Recently, when the GY of this Ministry of Justice announced the details of the new policy in a press conference, the price of new condominiums in the center of Tokyo rose by7.1%year-on-year, which has beenhigher forsixconsecutivemonths.

At a real estate agent’s office in Tokyo, Japan, Mr. Lim, a Singaporean investment consultant, was analyzingthe return on investment fora45million yen condominium inOsaka for a client, while reminding,“The upcoming new regulations by Japan’s ZF mean that your home purchase information will go directly into the ZF database.“

The news thatthe yen’s exchange rate had fallen toa 34-year low cut through the calm of the Asian investment market like a bolt of lightning. Japanese real estate consultants excitedly pointed to the exchange rate chart on the screen:“Now enter the equivalent of a 70% discount!“The words just fell, the Singapore side of the consultant immediately retorted:“Do not forget that Japan next year, all home buyers must register their nationality, and our additional buyer’s stamp duty has already made a lot of foreign investors hesitate.“

I. Policy Watershed:

The Double Test of Information Transparency and Capital Threshold

Two new regulations announced by Japan’s ZFinDecember2025are reshaping the home-buying experience for foreign investors.

Startingin fiscal year2026, all homebuyers will be required to submit proof of nationality, such as passports, when registering for property rights, and this information will be stored in an internal database managed by the ZF, which Ministry of Justice officials made clear“will not be disclosed to the public“.

In parallel, the Ministry of Finance will expand the scope of reporting,previously only investment purposes to declare the purchase of real estate, the new rules requireeven self-occupation is required tocomplete the declaration within20daysafter the purchase of real estate.

The data behind this change is alarming:

A survey by Japan’s Ministry of Land, Infrastructure, Transport and Tourism showed that7.5%of new apartments built in Tokyo’s six central districts in the first half of2025have been sold to individual buyers from overseas, an increase of4.3percentage pointsyear-on-year.Prices of new condominiums in Tokyorose7.1 percentyear-on-yearin October, the sixth consecutive month of higher prices.

Singapore, on the other side of the Pacific, has taken a very different regulatory path.2025saw Singaporeraisethe additional buyer’s stamp duty (ABSD)on residential purchases by expatriatestoa staggering60%from30%, and the tax rate on property purchases by corporations and trusts to65%.

This means that a foreign buyer ofa S$5 million propertyin Singaporewould have to payS$3 millionin additional taxes alone, which isenough to buy three mid-priced apartments in central Tokyo.

Two regulatory philosophies diverge here: Japan tries to prevent speculation through information transparency, while Singapore uses economic levers to directly regulate demand.

Schematic diagram, source internet

Second, price polarization:

The reality of the world’s most expensive and exchange rate depressions

TheJulius Baer2025ranking oftheworld’s ten most expensive cities for high-end livingreveals a reality:Singapore tops the list, ahead of London, Hong Kong and New York. The median price of a private home in the city has reachedUS$1.2million, which istwo to threetimesthe price of a comparable property in Tokyo.

The high-end cost of living in Singapore goes hand in hand with its property prices. A newly built condominium in a core area (such as the 9th, 10th and 11th postal districts) can costS$3,000-4,000per square foot, while a similar property in Tokyo’s Minato Ward costs about3million yenper square meter(aboutS$2,800per square foot), a significant price difference.

The price differential is further magnified by the exchange rate factor.2025, the yen has fallen to a decade low against the Singapore dollar, and Singaporean investors are effectively getting a30%“exchange rate discount” forentering the Japanese market.This double price advantage makes Japanese real estatesignificantly moreattractive in2025.

The contrast in rental returns is even more stark. Major cities in Japan are able to offernet rental returns of4-6%compared to2-3%in Singapore.A100million yen (S$880,000) apartment in Tokyo, for example, can rent for350,000-400,000 yenper month, with a net return of about5%, while a Singapore property of the same value rents for aboutS$3,500per month, with a net return of less than3%.

Source: Lianhe Zaobao, Julius Baer

Third, capital choices:

Institutional and Individual Investors Diverge in Direction

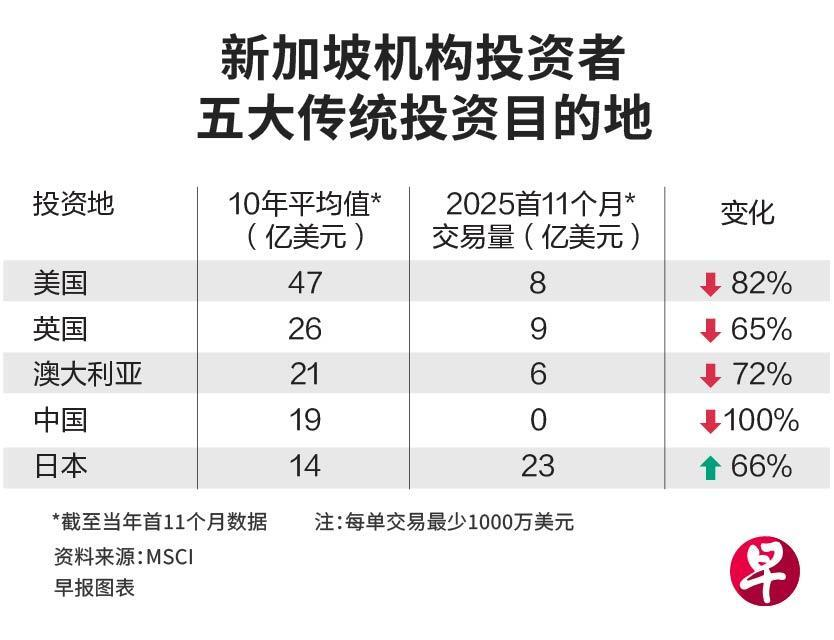

MSCIdata shows thatin the first11 monthsof2025,Japan became the only traditional investment destination for Singaporean institutional investors to grow, with investments amounting toUS$2.3billion, up66%from the average over the past decade. This increase contrasts with across-the-board declines in the US, UK, Australian and Chinese markets.

Source: Lianhe Zaobao

The keen sense of institutional investors has captured the market turning point. They noted that the Bank of Japan may end its negative interest rate policy, the yen exchange rate is expected to recover, and the current low price level provides a rare window of entry.

The behavior of individual investors is equally revealing. Vivian Liu, sales executive in the marketing department of Knight Frank’s international residential project, observed:

“Attracted by the weaker yen and attractive rental yields, Singaporean investors’ interest in the Japanese real estate market continues to soar.“She points out that Singaporean investors tend to acquire housesabove40million yen (aboutS$330,000)in Japan, and opt forpropertiesabove £500,000 (aboutS$860,000)in London.

Two investment logics collide here: some investors choose to pay Singapore’s high premium in exchange for ZZ’s stable, rule-of-law environment; others embrace Japan’s exchange rate advantage and higher return potential, and accept the added disclosure requirements.

Schematic diagram, source:unsplash

Third, the tax panorama:

From offshore income to the reality of global transparency

The realitythat all types of incomegenerated from offshore property investmentneed to be included in China’s individual income tax returnsis becoming inescapable. Under Chinese tax law, offshore income is categorized into 3 main types:

Investment income(including dividends, interest, rental income and capital gains) is subject to a20%proportional tax rate. This means that a Chinese tax resident who earns rental income from a property in Japan or Singapore is required to declare and pay20%individual income taxin China, but can deduct the tax already paid in the source country.

Income from services(e.g., consulting and technical services provided overseas) will be included in the“comprehensive income“and subject to asuper progressive tax rate of3%-45%. This is particularly important for investors who have both overseas business income and real estate income.

If the property is held through an offshore company, the company’s profits will be subject to local corporate income tax first, and then20%personal income taxwhen dividends are distributed to individuals. In this case, you can apply for an offshore tax credit to avoid double taxation.

*Click on the large image to see the details

As of2025,157countries and territories have joined theCRS(Common Reporting Standard) network, including China, Singapore, Japan and major offshore financial centers. Through this mechanism, Chinese tax authorities can automatically access information on residents’ overseas financial accounts, including balances, dividends and interest.

In 2025, tax authorities in several parts of China focused on notifying a number of cases of undeclared offshore income, with the highest amount of back taxes paid by a single person amounting to1.143million yuan. These cases release a clear signal: in the era of global tax transparency, ithas become a reality thatoverseas assetscannot be hidden.

Source: OECD

Risk Dimension:

Multiple challenges beyond market volatility

The main risks to the Japanese market center onexchange rate volatility and policy implementation details.The yen exchange rateis at a34-year low in2025, and a future rebound could erode returns on foreign currency-denominated investments. Meanwhile, while Japan’s ZZ promises that nationality information“will not be disclosed to the public“, investors remain skeptical about information security management.

Policy risk is more intuitive in Singapore, where ZF may further adjust stamp duty policy to control house prices, increasing the cost of ownership, anda significant adjustment in stamp duty in 2025has already demonstrated the unpredictability of the policy environment, an uncertainty that in itself constitutes a risk premium.

Holding costs vary significantly. In Japan, fixed asset tax and urban planning tax on properties together amount to about1.4%of the assessed value of the property, and older buildings are also subject to higher maintenance fees and repair funds. In Singapore, property tax is calculated on the basis of the annual value of the property and can be as high as10%for non-owner-occupied dwellings, so the long-term cost of ownership should not be underestimated.

Comparison of the legal environment also needs to be considered. Singapore’s legal system is based on English common law, which provides better protection for foreign investors, while Japan’s legal system is more unique, with language and cultural barriers that can complicate transactions. However, both countries have a good track record of protecting property rights, with the core differences being in the details of implementation and predictability.

Schematic diagram, internet source

VI. Crowd Fit:

Smart Choices for Different Portraits

The Japanese market is more attractivetoinvestors whoare looking for cash flow and can afford some management complexity.In particular,investors whocan take advantage of Japan’s low interest rate environment (mortgage rates around1-2%) to leverage up and realize higher cash returns.

This group includes families with children planning to study in Japan who need housing, investors who are bullish on the recovery of tourism in specific regions, and middle net worth individuals seeking to diversify their assets.

Forinvestorswho are focused on capital preservation and prefer to“buy and leave“, Singapore core properties may be more suitable. Despite the high barriers to entry, Singapore’s stable ZZ, sound laws and well-protected property rights make it suitable for ultra-high net worth families looking for a secure asset allocation. Families planning to educate their children in Singapore or interested in acquiring permanent residency may also be willing to pay a high premium.

Forinvestorswith income from offshore services or business operations, the tax interaction between property investment and other offshore income needs to be considered in a holistic manner. In this case, Singapore’s simple tax regime (no capital gains tax) may be more advantageous, especially for investors with diversified sources of income.

Long-term residential planning is also a key consideration. If an investor plans to move to the country where the property is located in the future, Singapore’s permanent residency application policy is separate from property ownership, while Japan’s various long-term visas (such as business management visas) are relatively friendly to property investors and can be used as part of the immigration path.

Image source: United Morning Post

VII Future Horizons:

Asset Allocation Logic in the Age of Transparency

In2026, the two markets will face different turning points. The full implementation of Japan’s new Z may cause some foreign investors to take a wait-and-see attitude in the short term, but in the long term it will help establish a more transparent and sustainable market environment. As the yen exchange rate gradually returns to normal, the exchange rate advantage may diminish and investors will focus more on Japan’s domestic economic fundamentals and rental return stability.

The Singapore market, on the other hand, may face a price restructuring. The high tax environment and weakening foreign investment demand may put downward pressure on some high-end residential prices.

For 2025, DBS hasloweredits private residential price growth forecast for Singapore from1-2%to0-1%, reflecting the shift in market expectations.

Global tax transparency will not be reversed, asthe CRSnetwork continues to expand and new asset classes, such as digital currencies, are brought under the regulatory umbrella. Investors will need to shift from“how to hide assets“to“how to allocate assets in a compliant manner“, with tax planning becoming a necessary rather than an optional add-on to overseas investments.

Regional economic integration could be a game changer. The development of the ASEAN Economic Community (AEC) andthe implementation ofthe Regional Comprehensive Economic Partnership (RCEP) are likely to boost capital flows within Southeast Asia, bringing in a new group of investors to the Singapore and Japanese property markets, especially from other Southeast Asian countries.

Schematic diagram, source: Lianhe Zaobao

[Conclusion

Inside an upscale cafe in Tokyo’s Ginza, three investors from Shanghai, Singapore and Hong Kong are comparing notes. They have just attended the same real estate investment seminar, but have come to different conclusions.

The Shanghai investor chose a55million yen apartment in Osaka for its near6 percentrental return; the Singaporean investor paid a high stamp duty to buy a small apartment in Singapore, which he plans to use for his children’s future education; and the Hong Kong investor decided to wait and see how the market reacts to Japan’s new regulations.

“Japan offers immediate affordability and Singapore offers long-term peace of mind.“The seminar facilitator concluded,“And in the context of global tax transparency, compliance filing is a necessary bridge to cross no matter which path one chooses. True investment wisdom lies not in finding the perfect market, but in finding the option that best matches your situation.“

As global asset transparency accelerates, the threshold for overseas property investment is shifting from a capital threshold to an information threshold and a compliance threshold. In this new era, successful investors are not those who look for loopholes, but those who can understand the logic of different markets and flexibly allocate their assets under different rules.

The property markets in Japan and Singapore are just like two mirrors reflecting the two philosophies of asset allocation in the era of globalization, withone side being value discovery and the other being safety and security.

Note: The content of this article is for general reference only and does not constitute professional legal or financial advice. Please consult a qualified cross-border tax practitioner or attorney before proceeding.*Referencesources:OECD,MSCI,HDBSingapore,URA, Lianhe Zaobao,NHKJapan, Julius Baer, comprehensive news reports, reprinted must indicate the source, infringement and deletion of contact.

…

👇Plus V to enter Singapore’s largest offshore community👇

Past Recommendations