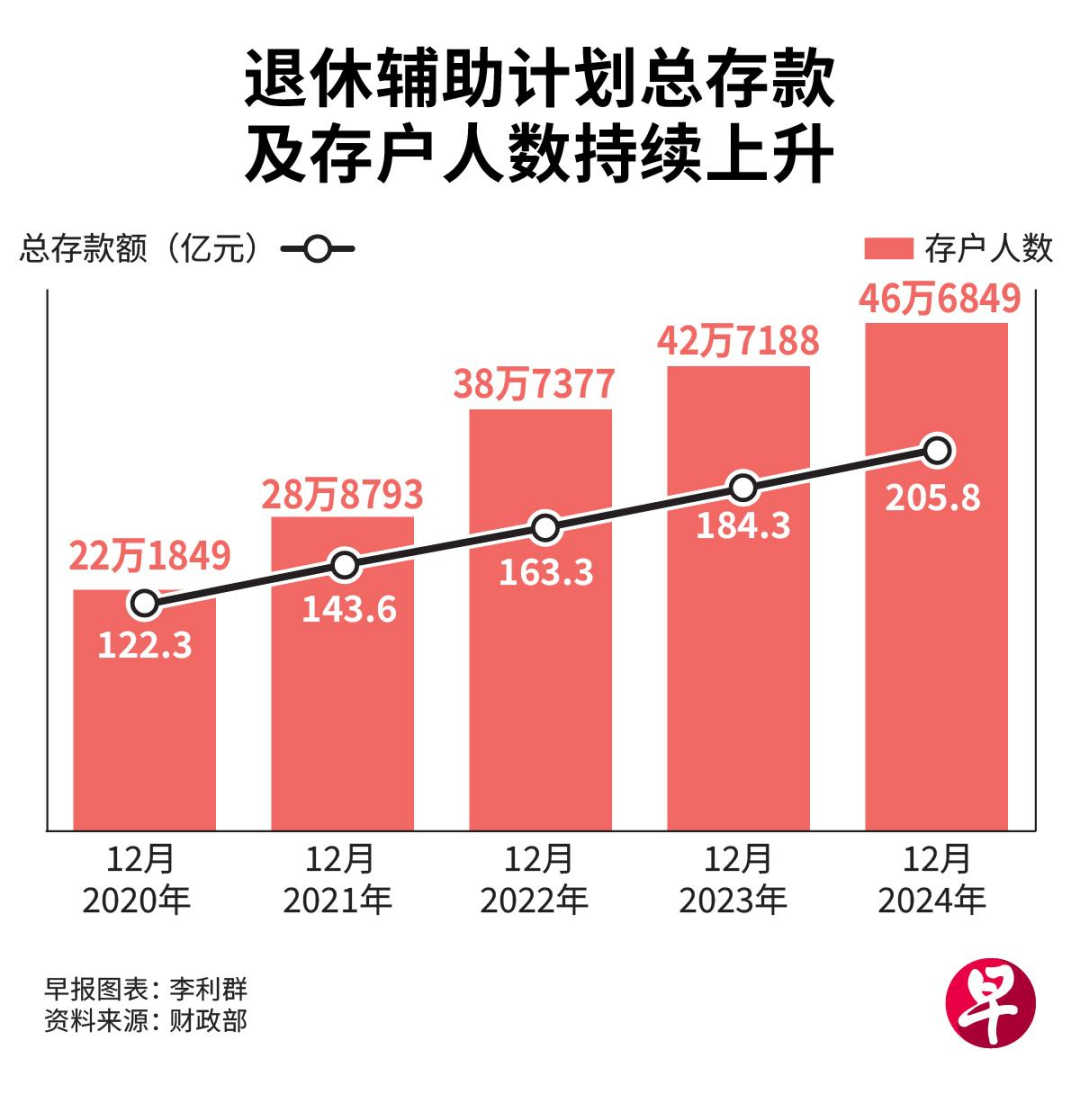

In Singapore, where the cost of living continues to rise, a seemingly simple financial decision to open anSRSaccount is enabling460,000 savvy individualstoenjoy immediate tax relief while quietly building a solid retirement protection, turning today’s tax planning into tomorrow’s wealth freedom.

I. What is theSRSprogram?

In Singapore,the Retirement Assistance Scheme (SRS), avoluntary retirement savings scheme introducedby the government in2001, complements the Mandatory Provident Fund (CPF) system to help people save more for their retirement.

Photo credit: United Morning Post

The most immediate appeal of anSRSaccount is itstax deduction benefits.As long asyou deposit money intoyour SRSaccountbeforeDecember31every year, you can enjoy a tax credit when you file your tax return the following year. The maximum amount that can be deposited annuallyisS$15,300for Singapore citizens and permanent residents, andS$35,700for foreigners.

It is worth noting thatthe interest rates on cash deposits withinSRSaccounts are very low, for example,the call rate onSRSaccounts atDBS Bankis well below the rate of inflation. Therefore,the keytorealizing value appreciation onSRSfunds is to invest Zi.

Photo credit: MOF, United Morning Post

Second,how much canSRSsave you?

Singapore adopts a progressive tax system where the higher the income, the higher the tax rate.Lowering your“taxable income“throughSRScontributionscan effectively reduce the amount of tax payable, andthe higher the income, the more significant the tax savings.

The table below visualizesthe tax savings that can be achieved bytop-shelf deposits ofSRSpayments (S$15,300)at different levels of taxable income:

* For illustrative purposes only

As you can see from the table,whenthe annual taxable income isS$80,000, you can save aboutS$1,071in taxes; and when the income is more thanS$1 million, you can save up toS$3,672in taxes.

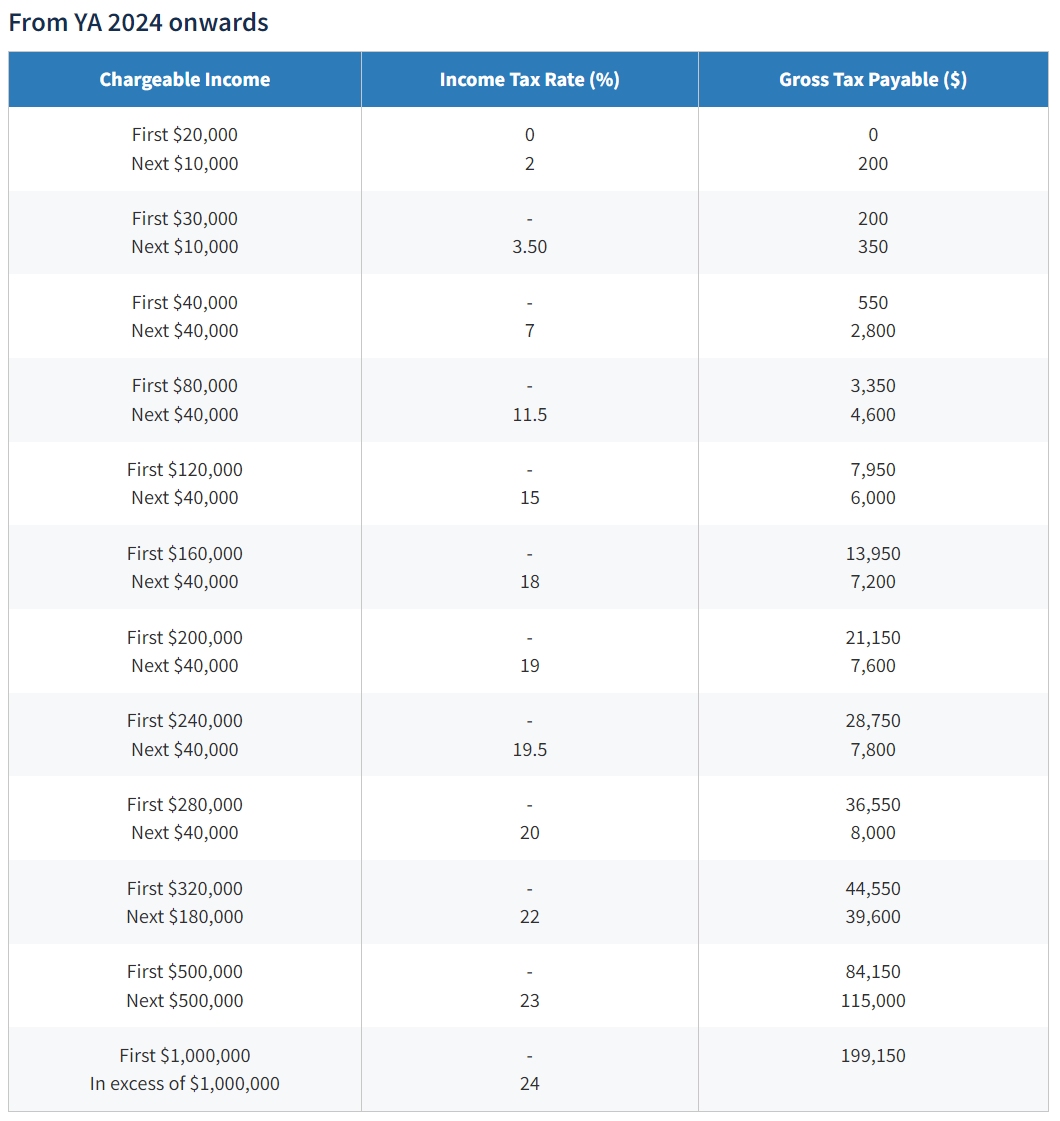

Singapore Personal Income Tax Form:

In Singapore, personal income tax for tax residents is calculated on a progressive basis on the previous year’s income less the corresponding exemptions, and the income tax rate for non-resident individuals(with the exception of employment income and certain incomes taxed at a reduced withholding rate) has been increased to 24%with effect from the assessment year 2024.

Figure/From YA 2024 onwards, source: IRAS

III. How to openanSRSaccount?

Eligibility toopenanSRSaccount is relaxed: anyone over18years of age who is not bankrupt and is of sound mind can apply.

Currently, three banks in Singapore are authorized to manageSRSaccounts:

DBS Bank (DBS/POSB), OCBC Bank (OCBC),UOBBank (UOB) and others.

The process ofopening anSRSaccount is usually:

Choice of bank: It is recommended to prioritize the bank where you already have a bank account for future management and transfers.

Preparation of documents: Usually only your ID card (for Singapore citizens/PR) or passport (for foreigners)is required.

Submit an application: You can visit a bank branch or submit an account opening application through the bank’s online platform.

Schematic diagram, source: United Daily News

III.Investment Zi options forSRSfunding

Funds in anSRSaccount can be used to invest in Zi a variety of financial products for long-term appreciation. Below are some common options:

* For illustrative purposes only

When choosing an investment Zi product, you need to consider yourrisk tolerance, investment Zi period and knowledge level.

If you’re new to investing in Zi, consider starting with Singapore Savings Bonds or Regular Shareholding Scheme (RSS), which allows you toinvest in a range of stocks,ETFsorREITsfor a minimum amountof S$100per month.

IV.SRSextraction rules and tax optimization

SRSfunds are set aside for retirement, so withdrawal rules are closely tied to tax benefits and require careful planning.

1. Withdrawal after reaching retirement age

The current statutory retirement age is63.Withdrawals made after this time, only50%of the amount withdrawnwill be counted as taxable income for the year. If you have no other income after retirement, you can avoid paying tax altogether by controlling the amount you withdraw each year.

For example, in2025, the personal income tax threshold isS$20,000, which means you can withdrawS$40,000a year(50%of whichi.e.S$20,000 is within the tax allowance) without paying tax.

2. Penalty for early withdrawal

If you withdraw yourSRSsavingsbefore the statutory retirement age,the full amount of the withdrawalwill be included in your taxable income for the year and you will also be subject toa penalty of5% ofthe amount withdrawn. Unless it is for a special reason such as serious illness.

3. Withdrawal Period

Once you start withdrawingyourSRSdeposits, they must bewithdrawn in installmentsover a periodof 10years.

Schematic diagram, source: United Daily News

V. Important notes

1. Avoid idle funds

The interest rate on cash in anSRSaccount is extremely low (e.g.0.05%), and leaving funds unused is tantamount to a missed opportunity to increase in value, and may depreciate in value due to inflation. Be sure to choose the right investment Zi product for your situation.

2. Pay attention to the total investment Zi cost

When investing ZiwithSRSfunds, it is also important to be aware of costs such as trading commissions and management fees, which can affect your net returns.

3. Planning ahead for the extraction strategy

Giventhe 10-year withdrawal period, it is recommended that you start planning as you approach retirement on how todistribute yourSRSaccount balanceappropriatelyovera 10-yearperiod to maximize the tax benefits.

4. Assessing individual mobility needs

Because there are penalties for early withdrawals, before deciding to deposit into anSRS, make sure it is unlikely that the funds will need to be accessed before retirement.

Conclusion:

Smart wealth planning starts with a simple choice. Opening anSRSaccount is not only an immediate reward for saving thousands of dollars in taxes every year, it is also a way to sow the seeds of wealth for your future retirement. By actively investing in Zi, this long-term persistence will add up to solid financial security.

Act now and utilizetheSRSas a powerful tool to turn today’s tax benefits into a solid foundation for tomorrow’s comfortable retirement, and start your journey to a smart retirement with ease.

We hope this explanation ofSRSplanning will help you better utilize this powerful retirement and tax planning tool. If you have further questions about specific Investment Zi products or more detailed tax savings calculations, please consult one of our professional financial advisors.

Note:理Cai有风险,投Zi要谨慎,专业的事情,请交给专业的人去做。

*Reference sources: Singapore MOF,IRAS,CPF, the United Morning Post and other media, the synthesis of news reports collated, reproduced must indicate the source, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇