When it comes to pensions, is the first thing that comes to your mind, “Pensions are small, slow to be received, and depend on state policy“?

In fact, each country’s retirement system has its own wisdom and characteristics. Today, we will look at Singapore, the United States and China to see how they make their retirement life“secure“.

By comparing them, you can not only understand the logic of the operation of the pension mechanism in each country, but also see the differences in the design concept, level of protection and sustainability.

I.CPFSingapore:

The Secret to Retirement Savings for Everyone

Singapore’s pension system has been described as a world-class example, with theCentral Provident Fund (CPF)at its core.

This is amandatory savings schemecovering Singapore citizens and permanent residents, with employees and employers contributing funds on a monthly basis in proportion to their salaries for retirement, healthcare, housing, etc.

Simply put, the money you pay when you are young will become the protection for your old age, while the official is responsible for the unified management and investment to increase the value.

Photo/Lee Hsien Loong attends CPF’s 70th anniversary event, Source: Lianhe Zaobao

1. Half of your salary goes into your account? Singapore mandatory savings play

Foremployees under the age of55, individuals contribute20%of their salaryand employers contribute17%.

CPFaccounts are not pay-as-you-go, but are personal savings accounts managed by the Singaporean government. The money that an employee receives for future retirement comes from his or her own youthful savings plus investment returns, not from the next generation’s contributions.

For example, if an employee earnsS$5,000per month, then he or she contributesS$1,000per monthand the employer contributes anotherS$850per month, which goes into three sub-accounts:

OrdinaryAccount(OA),Special Account(SA),Medisave Account(MA).

The general account can be used for home purchases and investments, the special account is used for retirement investments, and the medical account is used formedical expenses.

Source: CPF Singapore

2.BRS,FRS,ERS: Have you chosen the right pension bracket?

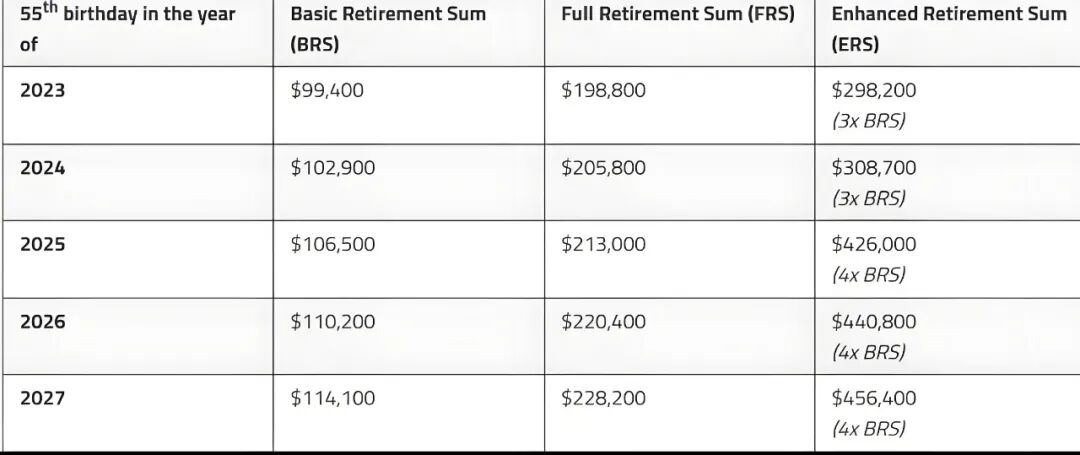

There are three levels of retirement benefits:

BRS(Basic Retirement Sum): Basic Retirement Savings,standardized toS$106,500in2025

FRS(Full Retirement Sum): Full Retirement Savings,standardized toS$213,000in2025

ERS(Enhanced Retirement Sum): Excess Retirement Savings,standardized toS$426,000in2025

Farmers, cleaners and civil servants have the same basic pension for the same length of service, but the differences are reflected in the level of savings and earnings over the course of their careers.

In this way, the Singaporean system pursuesequity of outcomeby guaranteeing a minimum standard of living for the low-income group while allowing the high-income earners to enhance their retirement benefits through additional savings.

Source: CPF Singapore

3. Equality for all? The Magic of Fairness in Singapore Pensions

The design of the Singaporean system emphasizes“personal responsibility, risk control, transparency and fairness“. Officials have made it clear to everyone how much pension they can expect to receive in the future by standardizing standards, disclosing investment yields and adopting a tiered deposit system.

In addition,CPFSingaporealso allows employees to invest part of their money in officially approved funds, stocks or insurance products, which increases the potential for capital appreciation and also allows individuals to have some choice.

In this way, even the low-income group can ensure a basic retirement life, while the high-income group can increase their pensions through additional savings and realizeflexible retirement that varies from person to person.

Source: CPF Singapore

II. Guide to Retirement in the United States:

Combination ofSocial Security+Individual Accounts

The U.S. pension system is acombination of pay-as-you-go and individual savings accounts.

SocialSecurity(SS) is the base coverage, whileIRAs such as401(k)soffer additional options.

1. The pay-as-you-go model: bottom-line guarantees for U.S. pensions

The Social Security system pays the pensions of current retirees from taxes paid by active employees. The standard tax rate is12.4 percent, split 50/50 between the employer and the employee.

Pensions are calculated on the basis of length of service and contribution history to protect the basic needs of low-income earners, but are subject tothe pressures of an aging populationand face challenges to their sustainability in the future.

Source: U.S. FHA

2、 “ 401 (k) Plan “:Save your own money and spend it yourself!

The individual account portion isrepresented bythe 401(k)plan, in which employees can voluntarily contribute a portion of their salary to a pre-tax account, usually matched by a percentage from the employer. The money can be invested in stocks, funds or bonds and collected at retirement, with the investment earnings belonging to the individual.

For example, an employee who contributes10 percentof his or her paycheck each month, with an employer matchof 5 percent,compoundedover 30years, could retire with a pension far higher than Social Security.

The U.S. model emphasizespersonal responsibility and the ability to invest, but is risky for those with little awareness of financial planning.

3. The pension dilemma: how the United States system copes with ageing

Asthe “baby boomer“generation enters retirement age, social security in the United States is under tremendous pressure. In order to cope with this, the United States has continued to adjust the retirement age, contribution rates and benefit levels, and has encouraged individuals to participate more in401(k)andIRAplans in order to reduce the official burden.

The U.S. system emphasizesflexibility and diversity, but the level of coverage varies widely, and low-income groups continue to rely on the social safety net.

Source: U.S. FHA

III. China’s pension map:

Regional differences in the context of a multilayered system

China’s pension system consists ofbasic pension insurance, enterprise annuities and commercial insurance, presenting a multilevel structure. There are differences between urban workers and urban and rural residents in terms of contribution bases, ratios and entitlements.

1. Urban workers and urban and rural residents: big difference in pensions

The basic pension insurance for urban workers is based on a pay-as-you-go system, with contributions usually amounting to20%from the unitandabout8% fromthe individual, and pensions are calculated after retirement on the basis of the average contribution salary and the number of years of contribution.

The urban and rural pension system is flexible, with lower contributions and some official subsidies.

For example, the upper limit of urban workers’ contributory salary in Beijing is about20,000 RMB, and the formula for calculating the pension combines the individual contributory index and the local average salary; while rural residents’ contributions range from a few hundred to a few thousand RMB, and the amount of money they receive in retirement is significantly lower.

Source: Internet, deleted

2. Corporate pensions and commercial pensions: a plus of your choice

To encourage employees to save extra, enterprise annuities and commercial pension insurance are gradually being promoted. Enterprise annuities are usually jointly contributed by the enterprise and the individual, with investment returns credited to the individual’s account. Commercial pension insurance, on the other hand, offers personalized options that can be flexibly allocated according to risk preferences and return objectives.

These supplementary levels enhance retirement security and reflectthe flexibility of the system, but the effectiveness of implementation is significantly affected by the size of the enterprise, the financial capacity of the individual and the level of the regional economy.

3. Wide differences between the South-East and North-West: a test of pension equity

There are large differences in economic levels across China, and with them marked differences in pension entitlements. Pensions are generally higher in developed areas along the eastern seaboard, while they are lower than average in the central and western parts of the country and in rural areas.

In order to alleviate the imbalance, China has continued to promote a national coordinated fund and an urban-rural coordinated system, with the goal ofsafeguarding basic livelihoods and narrowing the gap.

Photo credit: United Morning Post

IV. Whose pension system is smarter

1. Design concept competition: savings, responsibility and equity

Singapore: Compulsory savings+tiered system, individual responsibility, fairness in safeguarding outcomes;

United States: Social Security+Personal Accounts, Protection Base+Investment Appreciation;

China: Multi-level coverage+official regulation, balancing equity and flexibility.

2. Who gets the most protection? Comparison of pension entitlements

The Singapore Basic Pension covers all occupations, with security for low income earners and additional savings for high income earners.

Social Security in the United States provides minimum guarantees and individual investments vary widely. China has higher protection for urban workers and slightly lower for urban and rural residents, but there are official subsidies and enterprise annuities.

Photo credit: United Morning Post

3. Is the vault enough? Future challenges for the pension system

Singapore‘s CPFaddresses sustainability through value-added investments, the United States faces pressures of an aging population, and China faces the dual challenges of regional disparities and aging. All three countries are looking forsolutions thatbalance equity, efficiency and sustainability.

4. Retirement Wisdom Revealed: Lessons Learned from the Pensions of Three Countries

By way of comparison, we can draw several lessons:

Mandatory Savings+Transparent Management: Singapore Model Ensures Security for Low-Income People

Multi-tiered systems: United States and Chinese models provide room for choice and meet different needs

Combining investment appreciation and official regulation: ensuring the long-term sustainability of the system.

Photo credit: United Morning Post

In short, businesses, individuals and policymakers alike canlearnfrom the experience of the three countries toboth protect the bottom line and enhance the quality of retirement life through savings and investment.

In the future, with the accelerated aging of the population, innovation in the pension system will become the focus of global attention.

Note:References from SingaporeCPF, United Morning Post, U.S.FHA,401(k)plan, comprehensive news reports collated, reproduced must indicate the source, invasion and deletion of contact.

……

👇 Plus V enters Singapore’s largest outbound community 👇

Past Recommendations