Last year, the Monetary Authority of Singapore (MAS) made a series of precision adjustments to the Family Office Tax Incentive Scheme:

It has both simplified the application process and further clarified the compliance boundaries, providing clearer guidelines for the long-term placement of global family capital in Singapore.

I. Refined evolution of the regulatory environment

Singapore’s financial regulation has always been in a dynamic balance, a feature that is particularly evident in the family office sector. As Asia’s leading wealth management center, Singaporehas made a new round of adjustments to its family office tax incentive scheme between2025and2026.

These changes not only reflect ZF Singapore’s commitment to attracting high-quality family capital, but also its prudence in guarding against abuse and maintaining the integrity of the financial system.

Recent adjustments have centered around 3 main areas:

First, effectiveJanuary 1,2026, the requirement to submit an external background check report at the time of application was repealed;

Second, the qualification standards for investment professionals have been further clarified;

Thirdly, the restrictions on fund structures to hold stakes in family-run businesses have been relaxed. Together, these adjustments constitute the latest evolution of the regulatory framework for family offices in Singapore.

Photo/Singapore’s MAS simplifies home office process, Credit: Lianhe Zaobao

II. Simplification of the application process:

Transfer of responsibility for background checks

In the past application process, the Monetary Authority of Singapore (MAS) hadlaunched a pilot program on October1,2024to require all new13O/13Utax credit applications to be accompanied by a due diligence report issued by a designated service provider. This requirement covers comprehensive background screening of funds, single family offices and their related individuals and entities.

This external reporting requirement will be eliminated with the new regulations, but it is important to note thatMASis not relaxing its review standards, but rather internalizing its review responsibilities.

Applicants will still be required to provide details of all relevant individuals and entities, andMASwill conduct its own screening. This adjustment responds directly to industry concerns about privacy protection, while also reducing the time and financial cost burden on applicants.

This change reflects a shift in regulatory logic:

There is a shift from relying on external certifications to strengthening internal review capabilities. For family offices, this means a more efficient application process, but it is also important to realize that it is more important than ever to provide accurate, complete and relevant information, as any inaccuracies can directly affect the outcome of the application.

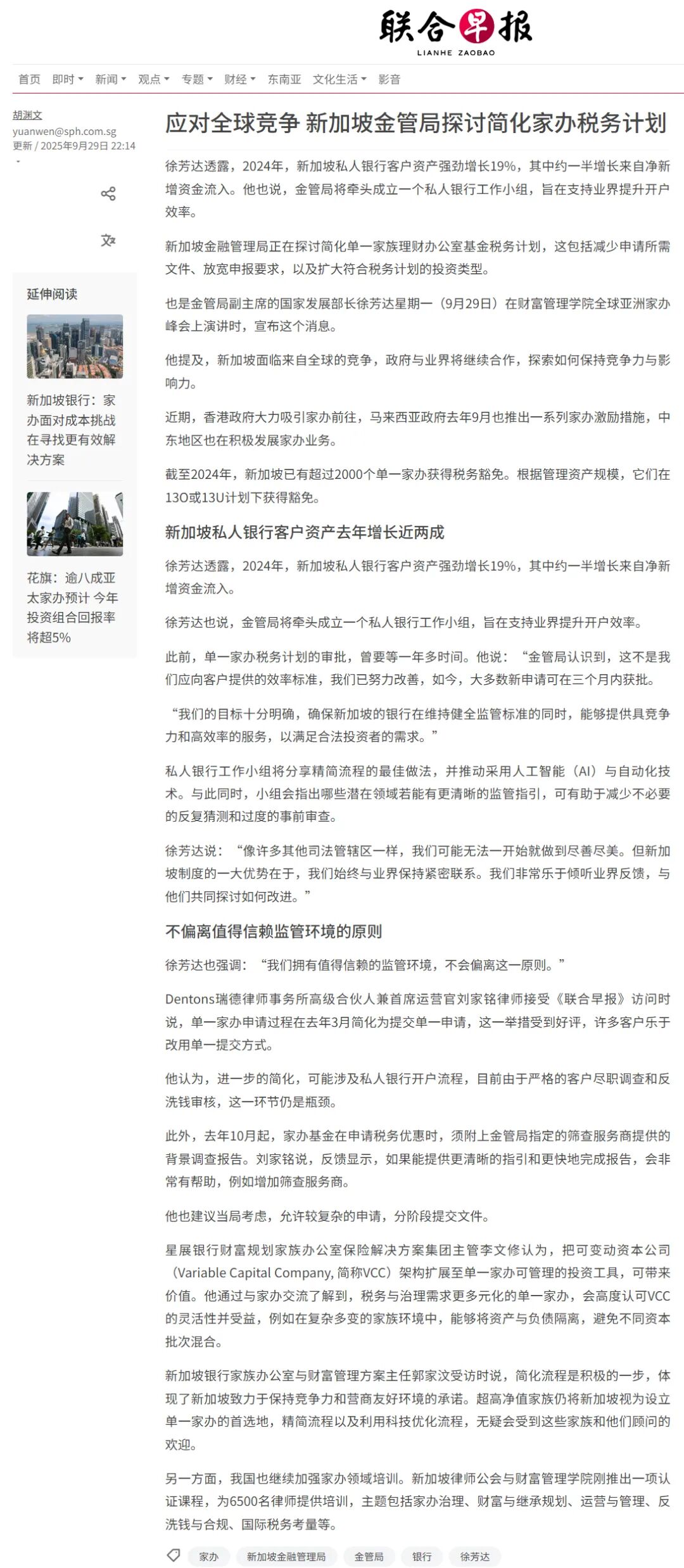

Currently, thereare sixMAS-designated screening service providers (SSPs):

①Avvanz;

②BDO Advisory;

③DC Frontiers;

④ Ernst& Young Advisory;

⑤ KPMGServices;

(vi) PricewaterhouseCoopers (Pwc).

Note that new applications for home office tax incentives must also providethe background check reports provided by thesixcompanieslisted above.

Figure/List of Service Providers, Source: MAS Singapore

III. Redefinition of asset management scale

Stratification with local expenditure requirements

There has been a significant change in policy direction withrespect to measuring the size of assets under management.Whereas in the past the requirement was to focus on total asset size, as ofJanuary 1,2025,MASis focusing precisely onthe “designated investments“component.

This adjustment allows family offices to plan their compliant asset allocations with greater clarity, avoiding asset class confusion that could affect compliance status.

The adjustments to the local business expenditure requirements similarly reflect a refined regulatory mindset. Previously, the local expenditure requirements were relatively uniform atnot less thanS$200,000per annum for13OschemesandS$500,000per annum for13Uschemes. The new rules adopt a tiered model, setting different standards based on asset size.

Specifically,funds withassets belowS$250 million are required to spend no less thanS$200,000a year on local expenses;for fundswith assets betweenS$250 million andS$2 billion, the standard is raised toS$300,000; andfunds withassets aboveS$2 billion are required to meet a minimum ofS$500,000a year onlocal expenses.

This tiered design reflects the mature development of Singapore’s regulatory policy: it ensures that larger family offices make a commensurate contribution to the local economy, while providing smaller offices with a reasonable amount of room to operate.

Schematic diagram, source: United Daily News

IV. Investment Professionals Qualification Standards for

Clarification and Flexibility

The MASprovides a clearer and more flexible framework of guidance onthe qualification requirements for investment professionals.Under the new rules, family offices are required to employ at leasttwoinvestment professionals, at leastoneof whommust be a non-family member.

Eligible professionals are required to meet any of the following criteria:

Relevant investment experience, including personal investment experience; or previous positions in investment management, research and analysis, trading, and mergers and acquisitions. As far as academic qualifications are concerned,MAStakes a more flexible approach, accepting degrees in accounting, finance, economics, business administration, and other majors, as well asrelevant professional certifications such asCMFASandCFA.

This flexibility reflects the pragmatic approach to regulation in Singapore:

This ensures that the family office has the capacity to operate professionally, but avoids overly rigid requirements that would discourage the participation of genuinely competent professionals. For family offices, this means more options when it comes to assembling a team, but care needs to be taken to keep the relevant credentials on file in case of a review.

Schematic diagram,source: United Daily News

V. Relaxation of shareholding restrictions in family-run businesses

For many family businesses, one of the most practical adjustments in the latest policy isthe relaxation of restrictions on shareholdings in family-run businesses. Under the new rules, family office funds can now hold stakes in family-run businesses and there are no longer restrictions on shareholdings.

This policy adjustment needs to be understood in the context of two important conditions:

First, equity interests in family-run businesses can still not be used to meet the minimum AUM requirement; second, as long as they meetthe definition of“designated investments“, they can be included in the AUM for purposes of calculating other requirements such as annual local business expenses.

There is a clear policy logic behind this change:

MASwants to encourage family offices to invest in more productive areas of the economy, rather than being satisfied with merely meeting the asset management size threshold. This adjustment opens up new possibilities for asset structure optimization for families looking to integrate family business and wealth management functions.

Comparison of Multiple Home Offices, Credit: Union-Tribune, Dakota

VI. Systematic upgrading of the application and compliance process

Along with the policy content adjustments, Singapore has also systematically upgraded its application and compliance processes.

One of the most notable changes was the launch of the new Family Office Tax Program Portal, which consolidatesa number of functions such astax incentive program applications, annual review filings andcommunicationwithMAS.

In terms of the application process, the new system has greatly improved efficiency by consolidating the previous multi-step submission into a one-time completion. Meanwhile, the newly effective Corporate Service Providers Act has strengthened the regulation of service providers in the industry, and all corporate service providers are required to complete mandatory registration and fulfill the corresponding compliance obligations.

Together, these systemic changes constitute a more transparent and efficient regulatory environment. For family offices, this means a clearer path to compliance, but also a need to adapt to the new requirements of digitized filing to ensure that all filings are completed in a timely and accurate manner.

Schematic diagram,source: United Daily News

VII. Regulatory logic and long-term trends

The evolution of Singapore’s family office policy reflects the dual objectives of its regulatory thinking:

On the one hand, it attracts genuine long-term capital, and on the other hand, it strengthens governance and compliance requirements. Thisdual-track approach of“simplifying processes“and“clarifying boundaries“reflects the regulatory wisdom of Singapore as a mature financial center.

The elimination of the external background check report requirement reflects a concern for applicant privacy and cost burden; while the clarification of the qualifications of investment professionals and the regulation of family business holdings ensures the professionalism and transparency of the family office.

Together, these adjustments point to a single goal:

Ensure that this growth is sustainable and of high quality while maintaining Singapore as a preferred destination for family offices.

For HNW families considering setting up a family office in Singapore, these changes mean a clearer policy environment and a more efficient application process, but also a need to pay more attention to compliance building and professional team building.

Schematic diagram,source: United Daily News

[Conclusion]

The continued optimization of Singapore’s family office tax incentives is a sign of its maturing development as a global wealth management hub.Through precise policy adjustments, Singapore has maintained its attractiveness to external capital while strengthening the maintenance of the integrity of its financial system.

For family offices, these changes are both opportunities and challenges. A more efficient application process and clearer regulatory requirements provide a favorable environment for legitimate and compliant family wealth management; while the ever-escalating compliance standards and professional requirements have prompted family offices to continuously improve their professional capabilities and governance.

Against the backdrop of a changing global wealth management landscape, Singapore provides a stable, transparent and professional development platform for family offices through its continuously optimized regulatory framework. With the announcement and implementation of more rules and regulations, Singapore is expected to further consolidate its leading position in the global family office space.

*Reference sources:MASSingapore,RAS, Lianhe Zaobao,Corporate Service Providers Act,Dakota,comprehensive news reports collated, reprinted with attribution, infringement and deletion of contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations