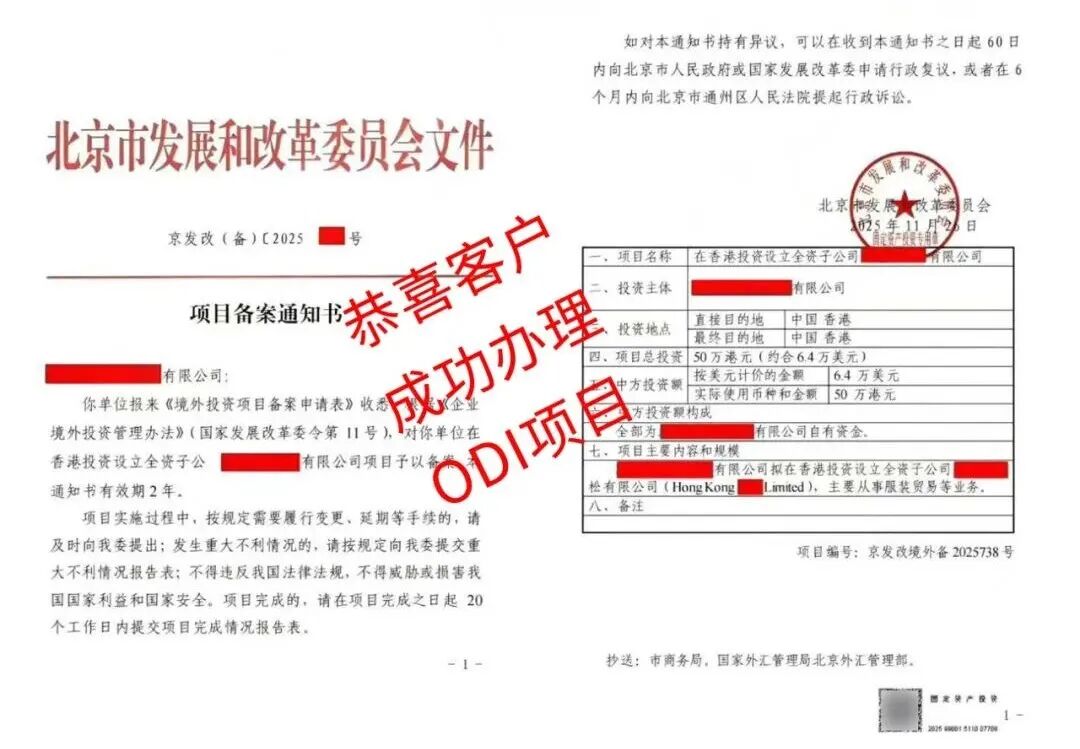

The filing notice of the project of Hong Kong subsidiary ofBeijingACompany was officially approved, and afund of RMB100,000from the domestic marketis flowing to Hong Kong through a compliant path, which isa microcosm in the wave of“going out” ofmany Chinese enterprises in2025.

With the continuous improvement of China’s comprehensive national power, more and more Chinese enterprises are casting their eyes on the international market, and OFDI by enterprises has become an important force in promoting the transformation and upgrading of the domestic economy.

According to official data, in2025alone, hundreds of enterprises completed the record-keeping process for overseas investment, obtaininga “pass“to the international market.

I. New policy developments:latestODIrequirements

In order to strengthen the macro guidance on outbound investment and further guide and standardize the direction of outbound investment,2025China’s relevant departments have introduced a number of new policies and formed a more comprehensive management system for outbound investment.

OnOctober14,2025, the Ministry of Commerce, the Ministry of Foreign Affairs, the National Development and Reform Commission and other five departments jointly issued the “Guiding Opinions on Further Improving the Overseas Comprehensive Service System”, proposing the construction of athree-dimensional, full-chain overseas comprehensive service ecosystem of“central and local coordination, regional synergy, resource concentration, internal and external connectivity“.

There have been some new changes in the policy regarding the filing and management of outbound investment by enterprises. According to the relevant departments,the scope of filing has been expandedand more types of outbound investment projects have been included in the filing management, including the establishment of subsidiaries, mergers and acquisitions of foreign enterprises, and equity investments.

Particularly noteworthy is the more stringent filing requirements for projects involving sensitive industries, such as energy, communications and finance.

In terms of the filing process, ZF has improved the efficiency of filing through information technology, and enterprises can submit materials through the online platform to realize the“one network to do“and reduce the number of offline runs.

Schematic diagram / source network, infringement of deletion

II.Importance ofODI.

Why do companies go overseas forODI?

ODIfiling has multiple important meanings for Chinese enterprises, especially in the current complex international economic and trade environment.

From a regulatory point of view,ODIfiling is the basic system for the implementation of outbound investment management by the State, which ensures that the outbound investment behavior of enterprises is in line with the national policy orientation and the requirements of laws and regulations. This system helps to prevent financial risks and safeguard national economic security.

For enterprises, the completion of theODIfiling means that they have obtained the officially recognized qualification for offshore investment and can legally transfer funds abroad to carry out business activities. Enterprises that have not completed the filing will be subject to restrictions on cross-border capital flows such as foreign exchange remittance and profit repatriation.

Specifically, the role of outward investment filing by enterprises is mainly reflected in 3 aspects:

Obtaining legal channels for the exit of fundsand guaranteeing the smooth flow of cross-border funds;establishing compliance with investment behaviorsand avoiding subsequent legal risks; as well asobtaining policy guidance and service support, and enjoying the various types of facilitation measures provided by the State.

In addition, according to the latest policy orientation, the State encourages the development of offshore investment, including:

Infrastructure investment thatis conducive tothe construction of the“Belt and Road“and the interconnection of neighboring infrastructures; investment that drives the export of advantageous production capacity, high-quality equipment and technical standards; investment and cooperation with overseas high-tech and advanced manufacturing enterprises, as well as the establishment of research and development centers abroad, and so on.

Schematic diagram / source network, infringement of deletion

III.Guidance and regulation of the direction ofODIinvestment

The guidance on further guiding and regulating the direction of outbound investment issued in2025clearly put forward themodel of“encouraging development+negative list“, which classifies the direction of outbound investment into three categories: encouragement, restriction and prohibition.

The introduction of this policy is based on the judgment of profound changes in the international and domestic environments, seeing the better opportunities for Chinese enterprises to carry out outbound investment, but also fully aware of the many risks and challenges.

With regard to the encouragement of outbound investment, the policy clearly indicates that the level of service will be further improved in the areas of taxation, foreign exchange, insurance, customs and information, so as to create more favorable facilitation conditions for enterprises. This providesa strong policy guaranteefor compliant enterprisesto “go out“.

On the other hand, the restricted outbound investments mainly include investments in countries and regions with which China has not established diplomatic relations or where wars have occurred; investments in real estate, hotels, cinemas, entertainment and sports clubs; and the establishment of equity investment funds or investment platforms with no specific industrial projects abroad.

The offshore investments that are prohibited are even more stringent, including those involving the export of core technologies and products of the military industry that have not been approved by the State; investments that utilize technologies, techniques and products that are prohibited for export in China; investments in the gambling industry, pornography, etc., as well as other investments that jeopardize or are likely to jeopardize the interests of the State and national security.

Schematic diagram / source network, infringement of deletion

IV. Successful practical exercises:

BeijingCompanyA‘s Path to Hong Kong Investment

On November26,2025, BeijingCompanyAobtained the filing notice for the project of investing and establishing a wholly-owned subsidiary in Hong Kong. This case provides awindowinto thehands-on process ofODIfiling.

Similarto BeijingCompanyA, a trading company in Nantong, Jiangsu Province, which specialized in textile exports, had planned to set up a wholly-owned subsidiary in Hong Kong by way of a new establishment in order to expand its international market.

The company’s total investment amounted toRMB100,000, the source of capital contribution was100%own funds, and the mode of capital contribution was domestic cash contribution.

During the filing process, the company adopted an investment structure whereby the Chinese party directly holds the Hong Kong subsidiary without multi-layer nested structure, which reduces the compliance risk. In the end, the whole process from submission to obtaining the certificate took about20working days.

Through the North Bund Overseas Service Center and other organizations, a number of service providers in the fields of legal services, human resources, tax services, financial services, etc.have successfully assisted many enterprises in completingthe process of“going out“. With rich experience in cross-border investment services, these service providers have customized all-round solutions for their clients.

In the case of a power transmission and distribution manufacturing company, for example, with the assistance of the service provider, the company designed a structure whereby the investment is routed through a Hong Kong company, with Malaysia as the final investment destination. This structure takes into account the convenience of investment and also reserves space for possible future capital deployment and tax optimization.

Photo/Client’s successful application for the ODI program, photo theft is a must!

V.ODIApplication Tips and Notes

According tothe content of the training session on Overseas Investment Filing and Inspection organized bythe Beijing Municipal Commission of Development and Reform2025, enterprisesneed to master several key aspects inapplying forODIfiling.

Enterprises should first understand that outbound investment is categorized into two types of situations: record-keeping and approval. For projects that do not involve sensitive countries and regions and sensitive industries, record management is usually implemented; for projects involving sensitive countries and regions and sensitive industries, approval is required.

Sensitive countries and regionsinclude countries with which we have not established diplomatic relations, countries under United Nations sanctions, and countries and regions at war. Enterprises can check the latest list through the web site provided by the relevant departments.

During the application process, enterprises are required tofill in the electronic datathroughthe “Overseas Investment Management System“, print the “Overseas Investment Filing Form” and submit it with a stamp.

The completeness and accuracy of the material is of paramount importance, in particular with regard to the identification of the enterprise abroad of final destination. According to the regulations, the final destination is the location where the enterprise’s investment is ultimately used for the construction of a project or for ongoing production operations.

It is worth noting that the investment entity shall obtain the project approval document or filing notice before the project is implemented, where“before the project is implemented“means before the investment entity or the foreign enterprise under its control invests assets, interests or provides financing or guarantee for the project.

Some enterprises may be concerned about the timing, for example, whether a domestic enterprise participating in the bidding of an overseas oil and gas block project is required to apply for filing before winning the bid? In fact, enterprises do not need to apply for filing before participating in the bidding, but can simply obtain the filing notice before the implementation of the project after winning the bid.

Schematic diagram / source network, infringement of deletion

VI. From filing to operation: full-cycle management

The passage of anODIfiling does not signal the end of regulation; rather, it marks the beginning of a series of subsequent regulatory obligations.

After obtaining a notice of filing, companiesmust comply with a number of requirements during the implementation of the project.In the event of a material adverse circumstance, the required Material Adverse Circumstance Report Form needs to be filed;a Project Completion Report Formalso needs to befiled within20working daysafter the project is completed.

The Beijing Municipal Commission of Development and Reform has optimizedthe functions of the module on overseas investment of theComprehensive Management Platform for Administrative Law Enforcement Operationsto further ensure that enterprises are able to complete these follow-up reports in a more concise and convenient manner. This initiative reflects the concept of emphasizing both law enforcement and legal literacy, as well as supervision and service.

The latest policy also facilitates enterprises that plan to set up a special purpose company abroad in order to realize the listing of the company’s interests abroad. According to the regulations, such investments are no longer approved on a case-by-case basis, and as long as they do not involve sensitive countries (regions) or industries, filing is sufficient in accordance with regular procedures.

The continuous improvement of the overseas integrated service system also provides more support for enterprises. According to the latest policy, the relevant departments will guide enterprises to make good use of public products such as country (regional) guides for outward investment and cooperation, country trade guides, and reports on the business environment in key countries (regions).

These measures are designed to help companies better understand the legal environment, market conditions and potential risks in their investment destinations.

Schematic diagram / source network, infringement of deletion

[Conclusion]

Below the filing notice approved forBeijingCompanyA,there is a striking line of expiration date labeled:“This notice is valid for2years.“This means that the company needs to complete its investment plan within the stipulated time, or it will need to reapply.

The global journey of Chinese enterprises begins with this certificate. It is not only a legal certificate, but also a commitment of responsibility. In the changing international market, more and more Chinese enterprises take compliance as the strongest ballast for stability and success.

*Reference sources: Ministry of Commerce, Financial Supervisory Bureau, Development and Reform Commission, comprehensive news media reports collated, reprinted must indicate the source, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations