Corporate Tax

We provide comprehensive corporate tax services for our business clients. We assist clients with corporate income tax filing and planning, optimize tax structures, reduce corporate tax burdens, and ensure compliance with tax regulations.

The Process

Corporate tax services are designed to offer business clients consulting and filing services pertaining to corporate income tax and other relevant taxes.

01

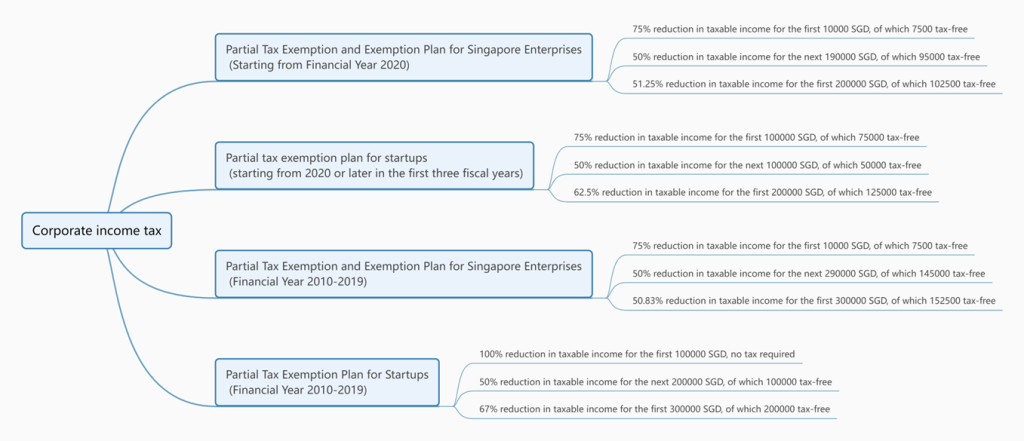

Corporate Income Tax Filing

Assist business clients in preparing and filing corporate income tax, including calculating the taxable income and determining the applicable tax rates.

02

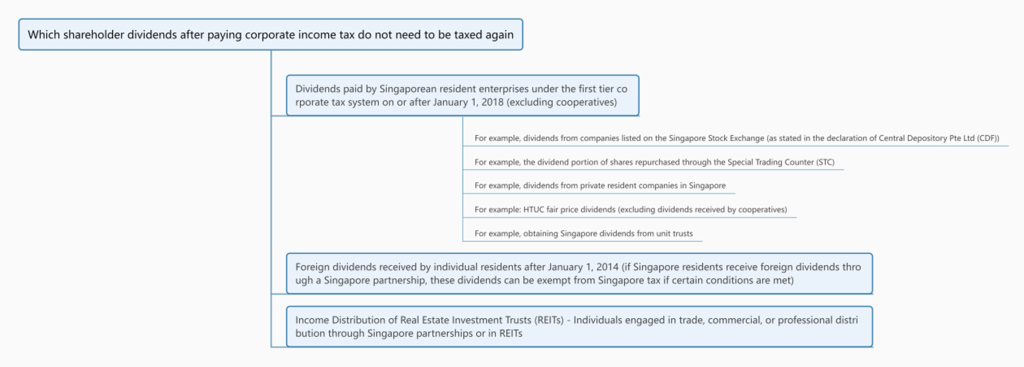

Tax Optimization

Provide advice on corporate tax optimization, assisting businesses in maximizing tax deductions and incentives while legally reducing tax burdens.

Project Advantages

Tax Compliance

Ensure that business clients comply with corporate income tax regulations and requirements, reducing the risk of non-compliance and penalties.

Tax Optimization

Help business clients legally reduce their corporate income tax burden through professional tax optimization strategies.

Tax Planning

Provide personalized tax planning and consulting based on the company’s financial situation and objectives.