In2025, a challengingyear forthe global economic and trade environment, many companies based in Singapore and with a global outlook are faced with new issues of tax compliance.

In particular,the registration and declaration ofSingapore’sGSTis both a legally mandatory threshold and a possible strategic tool for companies to optimize costs and enhance competitiveness.

A typical example of acompany we recently assistedis Head OfficeZ, which has successfully turnedGSTcompliance into a development advantagethrough proactive planning.

I. Business Expansion Meets a Critical Mass, Compulsory Registration Becomes Inevitable

Head OfficeZis a local company specializing in the trading and solution provision of high-end electronic components. In recent years, the company’s business has grown at a rapid pace and based on its detailed financial projections, itstaxable turnover forthe next12months is set to surpass thekey statutory threshold ofS$100million at with certainty.

This means thatthe company has touchedthe point of obligation formandatoryGSTregistrationunder the Inland Revenue Authority of Singapore (IRAS).

Under theSingapore Ministry of Finance’s optimization policy,the buffer periodbetween a company’s forecasted compliance and the commencement ofGSTcollectionhas beenextended to 2 monthssinceJuly1 ofthat year,from the previous1 month.

While this policy gives SMEs more time to prepare, it also puts clear requirements on upgrading their financial and tax systems, internal process grooming and compliance awareness.

II. Tax Compliance: Strategic Considerations Behind Proactive Choices

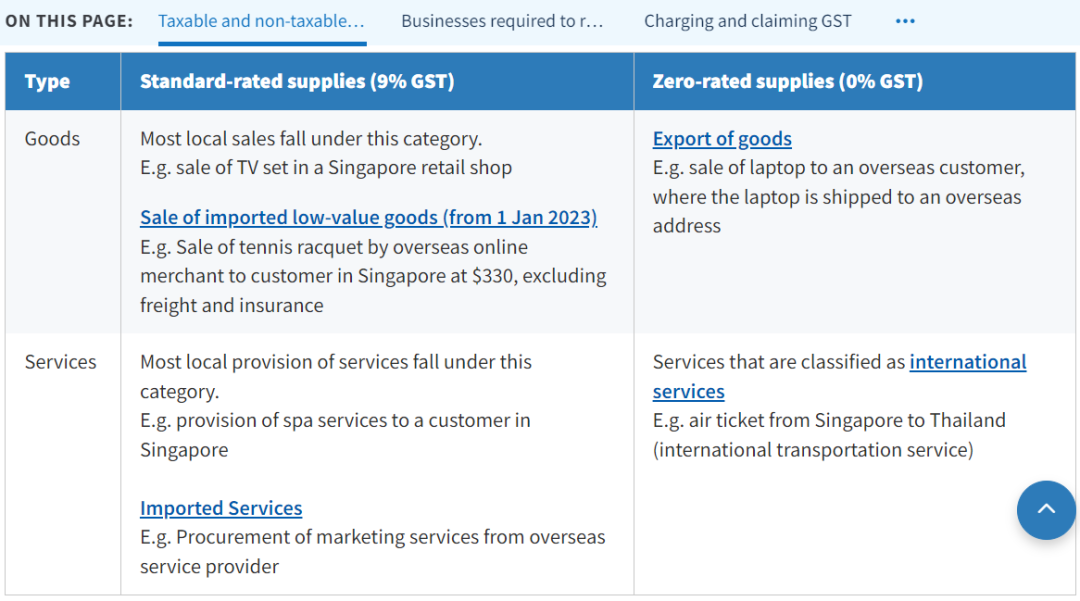

After an in-depth analysis ofHead OfficeZ‘s business model we found that although part of its business involves exports (which are zero-rated supplies), its main market and cost structure dictate that purely passive compliance is not an optimal solution.

Our Account Managerconducted several rounds of communicationwithMr.Z’s team to explainthe potential strategic benefits of“Voluntary Registration“inthecurrent9%GSTrate environment:

1、Cash flow optimization and cost control

Afterregistering as aGSTcompany, theGST(input tax)paid by a company in its business activities such as purchasing goods and paying service feescan be used to offset theGST(output tax)charged to customers in the sales process. This means that a significant amount of tax included in the company’s upfront operating costs can be refunded, significantly improving cash flow and reducing the actual tax burden.

2. Enhance enterprise reputation and competitiveness

Many large corporations, ZF organizations and multinational companies prefer toworkwithGST-registeredand compliant companieswhen choosing a partner.Having aGSTregistration number is a reflection of a company’s financial standardization and formal operation, which helps to win the trust of high-end clients and expand broader business opportunities.

3. Paving the way for future growth

Early registration gives companies ample time to complete accounting system configuration, staff training and invoicing process modification, avoiding the risk of facing fines due to omissions resulting from hasty compliance during busy business periods.

Source: IRAS

Third, professional escort, efficient completion of registration

Based on the above analysis,Mr.Zdecided decisively not to wait for the arrival of the mandatory registration point, but to start the voluntary registration process immediately. With our professional assistance, the whole process advanced efficiently:

1、Qualification evaluation and material preparation

We assistedHead OfficeZin a comprehensive review of company documents, financial forecast statements and business contracts to ensure that all materials wereIRAScompliant.

2. Online application and policy application

The application was submitted onlinethroughMyTax PortalofIRAS.In the application, we have specifically identified the zero-rated supply component included in the company’s business andhave accurately planned theGSTtreatment ofspecial transactions such as deposits and prepayments based on the latest tax guidelines.

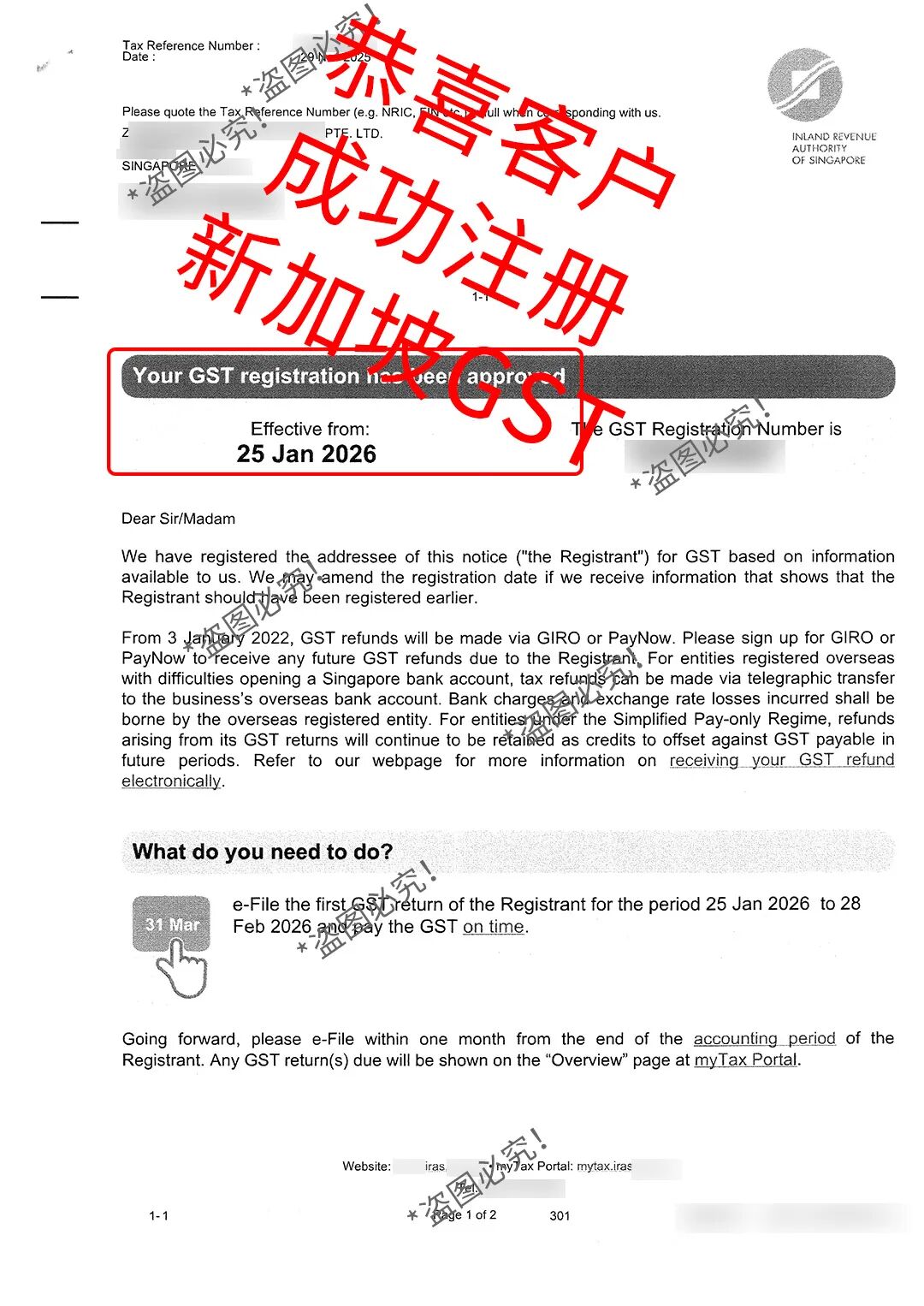

3、Precise communication and fast approval

The IRASaudit process went very smoothlydue to thorough preparation and detailed documentation.We successfully secured the desiredGSTeffective date ofJanuary25,2026for the company.This date ensured that the company had nearly3 monthsto complete its preparation cycle and also perfectly aligned with its business plan for the new fiscal year.

Photo/Client company successfully registered for GST, stolen photo must be taken!

IV. Successful landing and long-term value

Upon successful registration,Head OfficeZimmediately set about updating its quotation system, contract templates and all invoices to ensure full compliance from the effective date. More importantly, the company has started planning how to optimize its supply chain sourcing strategy using the input tax credit mechanism.

The successfulGSTplanning not only enabledZtoavoid the potential risk of late registration, but also transformed tax management from a“cost expense“to a“value creation“process, laying a solid financial and compliance foundation for the next stage of large-scale development. The foundation for the next stage of large-scale development was solidly laid in finance and compliance.

[Conclusion]

This case clearly demonstrates thatGSTregistration is far from being a passive administrative burdenunder Singapore’s rigorous and transparent tax system.

For companies with foresight, forward planning and proactive management with the assistance of a professional organization can turn compliance requirements into strategic opportunities to improve internal management, optimize cash flow and enhance market credibility.

*Reference source: SingaporeIRAS,ACRA, the United Morning Post, comprehensive news reports collated, reproduced with attribution, infringement and deletion of contact.

…

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations