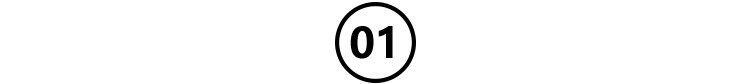

InJanuary2026, U.S. Immigration and Customs Enforcement (ICE)executed an arrest of 68-year-old Hong Kong, China resident Chui Lijie, an action centered on alleged violations of U.S. immigration law.

This case is not an isolated incident, but isthe inevitable result of a long history of systematic violations of the lawby his family’scasino, theBohol Pacific Palaceon Saipan.

This case directly touches on two high-risk areas in transnational business:

Employment Compliance and Industry Entry. By analyzing this case and comparing it to the tight regulatory frameworks in Singapore and the United States, we can provide a clearmapfor entrepreneursto “avoid the pitfalls“.

I. Visa fraud and illegal employment policies:

Instantaneous disintegration of business foundations

Cui Lijie is Ji’s mother, and actress Peggy Wu hasfourchildrenwith Ji.

Cui Lijie was a major shareholder of Hong Kong, China-based Bovada Pacific International Holdings Limited, which reportedlyentered SaipaninJuly 2014and was awarded an exclusive casino resort developer license by the local Lottery Control Board.On August24, 2015, Cui Lijie increased her stake in Bovada Pacific by100million shares, accounting for a shareholding of64.37%, making her Bovada Pacific’s first major shareholder. shareholder. The company is currently bankrupt.

It is reported that Lijie Cui is currently being held at the Village of Susupe Correctional Facility. At press time,ICEhad not released specific details of the arrest or the date of the immigration court hearing.

One of the central allegations in the Cui Lijie case is the alleged large-scale“illegal employment of foreign workers“in his casino projects. According to reports, the casino was revealed to have engaged in widespread illegal hiring of Chinese nationals on tourist visas. This is a direct violation of fundamental principles of U.S. immigration law.

In the United States, any non-citizen worker must have legal authorization that matches the type of work he or she is doing. For example, foreign nationals working in temporary, non-agricultural jobs usually need an employer to apply for anH-2Bvisaon their behalf. This process strictly requires that the employer must first demonstrate to the U.S. Department of Labor that it is unable to recruit suitable national employees and obtain a labor certification before the visa application can be initiated.

Casinos that allowB-1/B-2tourist or business visa holders to work in permanent, sedentary jobs constitute classic“visa fraud.“TheU.S.ICE‘s enforcement actions make it clear that any violation of the conditions of stay is a priority.

The “effect“of such violationscan be devastating. Not only does it lead to the investigation and closure of the project, but it also directly shakes the legal residency status of the investor.

As the principal investor, Lijie Cui’s own immigration status (most likely anE-2visatied to the investment) was invalidated by the violation of the law by the underlying business entity, which ultimately led to her arrest. This proves that employment compliance is an unshakeable cornerstone of the legal existence of businesses and individuals in the United States.

Photo/Lijie Cui, Source: Red Star News, Censored

(b) Special industry access license policy:

The absolute red line of no license means no business

The casino industry in this case isone ofthe most heavily regulated“specialty industries“in the world.Whether operating on Saipan, in the United States or in Singapore, such businesses must first cross themountain of“industry access“.

In Singapore, the relevant regulation is more centralized and stringent. The gaming industry, for example, is mainly regulated by the Casino Control Act and theGambling Control Act2022. In order to operate a casino, one has to apply for an Integrated Resort License from the Casino Control Authority of Singapore, which is an extremely stringent process with very few quotas.

For more extensive gambling services such as betting shops and public lotteries, a license must be obtained from the Gambling Control Board. Even forentertainment services such asmassage parlors,KTVsand nightclubs, their licenses are mostlycentrally managedby the Singapore Police Force (SPF).

In granting approval,the SPFwill comprehensively assess factors such as the background of the owner, the impact of the business location on the community and the risk to law and order to ensure that such premises will not become hotbeds of crime.

TheExclusive Casino Resort Developer‘s License (ECRDL) that Lijie Cui obtained in Saipanis in itself a form of licensed access to the industry. However, obtaining a license is only the beginning, and continued compliance with all additional conditions (e.g., legal employment, legal tax filing, and safe operation) is the key to maintaining a valid license.

As a result of the subsequent series of violations, the casino had in essence violated the licensing requirements and eventually went bankrupt and closed down. The“impact“of thisis absolute: in highly regulated industries,“operating without a license“is a criminal offense, and“operating with a license but in violation of the law“will inevitably lead to the revocation of the license and the end of the business. business is terminatedand all investments are lost.

Schematic / Barack Obama, Lijie Cui, Credit: Union-Tribune

III. Anti-Money Laundering and Funds Supervision Policy:

Regulatory Sword to Penetrate Business Practices

In this case, the company in question was also accused of“transferring more than$24 millionto the United Statesto finance illegal activities“. This touches another high-pressure line in cross-border operations, anti-money-laundering and capital controls.

With regard to cash-intensive industries such as casinos and entertainment, all countries have established the most stringent financial monitoring systems. In the United States, casinos, asone ofthe “financial institutions“, are required to strictly comply with the Bank Secrecy Act, establish an anti-money-laundering internal control system, report cash transactions above a certain amount and monitor and report all suspicious transactions.

Unusual cross-border movement of funds, especially in an unspecified direction orinconsistentwith declared business purpose, immediately triggers an alert from FinCEN.

Singapore is a global leader in its anti-money-laundering framework. Its Monetary Authority (MAS) and Gambling Control Regulatory Authority (GRA) have clear customer due diligence, record-keeping and suspicious transaction reporting obligations on licensed institutions.The Commercial Affairs Bureau ofthe Singapore Police Force (SPF) is also deeply involved in investigating complex commercial and financial crimes.

A comprehensive system is designed to“penetrate“complex business transactions and trace the origin of funds. Therefore, any attempt to conceal the true flow of funds, tax evasion or transfer of benefits through a complex structure will have the“effect“of directly inviting criminal investigation, making the so-called business empire vulnerable to the regulatory sword.

Schematic/Kee, Peggy Wu

IV. Employer Responsibility and Compliance Obligations Policy:

Non-transferable personal risks of business owners

The fact that this case ended with the personal arrest of Lijie Cui is a poignant reminder that, in strict jurisdictions, legal recourse ultimately penetrates the corporate veil and reaches the individual decision maker. This is thepower of“employer responsibility“policies.

Under U.S. law, employers have a legal obligation to verify the work eligibility of all employees (by completingFormI-9), and knowingly hiring or continuing to hire unauthorized employees faces severe civil and even criminal penalties.ICE‘s enforcement actions often include prosecutions of individual employers.

Similarly, in Singapore, the Ministry of Manpower (MOM) imposes heavy penalties, including hefty fines and imprisonment, on employers who hire illegal foreign workers. The Singapore Police Force (SPF) also holds licensees (usually business owners or individuals) accountable for their management when administering special trade licenses.

The “impact” of such policiesis that they tie corporate compliance directly to the personal freedom and reputation of entrepreneurs and executives. The outcome of the Cui Lijie case shows that corporate bankruptcy does not exempt those responsible for major systemic violations.

Individuals are subject to the direct legal consequences of a company’s non-compliance, including fines, imprisonment, deportation, and even a lifetime ban on entering the country. This requires business owners to view compliance as a“bottom line“projectfor themselves, rather than a mundane matter that can be delegated or ignored.

Schematic/Singapore

Conclusion: Fromthe “Trigger Trap“to the Only Way to Build Transnational Immunity

The Saipan debacle of Lijie Cui’s family shows a complete path of failure starting from“visa fraud“, passing through“unlicensed/unregulated operations“, accompanied by“financial irregularities“, and ending with “personal accountability”. ” Personal accountability“for the end of the path of failure. It is a painful reminder that in markets where the rule of law is mature, especially in Singapore and the United States, the model of trying to exploit regulatory gaps or obtaining short-term profits through bribery is no longer viable.

For the rational investor,the path tobuilding“immunity” tocross-border operationsis clear and unique:

1, reverence front: the target country’s immigration, labor, industry access to legal research before the business conception and investment decisions.

2. Professional escort: It is important to rely on a team of local compliance lawyers, accountants and consultants to ensure that every step of the process, from the establishment of the structure to the day-to-day operations, is compliant.

3. System construction: establish a permanent compliance function within the enterprise, continuously monitor the timeliness and legality of visas, licenses, and financial reports, and consider compliance costs as core operating costs.

Globalization is not an extraterritoriality, and the free flow of capital is always accompanied by the strict enforcement of legal obligations. Cui Lijie’s fall from“casino queen“to“prisoner“is the ultimate wake-up call for all cross-border operators:

In the grid world of rules, compliance is the only passport and the strongest shield to guard wealth and freedom.

*Reference sources: Red Star News, United Morning Post, SingaporeICA,SPF,ICE,the United States, comprehensive news reports collated, reprinted must indicate the source, invasion and deletion of contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations