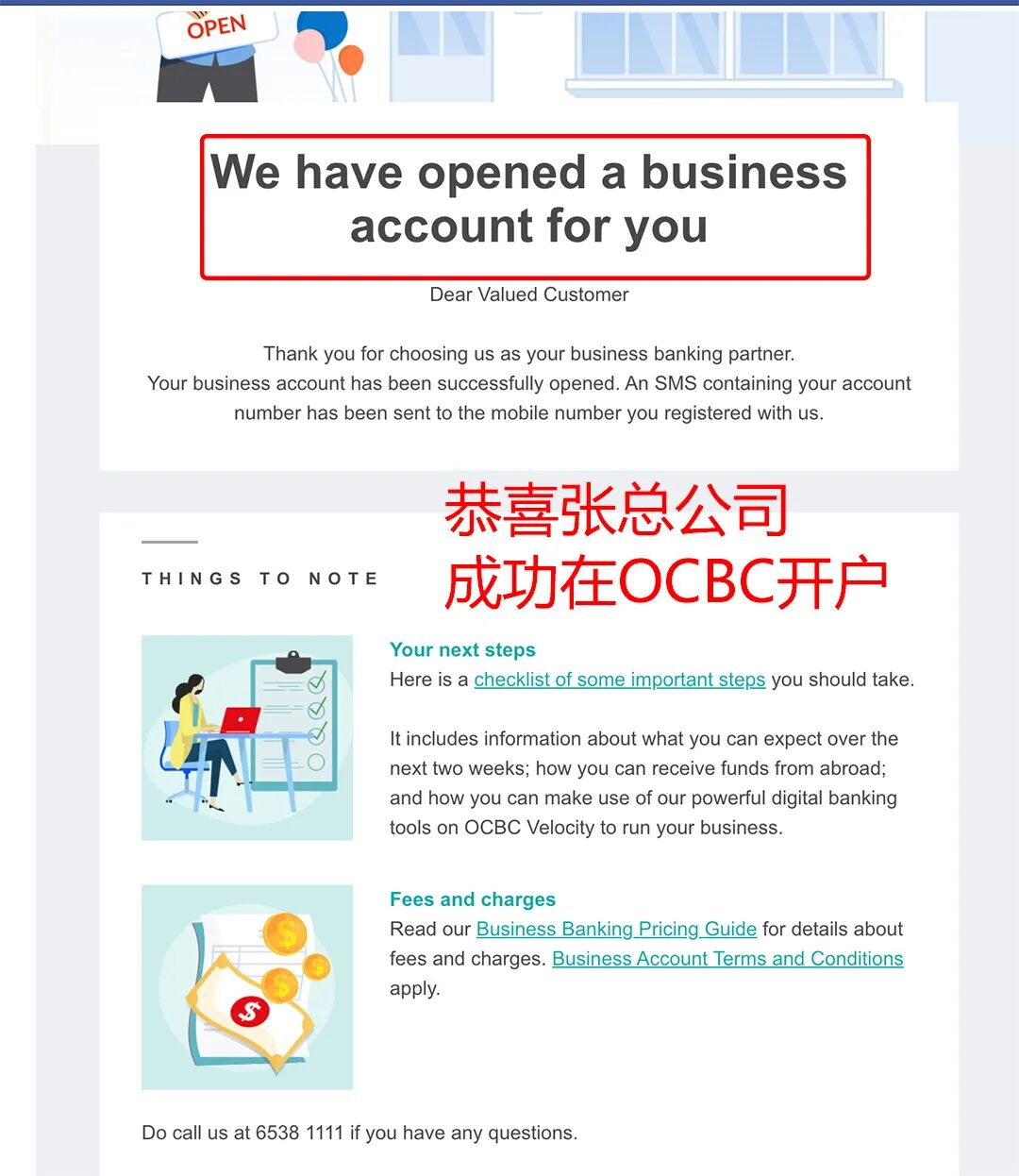

Hardware giant leverages OCBC account to open cross-border funds “both veins” and break the global trade! Congratulations to Mr. Zhang, who has successfully opened a company account with OCBC!

Application deadline:6/2/2025.

Successful account opening:2/27/2025.

From submission to account opening in just 3 weeks! How Mr. Zhang used OCBC Bank to realize the efficient flow of global funds?

1、Customer Background: “Internationalization Breakthrough” of Traditional Manufacturers

Industry: Hardware and Building Materials Trading.

Scale: Large factory in China + Southeast Asia branch.

Goal: Integrate the supply chain between China and Southeast Asia to export high value-added products to Europe, America and Oceania.

Pain points: slow cross-border settlement, difficult multi-currency management, insufficient international credit endorsement.

2、Why choose OCBC Bank Singapore?

Location Advantage: Singapore’s position as a global financial center and seamless access to international trade networks;

Policy dividend: enjoy the China-Singapore tax treaty to reduce cross-border transaction costs;

Functional upgrades:

Multi-currency account:supports direct settlement in 12 currencies including USD and EUR;

Real-time arrival:Europe and the United States remittances are credited in 2 hours at the earliest;

Digital banking services:APP one-click management of global accounts, intelligent warning of exchange rate fluctuations;

Credit Enhancement:OCBC bank credit rating (AA) helps overseas bidding competitiveness.

3, OCBC company account extremely fast account opening full record

Day 1-3: Diagnosis of needs

The team of consultants customized the program to match the scale of Zhang’s head office’s trade of $300 million in annual turnover;

Day 4-10: Pre-screening of materials

Synchronized preparation of company registration documents, shareholder background information, and sample trade contracts;

Day 11-20: OCBC Green Channel

Exemption from physical office address requirement, video interview to complete KYC;

Day 21: Account Activation

The first cross-border payment of US$500,000 was completed on the same day for settlement test!

4. Outcome: 3-fold increase in financial efficiency

Cost optimization: 40% reduction in cross-border handling fees, annual savings of more than $120,000 USD;

Timeliness improvement: the payback cycle was reduced from 15 days to 3 days;

Business Expansion: With the help of OCBC letter of credit service, we successfully took large orders from Australia!

Mr. Zhang’s testimonials:

“In the past, we were always ‘stuck’ by cross-border payment, but now the OCBC account is like a global capital highway! From the factory in Southeast Asia to the European customers sign receipt, the entire flow of funds transparent and controllable, and truly realize the dream of ‘sell global’!”

Break boundaries, make the world your market and your business can replicate success!

What else would you like to know about opening an account with Overseas Banking Corporation or Individual?

Note:References are from OCBC, MOM, synthesized from Mr. Zhang’s dictation, reproduced with attribution.

*Specific account opening requirements are subject to publication by OCBC Bank.