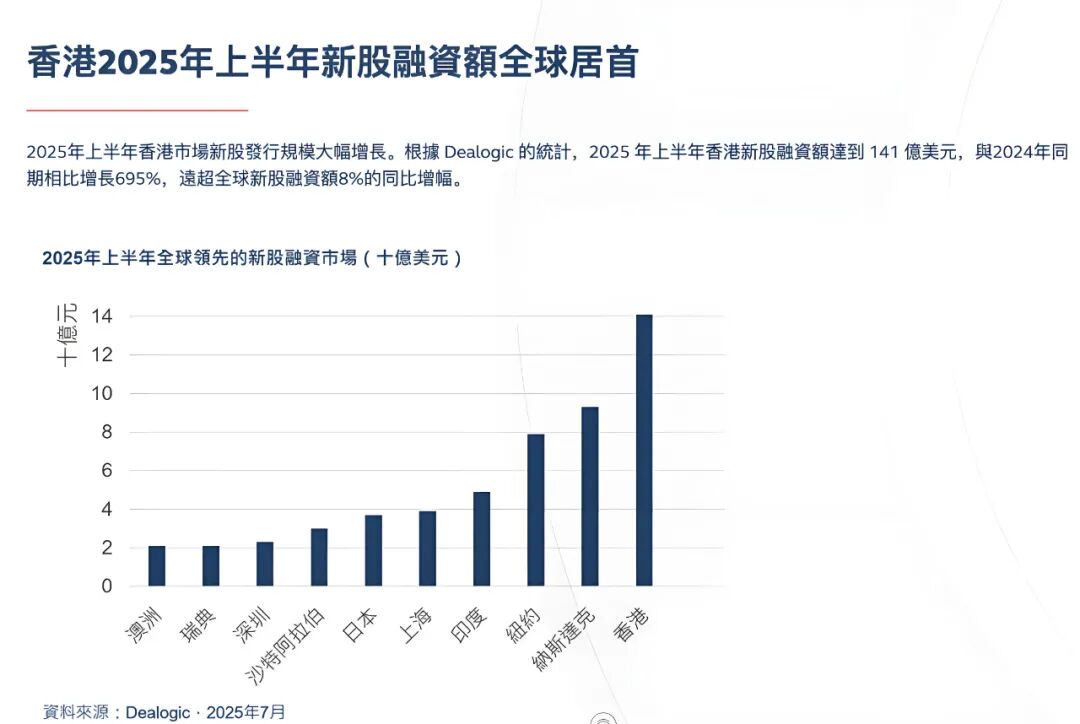

Image source:Dealogic

Second,theIPOmarket exploded:

Hong Kong Stocks Return to King as Capital Boom Returns

“Hong Kong’s money, it’s really coming back.“

Based on data from the Hong Kong Stock Exchange and the London Stock Exchange Group:

As ofQ32025, Hong Kong’sIPO capital raised amounted toHK$182.3billion, ayear-on-year surge of228%, and the number of new shares increased by47%year-on-year, far exceeding the New York Stock Exchange (HK$125.6billion), successfully reclaimingtheglobalIPOcapital raising title.

The Hang Seng Index is up over30%for the year, with average daily turnover exceedingHK$250 billion.

Financial Secretary Paul Chan Mo-powroteinhisSeptember28accompanying note to the Secretary:

“There is a clear return of international long term capital and Hong Kong is re-emerging as the market of choice for Asian corporate finance.“

There are three main drivers behind this:

1.The“wave of return” ofmainland enterprisesto Hong Kong

Ningde Times, Hengrui Pharmaceuticals, three flowers intellectual control……a number ofA-share star enterprises in Hong Kong to launchH-share offerings, set off awave of“superIPO”.

The listing of Ningde Times, better known as“lit a fire on the Hong Kong Stock Exchange“, a single fund-raising scale record in recent years.

Hong Kong raisedUS$14.1billionin new equity financing in the first half of2025, a695%jump.

Source: Ningde Times

2. Active refinancing in the secondary market

Not only are IPOs hot, but refinancing is equally robust.

As ofSeptember, overHK$189.4billion hadbeen refinanced through stock placements, additional issues and warrants, almostthree times the amount ofIPOs.

This means that confidence in the capital market is fully restored.

3.“Charity codes“and market signals

Since1999, the HKEx has launchedthe “Stock Code Charity Program“, whereby listed companies can make donations in exchange for a“lucky code“.

In the first half of2025, the HKEx’s charitable fund generated an income of up to78million Hong Kong dollars, a year-on-year increase of160%.

This is a small figure, but it isthe most vivid footnote ofthe “heat“.

Source: Dagong Wenhui

Third, why is money flowing back to Hong Kong?

Some say it is because ofthe end of the US dollar interest rate hiking cycleand the resurgence of global capital in search of growth markets;

Others say it is becauseHong Kong’s system, transparency and liquidityare still the strongest in Asia.

But if you look deeper, you will find that this is a systematic“counter-offensive“.

1, the policy dividend: fromT + 1to interconnection upgrade

The Hong Kong Government has introduced a series of financial reforms in recent years:

The settlement cycle for stock tradinghas been shortenedfromT+2toT+1;

Promotethe southbound expansion of the Bond Connect;

Building Gold and Commodity Markets;

Further promotethe internationalization of RMB and Cross-border Wealth Management3.0.

This has once again made Hong Kong thepreferred bridgefor global capital into China.

2. Regulatory innovation: fintech and tokenization

As early as2021, the HKMAlaunchedthe “FinTech2025Strategy“to comprehensively promote the digitization of banks, central bank digital currency research and data infrastructure development.

InAugust2025, the Hong Kong Monetary Authority (HKMA) officially launchedthe “EnsembleProject“to create a trading sandbox for tokenized assets and to explore the application of tokenization for bonds, funds and even physical assets.

In the next few years, Hong Kong will become theworld’s first international center to truly realize the tokenization of the entire chain of financial assets.

This means that the future HKEx will not only bea place for stock trading, but also ahub for asset digitization.

3. Geography and trust: neutral, robust and earthquake-resistant

Speaking on his re-election, HKMA Chief Executive Raymond Yu said:

“Hong Kong’s position as an international financial center has remained unchanged over the past few years and will be strengthened again in the coming years.“

Photo:HKMA Chief Executive Raymond Yu, source Hong Kong Commercial Daily

His“four major tasks“constitute the underlying logic of Hong Kong’s financial stability:

① Maintain strong foreign exchange and banking resilience;

② Strengthen market monitoring and response mechanisms;

(iii) Enhance risk prevention, especially cybersecurity;

④ The most important thing is tomaintain market confidence.

In an era of global sanctions and frequent geopolitical games, this kind of“stability“has, on the contrary, become the most unique advantage of Hong Kong.

(d) The“smart flow” offunds:

Hong Kong’s Quadruple Attraction

Hong Kong is not“bouncing back by accident“, but rather making a strategic comeback.

Whether it is wealth management, green finance, family offices or innovative corporate finance, Hong Kong is repositioning itself.

1. Wealth Management Center

At the end of last year, Hong Kong’stotal assets under management amounted toHK$35.1 trillion, an increase of13%year-on-year.

Net capital inflow amountedtoHK$705 billion, an increase of81%.

This shows that not only is money coming back, but it is staying.

The HKMA is working with the Hong Kong Government to promotethe “International Wealth Management Center“strategy, including:

Optimize family office policies;

Launched the Guangdong, Hong Kong and Macao Cross-border Wealth Management System3.0;

Attracting Middle East and ASEAN capital to set up asset centers.

Source: Hong Kong Commercial Daily

2. Green finance and transition finance

Hong Kong will not only be a“capital channel“, but also a“green channel“.

In the next few years, Hong Kong will becomeone of the major markets for“Transition Finance“inthe world.

The Hong Kong Monetary Authority (HKMA) is now negotiating with international organizations on how to enable industries with high carbon emissions to achieve green transformation through financial means.

3. The Greater Bay Area and RMB Internationalization

The Hong Kong Government has emphasized the need to expeditethe “three links and three facilitators in the Greater Bay Area“: people flow, logistics, capital flow and data flow.

In particular, the cross-border flow of data will determine whether financial services can be“integrated” inthe future.

At the same time, Hong Kong is still theworld’s largest offshore RMB center, which is an important experimental field for the internationalization of RMB.

4. Fintech andAIIntelligent Regulation

AIis both an opportunity and a risk.

Yu Weiwen once joked,“Someone used my deep pseudo-video to sell financial products, put the sound all the same!“

Behind this is actually the challenge of regulatory technology.

The HKMA plans to establish anAIrisk assessment systemanda generativeAIreview mechanismto maintain Hong Kong’s“safe and trustworthy“status.

Image source:pexels

V. Signals of capital:

New businesses come, old businesses return

InSeptember2025, a couple of news stories got the whole market buzzing again:

Guangzhou Jiffy Technologysubmitted an application for listing on the Main Board of the Hong Kong Stock Exchange;

Famous Brandannounced to split its hip toy brandTOPTOYto list in Hong Kong;

China Resources Group‘s Yeebao beverages and building materials technology, plans to“move the register back to Hong Kong“from the Cayman Islands.

The common point of these moves is thatthe attractiveness of the Hong Kong market is increasing.

Against the backdrop of tighter regulation and geopolitical complexities in the US market, more and more Chinese companies are choosing to return to the familiar Hong Kong.

There isa familiar legal system, a robust currency environment and an international investor ecosystem, and more importantly,trust.

Photo credit: Famous

VI.“Super Lunar New Zealand“?

Hong Kong’s new golden decade

From the performance of the capital market and the innovation of the regulatory system to the advantages of international trust and geographic location, Hong Kong has regained its self-confidence.

The three key words for Hong Kong’s financial sector in the next five years will be:

1、Tech-driven ( Tech-driven ):From fintech to tokenization,AIinvestment research;

2 、Regional synergy( Regional synergy) :Deeply integrating into the Greater Bay Area, connecting ASEAN and the Middle East;

3 、Green power( Green power) :Becoming the largest green financing hub in Asia.

As the Financial Secretary, Mr. Paul CHAN, has said:

“Hong Kong’s role is not that of a substitute for some single market, but a superb bridge between global capital and Chinese innovation.“

Image source:pexels

Conclusion:

From thestructural transformation of“East rising and West falling“to the signal of capital returning to the East, Hong Kong is once again at the forefront of global financial trends.

Over the past few years, it has experienced lows and has been questioned, but it has been proved thatwhen the system, capital and trust are back on the same track, Hong Kong is still the place that can make the world’s heart beat.

In the next decade, the story of the world’s wealth will still not be able to get around this city.

From the sea breeze of the Victoria Harbor to the glittering screens on the trading floors, the bells of Hong Kong are once again ringing the beat of global capital.

Note:References from Hong Kong Economic Times, Hong Kong Commercial Daily,Dealogic, Ningde Times, Mingchuang Yuping, comprehensive news reports collated, reproduced with attribution, infringement and deletion contact.